DAILY MORNING NOTE | 7 February 2023

Technical Pulse: Nongfu Spring Co Ltd (HKEX: 9633)

Analyst: Zane Aw

(Current Price: HKD$45.05) – TECHNICAL BUYBuy stop: HKD$45.20 Stop loss: HKD$43.75 Take profit 1: HKD$48.35 Take profit 2: HKD$52.00

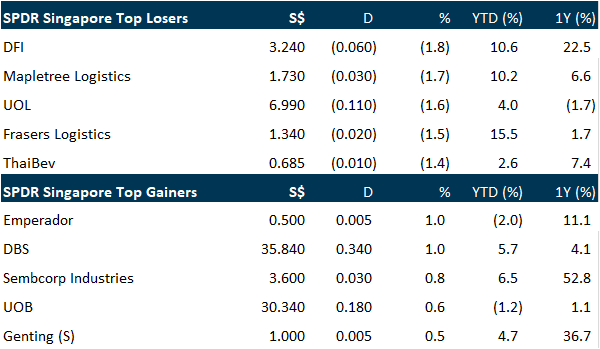

The Straits Times Index ended Monday (Feb 6) flat, inching up just 0.1 per cent or 1.64 points to end at 3,385.93. iFast Corporation was the top gainer, adding 7.7 per cent or S$0.41 to S$5.71. DBS and UOB were also among the top advancers for the day. DBS rose 1 per cent or S$0.34 to S$35.84, while UOB added 0.6 per cent or S$0.18 to S$30.34. OCBC closed flat at S$13.00. Electric-vehicle player Nio was the biggest loser, slipping 5.9 per cent or US$0.69 to US$11.00. Jardine Matheson Holdings was another top decliner, falling 0.5 per cent or US$0.29 to US$53.91.

Wall Street stocks finished lower on Monday following a downcast session marred by worries over Federal Reserve policy and the state of US-China relations. The Dow Jones Industrial Average dipped 0.1 per cent to 33,891.02. The broad-based S&P 500 dropped 0.6 per cent to 4,111.07, while the tech-rich Nasdaq Composite Index dropped 1.0 per cent to 11,887.45.

SG

The manager of CapitaLand India Trust (CLINT) has reported a distribution per unit (DPU) of 3.91 cents for its 2HFY2022 ended Dec 31, 2022, 9% higher than the DPU of 3.60 cents in the same period the year before. DPU for the FY2022 grew by 5% y-o-y to 8.19 cents from FY2021’s 7.80 cents. The higher DPU is mainly attributed to higher portfolio occupancy and income contribution from acquisitions. Total property income for 2HFY2022 stood at INR4.78 billion ($76.5 million), 11% higher y-o-y, leading to a total property income of INR11.9 billion for the full year. Total property expenses increased by 22% to INR2.5 billion, mainly due to higher operational and maintenance expenses and property management fees from existing and newly acquired properties. CLINT achieved a committed portfolio occupancy of 92% as at Dec 31, 2022 while the trust’s assets under management stood at $2.5 billion. Gearing ratio was 37%.

Boustead Singapore has launched a voluntary unconditional offer for all the shares in Boustead Projects it does not own for 90 cents each. The company intends to privatise Boustead Projects and delist it from the Mainboard of SGX-ST. As at Feb 6, Boustead Singapore directly holds 171 million shares representing approximately 54.87% of the total number of issued shares of Boustead Projects. The proposed acquisition of the shares is in line with Boustead Singapore’s intentions and ongoing strategic reviews and objective to streamline its investments, businesses, operations and the corporate structure of the group.

YKGI, the operator of Yew Kee Duck Rice and bubble tea brand Chicha San Chen’s Singapore franchise, fell 10.5 per cent or S$0.021 from its initial public offering (IPO) price of S$0.20 on its first trading day on the Catalist board of the Singapore Exchange. YKGI opened on its debut at S$0.20 on Monday (Feb 6), but fell after market open. YKGI had on Jan 26 launched its IPO, seeking to raise gross proceeds of about S$16.6 million through the sale of 82.8 million shares at a price tag of S$0.20 apiece. Of these, some 53.8 million shares were new shares, while the remaining 29 million shares were vendor shares sold by the group’s current shareholder. There was no public offer.

Furniture ODM manufacturer and brand owner Koda expects to report a substantially lower profit for 1HFY2023 compared to the six months ended Dec 31, 2021, based on the preliminary review of unaudited consolidated financial results. As it previously disclosed in its FY2022 ended June 30 results, the company has observed that the increasingly higher inventories in the US wholesale market could lead to a cyclical slowdown in furniture demand, while consumer spending switches to more services. The company also states that high inflation, rate hikes and geopolitical tensions could further obstruct global economic recovery and affect consumer spending sentiment, while the zero-Covid approach in China during the reporting period for 1HFY2023 have continued to weigh on business recovery.

New Housing and Development Board (HDB) flats continue to be affordable for most Singaporeans, with prices remaining stable despite rising costs and a tight supply situation, said National Development Minister Desmond Lee on Monday (Feb 6). “Close to 70 per cent of the Build-To-Order flats launched in 2022 across all estates can be affordably purchased with (the median Singaporean household income of) S$8,400 at a mortgage servicing ratio (MSR) of 25 per cent or less, meaning that these households use a quarter or less of their household income to pay for the mortgage instalment,” said Lee in his opening remarks for the debate on two parliamentary motions on keeping public housing affordable and accessible to Singaporeans on Monday (Feb 6).

Singapore is not affected by the collapse of solar energy company Sun Cable’s plan to send electricity from Australia to the Republic, Minister for Trade and Industry Gan Kim Yong said in a written reply to Parliamentary questions on Monday (Feb 6). Sun Cable’s proposal was among more than 20 received by the Energy Market Authority (EMA) in its ongoing requests for proposals for electricity imports. As part of the tender process, the EMA has been clarifying Singapore’s technical requirements with the renewable energy firm but “has not made any commitment, financial or otherwise”, said Gan.

US

Apple’s latest iPhones are selling at discounts of more than US$100 in China, an unusually steep price cut just months after launch that suggests dwindling demand for even its highest-end devices. JD.com and state carrier China Mobile are among the retailers taking 800 yuan (S$156) off the iPhone 14 Pro range over 11 days. Retailers in the southern electronics hub of Shenzhen have also begun cutting prices for the same handsets by 700 yuan, the official China Securities Journal reported after visiting outlets around the city. Apple’s own local website, meanwhile, continued to offer devices at regular prices. The discounting emerged around the end of the Chinese New Year season when retailers gear up for a holiday shopping spree before schools reopen. While it’s unclear how long the cuts may persist, they point to weak demand in the world’s largest smartphone arena just as Apple is counting on a recovery in China. Unusually, the roughly 7 per cent to 9 per cent discounts on the iPhone Pro range mirrored bargains offered on lower-end models, which typically get cut first.

Tesla raised the prices of its Model Y SUV in the US late on Friday (Feb 3). The cost of the Model Y Long Range has increased by US$1,500 to US$54,990, while the Model Y Performance is up US$1,000 to US$57,990, according to the company’s website. The move comes after the Biden administration introduced measures to make more crossover SUVs qualify for the newly revamped electric vehicle (EV) tax credit. The change, announced on Friday by the Treasury Department, expands the number of consumers who can take advantage of a lucrative US$7,500 consumer tax credit by broadening the definition of how a sport-utility vehicle is defined. Under the Inflation Reduction Act, SUVs costing up to US$80,000 can now receive the tax credits.

Dell Technologies, facing plummeting demand for personal computers (PCs), will eliminate about 6,650 jobs, becoming the latest technology company to announce it will let thousands of employees go. The company is experiencing market conditions that “continue to erode with an uncertain future”, co-chief operating officer Jeff Clarke wrote in a memo viewed by Bloomberg. The reductions amount to about 5 per cent of Dell’s global workforce, according to a company spokesperson.

Oracle plans to invest US$1.5 billion in Saudi Arabia in the coming years as it builds up its cloud footprint in the kingdom and opens its third public cloud region in Riyadh, a company official said. Increased demand for cloud computing has pushed technology companies such as Oracle, Microsoft, Amazon and Alphabet’s Google to set up data centres across the world to speed up data transfer. Saudi officials have pressed international companies to invest in the kingdom and move their regional headquarters to Riyadh in order to benefit from government contracts.

Tyson Foods’ profit slumped by two-thirds in the three months through December, as the U.S.’s largest meat processor struggled with cost squeezes and “operational inefficiencies”. Tyson said underlying earnings per share fell 70% from a year earlier to 85c, as a 12% rise in operating costs took a huge bite out of its margins. Profitability fell across all three of its main product categories – beef, chicken and pork, with the last of the three swinging to an operating loss in the period, the first quarter of its fiscal year.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

RESEARCH REPORTS

Keppel Corporation – Urban Development weighs on FY22 earnings

Recommendation: BUY (Maintained), Last Done: S$7.18

Target price: S$9.54, Analyst: Terence Chua

– FY22 net profit was below expectations, at 92% FY22e profit. Net profit of $927mn (-9% YoY) was under our expectations as Urban Development continued to underperform due to headwinds from China’s property market.

– $4.6bn in asset monetisation was announced, on track to exceed $5bn by this year. Another ~$10bn in assets to be monetised.

– Asset management target raised to $200bn from $100bn previously. This segment is the fastest-growing segment of the Group and the largest contributor to its earnings in FY22.

– Maintain BUY with higher SOTP TP of $9.54 (prev. $8.95). We adjusted our estimates for Keppel O&M and Asset Co higher, following the partial reversal of impairments made and the clearer path to divestment. Our TP translates to about 1.3x FY23e book value, a slight premium to its historical average as the Group’s transformation plans gain traction. Catalysts expected from approvals obtained for the transaction.

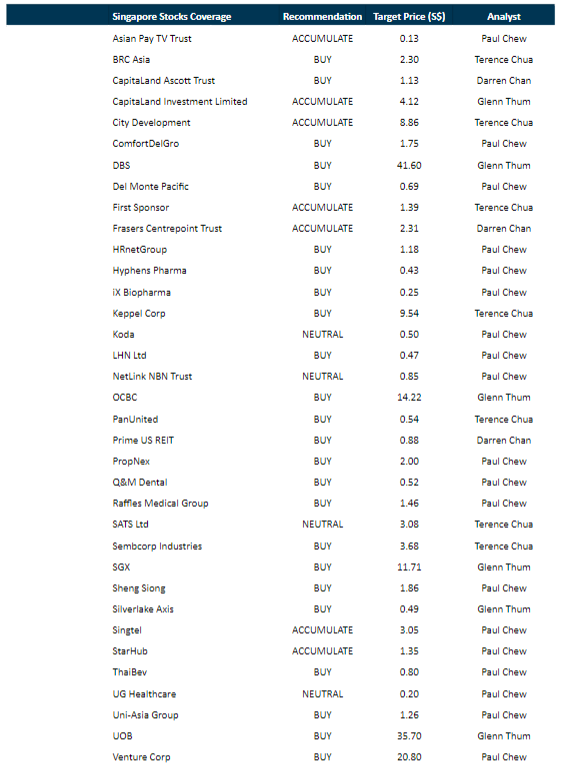

PSR Stocks Coverage

For more information, please visit:

Upcoming Webinars

Guest Presentation by LMS Compliance [NEW]

Date: 8 February 2023

Time: 12pm – 1pm

Register: https://bit.ly/3IX0pAr

Guest Presentation by Prime US REIT [NEW]

Date: 9 February 2023

Time: 1pm – 2pm

Register: http://bit.ly/3HmEzUI

Guest Presentation by Paragon REIT [NEW]

Date: 17 February 2023

Time: 12pm – 1pm

Register: https://bit.ly/3ZNn4W0

Guest Presentation by Keppel DC REIT [NEW]

Date: 17 February 2023

Time: 3pm – 4pm

Register: https://bit.ly/3CYgrGr

Guest Presentation by First REIT Management Limited [NEW]

Date: 23 February 2023

Time: 12pm – 1pm

Register: https://bit.ly/3GY2tp8

Research Videos

Weekly Market Outlook: Microsoft Corp, Netflix Inc, Technical Analysis, SG Weekly & More

Date: 30 January 2023

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials