DAILY MORNING NOTE | 7 December 2022

**Do note that the last day of Morning Note Issuance is on 15 December 2022. Morning Note will resume in January 2023**

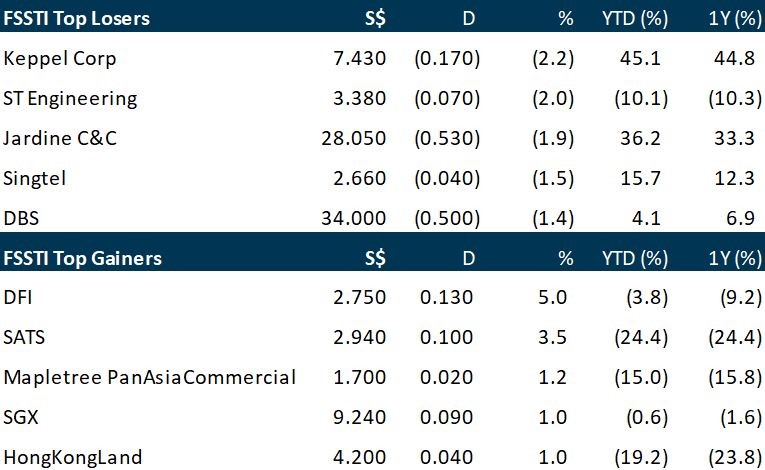

Singapore stocks fell on Tuesday (Dec 6), following an overnight decline on Wall Street, amid concerns over the path of rate hikes in the US. The benchmark Straits Times Index (STI) fell 0.5 per cent or 15.17 points to close at 3,252.37. Keppel Corp led the decliners on the local index after falling 2.2 per cent to close at S$7.43. Meanwhile, DFI Retail Group was the top STI performer. The counter climbed 5 per cent to close at US$2.75. Across the broader market, losers outnumbered gainers 271 to 244 on Tuesday, after 1.4 billion securities worth S$1.2 billion changed hands. DBS and UOB were the two most actively traded counters by value. They were also among the STI decliners on Tuesday, shedding 1.5 per cent and 0.7 per cent respectively. OCBC shares rose 0.2 per cent to close at S$12.20. Elsewhere, most markets in the region ended in the red, tracking Wall Street’s decline on Monday. Key indices in Hong Kong, South Korea and Australia fell between 0.4 and 1.1 per cent on Tuesday. The Nikkei 225 in Japan bucked the trend, rising 0.2 per cent, while Malaysia’s KLCI and the Shanghai Composite Index ended the day flat.

Stocks tumbled Tuesday, building on the previous session’s losses, as fears of a recession gripped Wall Street. The S&P 500 shed 1.44% to close at 3,941.26, while the Nasdaq Composite sank 2% to finish at 11,014.89. The Dow Jones Industrial Average dropped 350.76 points, or 1.03%, to settle at 33,596.34. Stocks added to Monday’s declines, with the S&P falling for a fourth straight day and its seventh negative session in eight. Tuesday’s moves bring the Dow’s two-day losses to more than 830 points. Media and bank stocks, which tend to suffer during recessions, led the losses. Paramount Global’s CEO warned of lower fourth-quarter advertising revenue, sending shares down nearly 7%. Morgan Stanley’s stock slumped amid news it’s planning to cut 2% of its workforce, continuing the recent layoff trend in the sector. Growth-focused technology names like Nvidia, Amazon and Meta Platforms also weighed on the market. JPMorgan Chase’s CEO Jamie Dimon echoed concerns of a downturn ahead, saying that inflation would push the economy into a recession. Inflation and its impact on the consumer “may very well derail the economy and cause a mild or hard recession that people worry about,” he said. With Tuesday’s losses, the S&P is already down 3.2% this week and the Nasdaq is off by 3.9%. Markets are largely expecting the Federal Reserve to slow its hiking pace to a half-percentage-point increase when it meets next week. But investors fear a step down in its clip won’t be enough to stop the economy from entering a recession in 2023.

SG

The trustee-manager of CapitaLand India Trust has signed a memorandum of understanding with the government of India’s Telangana state to develop a data centre in Hyderabad. The data centre, to be situated at the trust’s eight-hectare International Tech Park in Madhapur, will have a built-up area of approximately 250,000 square feet and 36 megawatts of power capacity. Madhapur is a suburb of Hyderabad and is known as a centre for information technology activity. Approximately INR1,200 Crores (S$210 million) is expected to be deployed in the next three to five years for this project, CapitaLand India Trust Management said in a filing on the Singapore bourse on Tuesday (Dec 6). The centre will be developed with the latest cooling and security technologies, and will include a dedicated gas insulated substation. “Its technologically advanced specifications will allow it to serve hyperscale players and large enterprises in the region,” the trustee-manager said. This is the trust’s second data centre development project in India, following its acquisition of a greenfield data centre development site in Navi Mumbai in 2021. CapitaLand India Trust chief executive officer Sanjeev Dasgupta said the trust has another two data centre projects planned in two key markets. He noted that Telangana is known for its ease of doing business, infrastructure and investment-oriented initiatives, and that CapitaLand India Trust will continue to strengthen its portfolio with “high-quality new economy assets”. Shri K.T. Rama Rao, India’s minister for information technology, industries, and municipal administration and urban development, said Hyderabad is one of the fastest-growing data centre markets in India. “The investment adds to the pace we look to keep up,” said the minister, who was present at the signing. Units of CapitaLand India Trust ended Tuesday at S$1.15, down 1.7 per cent or S$0.02.

Frasers Property has appointed Paolo Bevilacqua, former general manager of the group’s subsidiary Real Utilities, as the new group head of sustainability. In this newly created role, Bevilacqua will deepen Frasers Property’s environmental, social and governance (ESG) agenda by working with the leadership team and with its business units. He will also explore strategic partnerships with external stakeholders aligned with the group’s ESG ambitions, said the property company on Tuesday (Dec 6). Bevilacqua has over two decades of experience in the real estate industry and has previously held sustainability-related senior appointments in the International Living Future Institute and Living Future Institute Australia. He also represents Frasers Property on the Property Council of Australia’s national sustainability roundtable. “Bevilacqua has already been leading a group-wide taskforce over the last few years, so his familiarity with the group’s sustainability efforts and progress, coupled with his deep expertise in the real estate and energy sectors make him the right candidate to helm and drive our ESG efforts,” said Chia Khong Shoong, group chief corporate officer, Frasers Property. Bevilacqua will continue to be based in Sydney, Australia, and report to Chia in Singapore.

US

The US and European Union (EU) are weighing new tariffs on Chinese steel and aluminium as part of a bid to fight carbon emissions and global overcapacity, according to people familiar with the matter. The move would mark a novel approach, as the US and EU would seek to use tariffs — usually employed in trade disputes — to further their climate agenda. US aluminium and steel producers climbed in extended trading. The idea, generated within President Joe Biden’s administration, is still in an initial phase and hasn’t been formally proposed, according to the people, who asked not to be identified as the discussions aren’t public. An agreement with the EU, including specifics on how to identify thresholds for applying tariffs, isn’t likely until late next year at the earliest, one of the people said, adding that even that timeline was optimistic. The new framework, which builds on a related US-EU agreement last year, is mainly aimed at China, the world’s biggest carbon emitter and producer of steel and aluminium, as well as other large polluting nations, according to the people. The tariff plan would likely deepen divisions between Beijing and Washington, particularly at a time when the two countries have committed to working together to fight climate change. But talks between the US and EU to jointly address the climate crisis are a positive sign for a relationship that’s again suffering trade irritants, including Biden’s signature climate law that European countries say discriminates against their industries. It’s unclear what legal authority the Biden administration would use to implement new tariffs. A person familiar with the matter said that question is still being worked out internally and in talks with the EU, as well as with industry representatives and Congress. The White House is also talking to lawmakers about potential new authorities, the person added. US Trade Representative Katherine Tai and her team presented the idea to European Commissioner Valdis Dombrovskis and others in Prague in late October. EU officials raised several questions at the time, including regarding the legality and compatibility with World Trade Organisation rules, as well as with the bloc’s internal carbon pricing mechanism, people familiar with the talks said. USTR General Counsel Greta Peisch gave the US presentation in Prague and is leading the charge from Washington, one person said. A USTR spokesperson declined to comment. The climate-focused trade effort by the US and EU was first raised in October 2021, when the two sides resolved a key dispute over steel and aluminium tariffs that had been imposed by former President Donald Trump on national security grounds. One approach for the potential new tariffs may be to convert an existing investigation under Section 232 of the Trade Expansion Act — which served as the underlying rationale for Trump’s duties on European steel and aluminium in 2018 — into a new inquiry that targets carbon emissions and overcapacity. That would give the White House legal cover to move forward without having to wait for a new probe to conclude, according to another person. US officials are also still deliberating the tariff rate or band of tariff rates that would be applied to other countries, and the US has told EU officials that they’d like the agreement to be legally binding, the people said. Other countries have expressed interest in joining the talks, but the new framework would likely not include them at first. That could mean steel and aluminium imports from Japan and others risk being targeted by new duties. The goal, however, is to open the deal to other countries as quickly as possible, as long as they can meet the agreement’s ambitions, one person familiar with the plans said. For the Biden administration, the first-of-its-kind agreement would be one element of what the White House describes as its worker-centric trade policy, as it focuses on defending key industries and their workers, both in the US and in Europe.

Oil prices fell in a volatile market on Tuesday (Dec 6) as the US dollar stayed strong. Meanwhile, economic uncertainty offset the bullish impact of a price cap placed on Russian oil and the prospects of a demand boost in China. Brent crude futures fell US$1.21 or 1.46 per cent to US$81.47 a barrel by 1254 GMT (8.54 pm Singapore time). West Texas Intermediate (WTI) crude fell US$1.18 or 1.53 per cent to US$75.75. In Asian trading, Brent rose by over US$1. Crude futures on Monday recorded their biggest daily drop in two weeks after US services industry data indicated a strong economy. This drove expectations of higher interest rates than recently forecast. The US dollar index edged lower on Tuesday. But it was buoyed by bets of higher interest rates, following the biggest rally in two weeks on Monday. A stronger greenback makes US dollar-denominated oil more expensive for buyers holding other currencies, reducing demand for the commodity. In China, more cities are easing Covid-related curbs, prompting expectations of increased demand in the world’s top oil importer. Sources said the country is set to announce a further relaxation of some of the world’s toughest Covid curbs as early as Wednesday. The market was weighing the production impact of a price cap of US$60 a barrel set by the G7, European Union (EU) and Australia on Russian crude. This contributed to market volatility. The price cap added to the disruption caused by the EU’s embargo on Russian crude imports by sea. Similar pledges were made by the US, Canada, Japan and Britain. Russia declared its intention not to sell oil to anyone who signs up to the price cap. Russian Deputy Prime Minister Alexander Novak said Russia’s oil and gas condensate rose 2.2 per cent year on year, to 488 million tonnes for the period between January and November. He expected a slight output decline following the latest sanctions.

The investment bank Morgan Stanley is laying off about 2 percent of its global work force as deal-making grinds to a halt, two people with knowledge of the situation said. The layoffs will affect about 1,600 of its roughly 82,000 workers across all divisions, one of the people said. The people requested anonymity because they were not authorized to speak publicly about the layoffs. Like other investment banks, Morgan Stanley had paused layoffs during the pandemic, as deal activity spiked industrywide and banks raced to find employees to handle the workload. But jitters in the global economy, alongside a steep slowdown in deal-making, have forced investment banks to once again prune their work forces. “Some people are going to be let go,” Morgan Stanley’s chief executive, James Gorman, told Reuters last week. “We’re making some modest cuts all over the globe. In most businesses, that’s what you do after many years of growth.” In the third quarter of this year, there were about 2,273 U.S. deals worth $289 billion, a 64 percent decrease in deal value and 36 percent drop in deal volume from the same quarter a year prior, according to EY, a consulting firm. As interest rates have jumped, part of the challenge for deal makers has been limited appetite for the kinds of loans typically used to finance leveraged buyouts, making deals previously struck with lower rates less palatable. That has led to a buildup of loans on banks’ balance sheets that, in turn, has made it harder for them to take on more risk — or do more deals. One of the largest examples of so-called hung deals, or those that banks can’t sell to other investors, is the roughly $13 billion in debt financing that Morgan Stanley led to help fund Elon Musk’s acquisition of Twitter. Morgan Stanley, for its part, has used the pandemic to shift further away from a primary focus on investment banking and toward a presence in fee-based wealth management. Last year, the bank completed its $7 billion purchase of the investment and wealth management firm Eaton Vance shortly after its $13 billion acquisition of E-Trade. Shares of Morgan Stanley are down 12 percent over the past year, giving it a market capitalization of $146 billion. Shares of Goldman Sachs are down about 7 percent and JPMorgan Chase, about 18 percent.

Facebook parent Meta Platforms on Monday (Dec 5) threatened to remove news from its platform if the US Congress passes a proposal aimed at making it easier for news organisations to negotiate collectively with companies like Alphabet’s Google and Facebook. Sources briefed on the matter said lawmakers are considering adding the Journalism Competition and Preservation Act to a must-pass annual defence bill as way to help the struggling local news industry. Meta spokesperson Andy Stone in a tweet said the company would be forced to consider removing news if the law was passed “rather than submit to government-mandated negotiations that unfairly disregard any value we provide to news outlets through increased traffic and subscriptions”. He added the proposal fails to recognise that publishers and broadcasters put content on the platform because “it benefits their bottom line — not the other way around”. The News Media Alliance, a trade group representing newspaper publishers, is urging Congress to add the bill to the defence bill, arguing that “local papers cannot afford to endure several more years of Big Tech’s use and abuse, and time to take action is dwindling. If Congress does not act soon, we risk allowing social media to become America’s de facto local newspaper.” More than two dozen groups including the American Civil Liberties Union, Public Knowledge and the Computer & Communications Industry Association on Monday urged Congress not to approve the local news bill saying it would “create an ill-advised antitrust exemption for publishers and broadcasters” and argued the bill does not require “funds gained through negotiation or arbitration will even be paid to journalists”. A similar Australian law, which took effect in March 2021 after talks with the big tech firms led to a brief shutdown of Facebook news feeds in the country, has largely worked, a government report said. Since the News Media Bargaining Code took effect, various tech firms including Meta and Alphabet have signed more than 30 deals with media outlets, compensating them for content that generated clicks and advertising dollars, the report added.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

RESEARCH REPORTS

City Developments Limited – Hospitality lifts overall profitability

Recommendation: ACCUMULATE (Maintained), Last Done: $8.24

Target price: S$3.08, Analyst: Terence Chua

– SATS has provided more clarity on its funding structure for the Worldwide Flight Services (WFS) acquisition. We believe the added clarity will further reduce the overhang on the stock.

– With access to an acquisition bridge facility and the rights issue underwritten, we do not expect the discount for the rights to be steep.

– Downgrade to NEUTRAL from recent run-up in price with higher target price of $3.08 (prev. $3.02). Our valuation is still pegged to 18.5x FY24e. Risks to our view include 1) Integration challenges for WFS; and 2) revenue growth continuing to lag behind expenses growth

FAANGM Monthly November 22 – Continuing to lag

Recommendation: NEUTRAL (Downgraded); Analysts: Jonathan Woo, Maximilian Koeswoyo,Zane Aw, Phillip Research Team

– The FAANGM was up 2.7% in November, lagging both the S&P 500 and the Nasdaq which were up 5.4% and 5.5% respectively.

– AMZN and AAPL were the laggards, down 5.8% and 3.5%. META was the biggest gainer, up 26.8% on news of employee headcount reduction and other cost-cutting initiatives aimed at improving margins.

– With FAANGM earnings yield looking less attractive vs US10Y treasury yield, uncertainty surrounding earnings growth for FY23e, and shrinking margins, we downgrade our rating on FAANGM to NEUTRAL from OVERWEIGHT. Long-term secular tailwinds in cloud and streaming remain intact, but are overshadowed by near-term uncertainties in digital advertising and supply chain constraints in hardware.

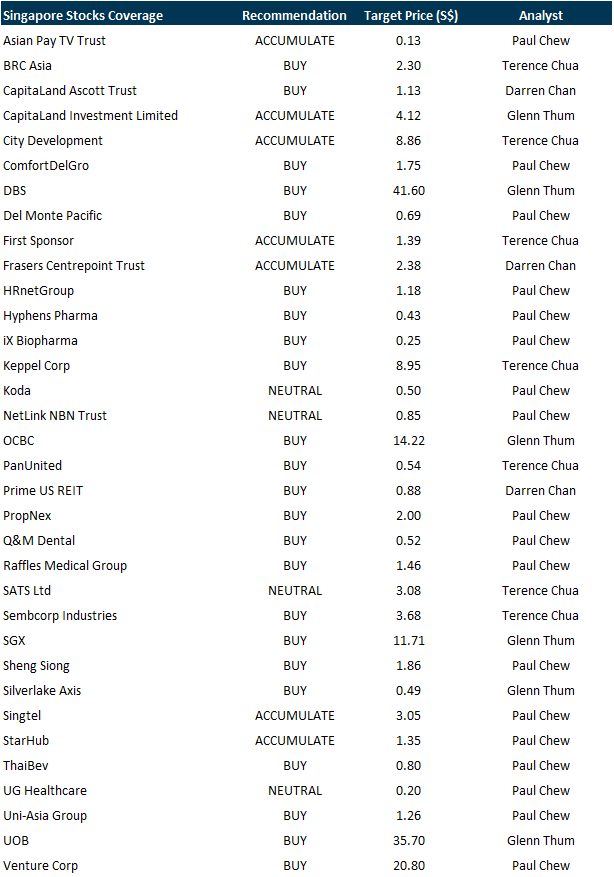

PSR Stocks Coverage

For more information, please visit:

Upcoming Webinars

Guest Presentation by Zoom Video Communications, Inc

Date: 7 December 2022

Time: 9am – 10am

Register: https://bit.ly/3TzxFQ6

Guest Presentation by Sabana Industrial REIT

Date: 8 December 2022

Time: 12pm – 1pm

Register: https://bit.ly/3UIuyXl

Guest Presentation by NoonTalk Media Limited [NEW]

Date: 13 December 2022

Time: 12pm – 1pm

Register: https://bit.ly/3gYzGI2

Guest Presentation by iWoW Technology

Date: 16 December 2022

Time: 12pm – 1pm

Register: https://bit.ly/3EqFiDT

Research Videos

Weekly Market Outlook: Salesforce Inc, ThaiBev, BRC Asia, Tech Analysis, SGBanking, SGWeekly & More

Date: 5 December 2022

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials