DAILY MORNING NOTE | 7 November 2022

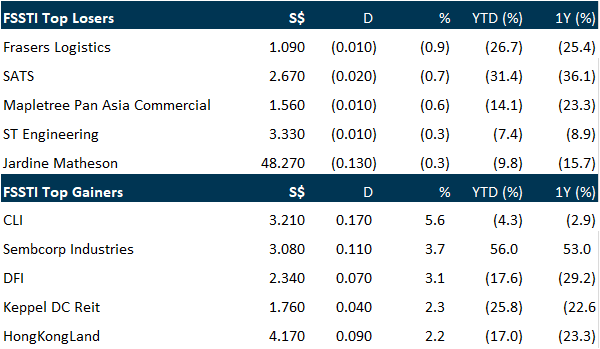

Singapore shares picked up the pieces from the previous day’s rout sparked by the Federal Reserve’s half-hearted dovish stance and recovered some ground on Friday (Nov 4) alongside most regional peers. The Straits Times Index (STI) rose 27.60 points or 0.9 per cent to 3,130.11 as traders trawled for value after Thursday’s sell-off and ahead of key US jobs data. It has ended in positive territory four of the five days, with the STI having gained 70.92 points or 2.3 per cent over the week. On the local bourse, some 1.65 billion securities worth S$1.26 billion were traded. Gainers outpaced losers, with 347 counters up and 218 down. Gains were held up by banking trio DBS, UOB and OCBC.

Wall Street stocks finished a volatile day sharply higher Friday (Nov 4) following good jobs data that was seen as keeping the pressure on the Federal Reserve to hike interest rates more. Friday’s gains ended a four-day losing streaks for stocks, reducing the week’s losses surrounding the Fed’s latest big interest rate hike. The Dow Jones Industrial Average finished 1.3 per cent higher at 32,403.22. The broad-based S&P 500 gained 1.4 per cent to 3,770.55, while the tech-rich Nasdaq Composite Index advanced 1.3 per cent to 10,475.25. Among individual companies, Starbucks shot up nearly nine per cent after reporting better-than-expected profits despite a hit from a drop in China sales. DoorDash was another big winner, rising more than eight per cent following a jump in revenues that showed consumer remain unperturbed by inflation.

Week 45 equity strategy: We are close to a “peak Fed and peak US dollar” investment theme. We still expect another 125bps of hikes until Mar23. (Dec22 +50bps, Jan23 +50bps and Mar23 +25bps). Hard to rally in a Fed pause because US equities must then grapple against the downward momentum in economic growth. This is economic weakness the Fed has warned and orchestrating for the US economy. We think positioning into REITs on a peak Fed and more defensive sectors in early 2023 is appropriate.

Paul Chew

Head Of Research

SG

Singapore Airlines (SIA) announced record operating profits for both its second quarter and first half financial year ending Mar 31, 2023. The outsized performance was driven by high demand for air travel during the peak summer season across all route regions, except East Asia. This resulted in a Q2 FY2023 operating profit of S$678 million, up 21.9 per cent from S$556 million in the previous quarter. It was the highest quarterly operating profit in SIA’s history. Second quarter net profit surged 50.5 per cent to S$557 million from S$370 million in the previous quarter. Revenue for the quarter to Sep 30 rose in tandem to S$4.5 billion, up 14.3 per cent from S$3.9 billion in Q1 FY2023. In bourse filings after the market close on Friday (Nov 4), the airline also announced the resumption of dividend payments, with an interim dividend of S$0.10 per share to be paid in December. Passenger flown revenue hit S$3.3 billion for Q2 FY2023, as traffic jumped 22 per cent, outgrowing capacity expansion of 11.3 per cent. However, cargo flown revenue fell 8.5 per cent quarter on quarter to S$1 billion, the fourth consecutive quarter crossing the S$1 billion mark. The fall was due to softening air freight demand and intensifying competition. Expenditure grew 13 per cent quarter on quarter to S$3.8 billion, driven by a S$150 million increase in net fuel cost and a S$288 million increase in non-fuel expenditure. Net fuel cost rose to S$1.4 billion, but was partially offset by higher fuel hedging gains. The non-fuel expenditure tracked the increase in passenger and cargo capacity. SIA is on track to hire about 3,000 cabin crew by the end of the financial year. It has also resumed cadet pilot recruitment to keep pace with operational needs, as well as fleet and network expansion plans. The airline expects demand to be strong heading into the peak year-end travel season.

AEM Holdings reported a 41 per cent jump in Q3 2022 revenue to S$206 million, from S$146 million a year prior, in a bourse filing on Friday (Nov 4). Net profit for the quarter grew in tandem, up 38.3 per cent to S$32.2 million, from S$23.3 million in the previous year. The topline and bottomline growth were driven by a ramp-up in volume from new and existing customers of AEM’s systems-level testing handlers and peripheral tools. Contributions from CEI, acquired in March 2021, also powered the semiconductor testing company’s growth. The company is investing in a longer-dated purchase order backed programme of about S$280 million, resulting in an increase of inventories from S$204.9 million as of Dec 31, 2021 to S$322.5 million as of Sep 30, 2022. Cash and cash equivalents have also reduced to S$153.6 million as of Sep 30, 2022, from S$216.2 million as of Dec 31, 2021. Revenue guidance for FY2022 is maintained between S$820 million and S$850 million on the back of strong demand from customers.

Venture Corporation reported a 24.9 per cent jump in its net profit to S$271.1 million for the first nine months of 2022, on the back of broad-based and diversified growth, the group announced in a bourse filing on Friday (Nov 4). “All technology domains contributed to the robust year-to-date performance, with lifestyle and wellness, life science and genomics and test and measurement instrumentation technology domains registering the strongest performance,” the filing noted. Earnings per share were up 25.1 per cent at S$0.932, from S$0.745 in the previous corresponding period. Revenue climbed 28 per cent to S$2.82 billion, up from S$2.2 billion previously. The group maintained a net cash position of S$700.7 million as at Sep 30, 2022. In its outlook, Venture Corporation said its Malaysian entities delivered the most impressive contributions to its overall performance. “Beyond FY2022, the science and technology market segments may continue to see volatility if geopolitical tensions, Covid-19 lockdowns and other headwinds remain unabated,” it added.

US

Nonfarm payrolls report for October showed the world’s largest economy created more new jobs than expected, but also flashed signs of a slowdown with a higher unemployment rate and lower wage inflation. Nonfarm Payrolls in the US rose by 261,000 in October, the data published by the US Bureau of Labor Statistics revealed on Friday. This reading came in much higher than the market expectation of 200,000. Additionally, September’s reading got revised higher to 315,000 from 263,000. Further details of the publication revealed that the Unemployment Rate edged higher to 3.7% from 3.5% and the annual wage inflation, as measured by the Average Hourly Earnings, declined to 4.7% from 5%. In addition, the Labor Force Participation Rate inched lower to 62.2% from 62.3%. Despite the strong jobs data, Fed officials on Friday said a smaller rate increase is still on the table for the December policy meeting.

Oil prices settled up by more than 5 per cent on Friday (Nov 4) amid uncertainty around future interest rate hikes by the US Federal Reserve, while a looming EU ban on Russian oil and the possibility of China easing some Covid restrictions supported markets. Though fears of global recession capped gains, Brent crude futures settled up US$3.99 to US$98.57 per barrel, a weekly gain of 2.9 per cent. US West Texas Intermediate (WTI) crude futures were up US$2.96, or 5 per cent, at US$92.61, a 4.7 per cent weekly gain. China is sticking to its strict Covid-19 curbs after cases rose on Thursday to their highest since August, but a former Chinese disease control official said substantial changes to the country’s Covid-19 policy are to take place soon. China’s stock markets have been buoyed this week by the rumours of an end to stringent lockdowns despite the lack of any announced changes. However, signals about the size of US interest rate hikes caused oil to pare some gains.

Berkshire Hathaway on Saturday posted a solid gain in operating profits during the third quarter despite rising recession fears, while Warren Buffett kept buying back his stock at a modest pace. The Omaha-based conglomerate’s operating earnings — which encompass profits made from the myriad of businesses owned by the conglomerate like insurance, railroads and utilities — totaled $7.761 billion in the third quarter, up 20% from year-earlier period. Berkshire spent $1.05 billion in share repurchases during the quarter, bringing the nine-month total to $5.25 billion. The pace of buyback was in line with the $1 billion purchased in the second quarter. Shares of Buffett’s conglomerate have been outperforming the broader market this year, with Class A shares dipping about 4% versus the S&P 500 ′s 20% decline. The stock dipped 0.6% in the third quarter. However, Berkshire suffered a $10.1 billion loss on its investments during the quarter, bringing its 2022 decline to $63.9 billion. Buffett continued to buy the dip in Occidental Petroleum in the third quarter, as Berkshire’s stake in the oil giant has reached 20.8%. In August, Berkshire received regulatory approval to purchase up to 50%, spurring speculation that it may eventually buy all of Houston-based Occidental. The conglomerate amassed a cash pile of nearly $109 billion at the end of September, compared to a total of $105.4 billion at the end of June.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

RESEARCH REPORTS

Oversea-Chinese Banking Corp Ltd – Earnings bolstered by NIM expansion

Recommendation: Buy (Maintained), Last done: S$12.04

TP: S$14.22, Analyst: Glenn Thum

– 3Q22 earnings of S$1.61bn were in line with our estimates. It came from higher net interest margin and net interest income offset by lower fee income. 9M22 PATMI is 73% of our FY22e forecast.

– NII grew 44% YoY underpinned by loan growth of 6% YoY and NIM surging 54bps YoY to 2.06%. Total non-interest income dipped 4% YoY as lower fee income was partly offset by higher trading and insurance income. Allowances fell 6% YoY to S$154mn.

– Maintain BUY with an unchanged target price of S$14.22. We raise FY22e earnings by 6% as we increase NII and lower provision estimates for FY22e. We assume 1.23x FY22e P/BV and ROE estimate of 10.4% in our GGM valuation. Catalysts include lower provisions and higher interest income as economic conditions improve. OCBC is our preferred pick among the three banks due to attractive valuations, upside in dividend from the 14.4% CET 1 buffer and lower provisioning as the Indonesian and Malaysian economies recover.

Venture Corporation Ltd – Revenue close to record levels

Recommendation: BUY (Maintained), Last done: S$16.13

TP: S$20.80, Analyst: Paul Chew

– 9M22 PAT was within expectations at 71% of our FY22e forecast. 3Q22 PAT jumped 27% YoY to S$97.4mn. The improvement was in part due to lockdowns in Malaysia a year ago.

– The company said that growth was across all sectors. We believe the strong US dollar was another tailwind to growth.

– We lift our FY22e revenue by 4% but maintain earnings as we lower margin assumptions. Our BUY recommendation and target price is unchanged at S$20.80, based on 16x PE FY22e. Venture’s dividend yield and valuation are attractive. However, we are cautious for FY23e and lower our revenue growth rate to 3% (prev. 7%). Macro uncertainty may push customers to turn cautious on their forward orders.

NetLink NBN Trust – Stable may not be enough

Recommendation: NEUTRAL (Maintained), Last done: S$0.89

TP S$0.85, Analyst: Paul Chew

– 1H23 revenue and EBITDA were within expectations, at 52/53% of our FY23e forecasts. 1H23 DPU was 2.62 cents, an improvement of 2.3% YoY.

– Residential fibre connections increased by 10,026 in 1H23 (1H22: +3,946). The jump follows the resumption of new home construction as restrictions were lifted. New connections are normalising to 20,000-25,000 p.a. in household formations.

– We nudged up our FY23e EBITDA by 2% to account for the higher diversion revenue. Regulatory review of fibre prices is still ongoing with possible completion by the middle of next year. Our base case is the regulatory review will have minimal impact on cash available for distribution as dividends. Our NEUTRAL recommendation is maintained. The DCF target price is lowered to S$0.85 (prev. S$0.96) as we raised our risk-free rate assumption.

Apple Inc. – Proving its resilience

Recommendation: Buy (Maintained), Last done: US$138.38

TP: US$190.00, Analyst: Maximilian Koeswoyo

– Revenue and PATMI in line at 100% of our FY22 forecasts. Resilient hardware revenue with 9% YoY growth in 4Q22 amid negative industry sentiment.

– Revenue growth deceleration and increasing FX headwinds guidance for 1Q23.

– Maintain BUY with a lowered target price of US$190.00 (prev. US$198.00). Valuations based on DCF with a WACC of 6.5% and terminal growth rate of 3%. We believe Apple will benefit from the increased average selling price (ASP) of its iPhone while volume growth is expected to face headwinds from both the lower demand compared to FY22 and potential supply constraints from the continued lockdowns in China.

Airbnb Inc – Record earnings as travel demand persists

Recommendation: Buy (Upgraded), Last done: US$96.09

TP: US$128.00, Analyst: Ambrish Shah

– 3Q22 results beat expectations. 9M22 Revenue/PATMI was at 79/115% of our FY22e forecasts. In 3Q22, revenue grew by 29% YoY despite FX headwinds. PATMI jumped 46% YoY driven by continued strong travel demand and higher operating leverage.

– Gross bookings value (GBV) grew 31% YoY to US$15.6bn supported by higher average daily rates (ADRs). Revenue guidance for 4Q22 is a growth of 17-23%.

– We upgrade to BUY from NEUTRAL after the recent fall in its stock price. We also increased our DCF target price to US$128.00 (prev. US$119.00) with a WACC of 7% and terminal growth of 4%. We increased our FY22e Revenue/PATMI by 1%/26% due to a slightly higher revenue take rate and lower expenses. While inflation and rising interest rates could weigh on discretionary demand for travel in the near term, we believe Airbnb is well-positioned as the platform offers better non-urban location listings versus hotels, benefits from travelers looking for long-term stays, and is more family and group travel-friendly.

Upcoming Webinars

Guest Presentation by Elite Commercial REIT [NEW]

Date: 8 November 2022

Time: 12pm – 1pm

Register: https://bit.ly/3FquBCh

Guest Presentation by IREIT Global [NEW]

Date: 2 December 2022

Time: 12pm – 1pm

Register: https://bit.ly/3DRroub

Guest Presentation by Marco Polo Marine [NEW]

Date: 6 December 2022

Time: 12pm – 1pm

Register: https://bit.ly/3h1bowW

Guest Presentation by Zoom Video Communications, Inc [NEW]

Date: 7 December 2022

Time: 9am – 10am

Register: https://bit.ly/3TzxFQ6

Research Videos

Weekly Market Outlook: Netflix, Alphabet Inc, Meta Inc, Microsoft, Amazon, UOB, Sheng Siong & more

Date: 31 October 2022

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials