DAILY MORNING NOTE | 7 March 2023

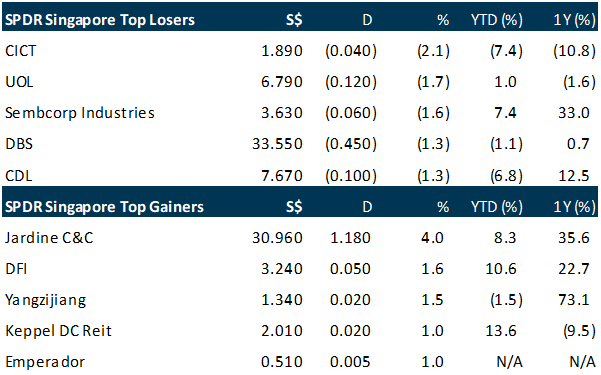

Singapore stocks started the week slightly higher on Monday (Mar 6), in tandem with most key indexes in the region after Wall Street closed with gains last Friday. Gainers and decliners were almost evenly split 256 to 252, on a turnover of 2.1 billion shares worth S$1 billion. Sembcorp Marine (Sembmarine) was by far the most traded stock on the Singapore Exchange by volume, with over 790 million shares transacted, but closed unchanged at S$0.111.

Wall Street stocks traded slightly higher on Monday, ahead of key jobs data and congressional testimony from Federal Reserve Chair Jerome Powell. The Dow Jones Industrial Average rose 0.1 per cent to 33,431.64, while the broad-based S&P 500 Index ticked up 0.1 per cent to 4,048.43. But the Nasdaq Composite Index lost 0.1 per cent to 11,675.73. The movements come as Fed Chair Powell is set for two days of testimony before Congress, on Tuesday and Wednesday, where he will be pressed about the central bank’s efforts to counter inflation. This would provide hints on what policymakers are thinking about price pressures, influencing the market’s movements.

SG

Energy utilities group SP Group has bought its first solar farm assets in Vietnam, as part of its plan to develop 1.5 gigawatts of utility-scale and rooftop solar projects in the country by 2025. SP Group said the assets will equip the company with capabilities to help commercial and industrial customers achieve “100 per cent clean energy consumption” once Vietnam’s direct power purchase framework is established. The framework promises to let renewable energy generators sell clean electricity to private offtakers for the first time.

Yangzijiang Financial Holding will team up with Singapore-based fund manager Tahan Capital Management to invest in private credit assets in Asia. The partnership is viewed as a “strategic move to diversify the group’s portfolio and promote sustainable growth in the region”. Citing data from investment data company Preqin, Yangzijiang Financial noted that the private credit market in the Asia-Pacific has grown significantly over the last few years and is expected to expand further.

Catalist-listed Fortress Minerals has been granted two new licences in Sabah, Malaysia to undertake prospecting operations for copper, nickel and cobalt minerals, the iron ore miner said on Monday (Mar 6). The prospecting licences “offer the opportunity to expand the group’s commodity profiles and diversify its revenue streams”, as part of its strategic growth efforts to “invest prudently through the cycle and to enhance long-term shareholder value”, said Fortress Minerals.

Or Kim Peow Contractors, a unit of OKP Holdings, has been awarded S$43.8 million over an arbitration case on a 2017 accident involving the Pan-Island Expressway (PIE) viaduct collapse. An arbitration tribunal ordered consultancy services company CPG Consultants to pay the full sum to the company within 28 days from Mar 3, the mainboard-listed company said in a bourse filing on Monday (Mar 6). The payment is expected to have a positive impact on the financial performance of the group for the current financial year ending Dec 31, 2023, said OKP.

US

American planemaker Boeing Co and its European rival Airbus have teamed up to bid for a UK government contract that would provide helicopters for the Royal Air Force and British Army, the companies said on Monday (Mar 6). The move comes as Britain looks to replace its ageing fleet of twin-engined medium transport helicopter, Puma HC Mk2. A joint statement by the two planemakers did not disclose the size of the contract they were bidding for.

The US dollar steadied on Monday (Mar 6), as investors awaited testimony from Federal Reserve chair Jerome Powell ahead of the February jobs report to be published at the end of the week. The US dollar index, which measures the greenback’s performance against six other currencies, was last flat on the day at 104.63, after lifting off a session low of 104.34. Last week, the index clocked a weekly loss for the first time since January.

Shares of Silvergate Capital fell 10 per cent in early trading on Monday (Mar 6) after the bank suspended its crypto payments network and expressed doubts over the viability of its business. The crypto-focused bank said late on Friday that it had made a “risk-based decision” to discontinue the Silvergate Exchange Network (SEN) effective immediately. The discontinuation could signal that Silvergate may consider winding down its operations, they added.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

RESEARCH REPORTS

Singapore Banking Monthly – NII growth offset fee income decline

Recommendation: Overweight (Maintained)

Analyst: Glenn Thum

– February’s 3M-SORA was up 16bps MoM to 3.21%, 3M-SIBOR was down 4bps MoM to 4.21%.

– 4Q22 results, banks’ NII rose 55% YoY as NIM improved by 69bps with loans growth of 2%. Fee income was a drag, declining 20%. Banks are guiding for NIMs of 2.10-2.25% (FY22: 1.75%-1.91%) and mid-single digit loans growth for FY23e.

– Singapore domestic loans dipped 1.89% YoY in January, below our estimates, while Hong Kong’s domestic loans declined 2.56% YoY in January. The CASA balance dipped slightly to 20.0%.

– Maintain OVERWEIGHT. We remain positive on banks. Bank dividend yields are attractive at 5.7% with possible upside surprise due to excess capital ratios and push towards higher ROEs. SGX is another major beneficiary of higher interest rates [SGX SP, BUY, TP S$11.71].

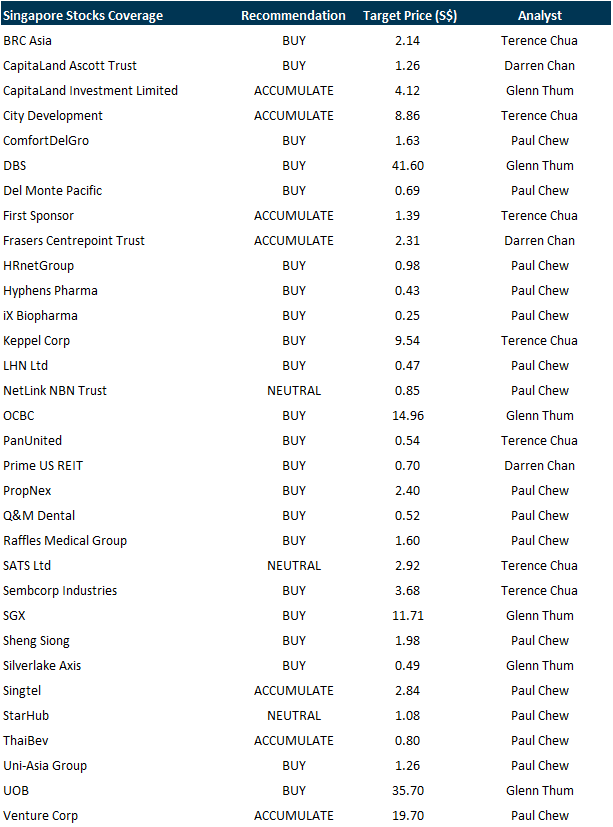

PSR Stocks Coverage

For more information, please visit:

Upcoming Webinars

Guest Presentation by Enviro-Hub Holdings Ltd [NEW]

Date: 14 March 2023

Time: 12pm – 1pm

Register: https://bit.ly/3KBprpA

Guest Presentation by Luminor Financial Holdings Ltd [NEW]

Date: 15 March 2023

Time: 12pm – 1pm

Register: https://bit.ly/3kj6LjP

Guest Presentation by Meta Health Limited [NEW]

Date: 16 March 2023

Time: 3pm – 4pm

Register: https://bit.ly/41oikGX

Guest Presentation by Keppel Pacific Oak US REIT (KORE) [NEW]

Date: 23 March 2023

Time: 12pm – 1pm

Register: https://bit.ly/3XY2n7v

Research Videos

Weekly Market Outlook: Block Inc, PropertyGuru, Sheng Siong, PropNex, Raffles Medical, Tech Analysis

Date: 6 March 2023

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials