DAILY MORNING NOTE | 6 September 2022

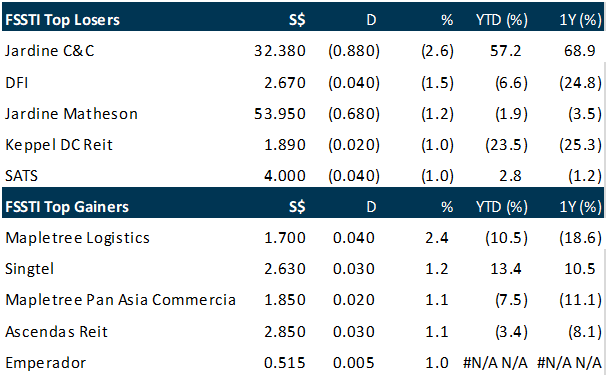

The Singapore stock market closed higher on Monday (Sep 5) even as regional markets traded mixed, reversing the downtrend from trading last week. The Straits Times Index (STI) rose 0.3 per cent, or 9.79 points to 3,215.48, following in the footsteps of other Asia-Pacific indices such as Shanghai and Australia. Some 1.51 billion units worth S$674.5 million were traded locally, with losers outnumbering gainers 263 to 219. Elsewhere, key gauges in Japan, Hong Kong and South Korea finished lower. The mixed closing follows a day of varied trading as positive vibes from the United States jobs report were offset by growing fears about an energy crisis in Europe, Chinese Covid lockdowns and geopolitical tensions..

The Germany’s DAX slid more than 2 per cent to lead declines among the European stock indexes on Monday after Russia stopped pumping gas via the Nord Stream 1 pipeline to Europe, sparking worries about surging energy prices and winter shortages in the region. The Europe-wide Stoxx 600 index closed 0.6 per cent lower, while Germany’s DAX index ended 2.2 per cent down to log its biggest one-day percentage fall in more than a week.

Stocks to watch: No Signboard Holdings

SG

Restaurant chain No Signboard Holdings on Friday (Sep 2) filed an application with the court to subject creditor OCBC to its ongoing debt moratorium, so that the bank may not initiate any legal proceedings against the company. This comes as No Signboard and OCBC have not been able to agree on the terms of repayment of a S$3 million outstanding bank loan, the company disclosed in a Monday (Sep 5) bourse filing. No Signboard believes that it will not have sufficient funds to make the monthly repayments of the loan from September, until it completes the agreement entered in July with potential investor Gazelle Ventures.

Semiconductor solutions provider AEM Holdings suffered a recent IT breach that resulted in unauthorised access to its network, the company disclosed in a Monday (Sep 5) bourse filing. It did not elaborate when the breach occurred. AEM has since contained the incident and prevented further unauthorised access, it said, adding that the business remains operational. The company has engaged incident response consultants and external counsel to assess and manage the incident. The breach is not expected to have a material adverse impact on AEM’s earnings per share for FY2022 ending December.

Shares of Asia-focused insurer Prudential have started trading on the Shenzhen-Hong Kong Stock Connect programme, the group announced on Monday (Sep 5). Additionally, Prudential has joined the Hang Seng Composite Index, it said in a press statement. The Shenzhen-Hong Kong Stock Connect allows investors in mainland China and Hong Kong to trade and settle shares listed via the Shenzhen and Hong Kong bourses, or clearing houses in their home market. Inclusion in this programmes means qualified investors in the Chinese mainland will now have direct access to Prudential’s shares through the Shenzhen Stock Exchange. Qualified investors in mainland China need to maintain a total balance of securities and cash account of at least 500,000 yuan (S$101,342).

Sembcorp Utilities, a wholly-owned subsidiary of Sembcorp Industries, has entered an agreement to sell its 100 per cent stake in its India-based coal power unit for 117 billion rupees (S$2.1 billion) to Tanweer Infrastructure. The unit, Sembcorp Energy India Limited (SEIL) is one of the largest independent power producers in India, operating 2 coal-fired plants totalling 2.6GW. The S$2.1 billion price tag is at an implied price-to-book multiple of 1 time, Sembcorp said in a bourse filing on Monday (Sep 5).

Keppel Land, a unit of mainboard-listed Keppel Corp, will acquire from its joint venture partner a 4 per cent stake in Kingsdale Development, which owns 80 per cent of the Spring City Golf & Lake Resort in Kunming, China. Keppel currently holds 86 per cent of Kingsdale via its subsidiaries, while the joint venture partner, Prime Growth Investments, owns 4 per cent. The remaining 10 per cent is held by another third party. Romeo, a unit of Keppel Land, will pay US$6 million for the stake, Keppel Corp said in a Monday (Sep 5) board filing. Of the sum, US$3.4 million will be for the sale shares, while US$2.6 million will be for the assignment to Romeo of shareholder loans extended by Prime Growth to Kingsdale.

GIC reported a 4.2 per cent annualised rolling 20-year real rate of return for the latest period ended Mar 31, and is rebalancing its portfolio — by shoring up on private equity and real assets — as recession risks grow. The rate of return, which spans 2003 to 2022 for the year ended Mar 31, is down 0.1 per cent from the previous year. Annualised nominal return, not accounting for inflation, came in at 7 per cent in US dollar terms — demonstrating the extent to which global inflation has eaten into returns. GIC said in its annual report published on Wednesday (Jul 27) that it has been increasing its allocation to certain high-growth asset classes, such as private equity, that “can provide returns that keep pace with elevated inflation”.

US

Despite global headwinds, the outlook for investing with environmental, social and governance (ESG) considerations investing is better than 12 months ago, according to Holger Frey, a portfolio manager for one of Credit Suisse’s impact funds. For Asian markets, specifically, companies that produce solutions for electric vehicles, renewable energy, as well as recycling would likely be the winners in the near future, said Frey, who manages investments for the Credit Suisse (Lux) Environment Impact Equity Fund. Differentiating the various forms of ESG investing, such as funds based on ESG ratings versus the thematically driven ones, Frey, who manages the bank’s environmental impact equity fund, said thematic ESG funds that are focused on environmental solutions are “very attractive” for investors.

UBS Group chief executive officer Ralph Hamers is facing questions over his digitally-led growth strategy after a signature deal to boost expansion in the US collapsed last week. Late Friday (Sep 2) UBS and US-based robo-adviser Wealthfront announced that the US$1.4 billion acquisition announced in January would not go ahead, though neither specified a reason for the decision. The deal would have been Hamers’ biggest transaction since becoming CEO less than 2 years ago, and was the centrepiece of his focus on broadening the Swiss-lender’s wealth-management offering beyond the traditional customer base through the use of digital platforms. At the same time, valuations for tech stocks have tumbled sharply in recent months, raising the prospect of UBS overpaying for its push into the US.

Credit Suisse will expand in Qatar via a partnership with the Gulf country’s Investment Promotion Agency (IPA Qatar), the Swiss bank said on Monday (Sep 5). It will create up to 100 jobs there over the next few years across its wealth management, investment banking and asset management divisions and through the launch of a technology and engineering hub. “This expansion will further strengthen the bank’s leading wealth-management business, deepen the bank’s local footprint and contribute to accelerating Credit Suisse’s development and digitisation in Qatar and the wider region,” IPA Qatar and Credit Suisse said in a joint statement.

OPEC+ agreed to make a token oil supply cut for October, seeking to stabilise global markets after a faltering economic backdrop triggered the longest price rout in 2 years. The group will reduce production by 100,000 barrels a day next month, taking supplies back to August levels, it said in a statement. In its final communique after Monday’s (Sep 5) online conference, the alliance also highlighted that it would be willing to call another ministerial meeting at any time if needed to address market developments. Its next scheduled talks will be on Oct 5.

Source: SGX Masnet, The Business Times, Bloomberg, Channel NewsAsia, Reuters, CNBC, PSR

RESEARCH REPORTS

Technical Pulse: Raffles Medical Group Ltd

Analyst: Zane Aw

Recommendation: Technical SELL

Sell limit: 1.40 Stop loss: 1.46 Take profit 1: 1.30 Take profit 2: 1.20

Raffles Medical Group Ltd (SGX: BSL) A potential bearish reversal to the downside.

Upcoming Webinars

Guest Presentation by United Hampshire US REIT [NEW]

Date: 7 September 2022

Time: 7pm – 8pm

Register: https://bit.ly/3SgiZFV

Guest Presentation by Credit Bureau Asia [NEW]

Date: 14 September 2022

Time: 12pm – 1pm

Register: https://bit.ly/3Rj2MP4

Guest Presentation by AIMS APAC REIT [NEW]

Date: 15 September 2022

Time: 12pm – 1pm

Register: https://bit.ly/3KAETjD

Guest Presentation by ComfortDelGro Corporation Limited [NEW]

Date: 29 September 2022

Time: 12pm – 1pm

Register: https://bit.ly/3Ql57J7

Research Videos

Weekly Market Outlook: Singtel, Salesforce Inc, Silverlake Axis, Phillip On The Ground, SG Weekly…

Date: 5 September 2022

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials