DAILY MORNING NOTE | 7 September 2022

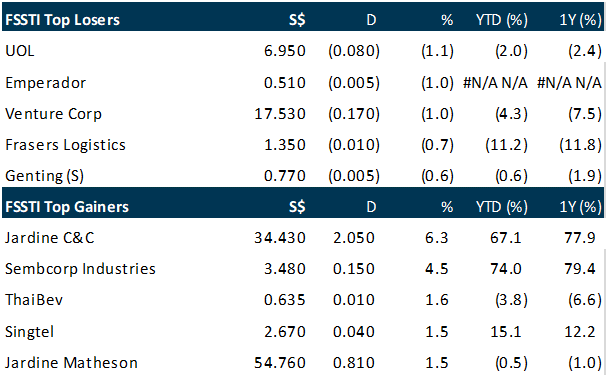

Singapore stocks finished higher on Tuesday (Sep 6) after a day of quiet trade across most of the region as there were few market-moving events with markets in the United States closed for a holiday. The Straits Times Index (STI) rose 0.3 per cent, or 8.7 points to 3,224.18. Losers outnumbers gainers 247 to 240, with 1.85 billion shares worth S$957.2 million changing hands. Other key indices in the region had a muted session, with Hong Kong’s Hang Seng index closing slightly lower by 0.1 per cent, while Japan’s Nikkei ended nearly flat, gaining a mere 0.02 per cent. However, the Shanghai Composite Index jumped 1.4 per cent, and the Shenzhen Composite Index climbed 1.2 per cent after China vowed fresh stimulus measures for the troubled economy. Among STI constituents, Jardine Cycle & Carriage and Sembcorp Industries were the top 2 gainers on Tuesday.

WALL Street stocks fell Tuesday (Sep 6), extending an equity downturn as worries about tightening central bank policy and Europe’s energy woes offset good US economic data. The American services sector expanded in August, defying expectations for a slowdown amid signs of easing supply issues and slowing price gains. Countering that positive was ongoing angst about the difficult energy picture facing Europe after Russia continued the suspension of natural gas deliveries to Germany through the Nord Stream pipeline.

Stocks to watch: Gallant Venture

SG

Indonesian magnate Anthoni Salim on Tuesday (Sep 6) raised his deemed interest in mainboard-listed Gallant Venture to 73.1 per cent, after an entity linked to him purchased 397 million shares in the company. The disclosure came after Gallant Venture soared 9.3 per cent in Tuesday’s early trade, on the back of 2 married deals – where shares were purchased at volumes of 157,000 and 240,000. In a filing after trading hours, it was revealed that an entity called River Point Ventures had purchased 397 million shares of Gallant for S$50.02 million via off-market transactions. This translates to an average purchase price of S$0.126 per share.

An indirect subsidiary of Watches.com, CKLY Trading Limited (CTL), is under investigation by the Hong Kong Customs and Excise Department (C&E) for alleged offenses related to Hong Kong’s Trade Description Ordinance (TDO). Under the laws of Hong Kong, the TDO prohibits false trade descriptions and forged trademarks in respect of goods provided in the course of trade or business. CTL is also an indirect associate of electronics distributor Incredible Holdings.

Internet service provider MyRepublic Group has launched MyRepublic Digital, a platform-as-a-service spin-off company that the group believes will serve as its latest growth channel. In a joint press statement on Tuesday (Sep 6), MyRepublic and its spin-off company also announced the debut of the latter’s flagship product – a cloud-native digital platform named Encore, which is said to come built with industry practices and BSS/OSS (business support system/operations support system) features. The pre-configured platform is “ready out of the box” and will offer “unmatched” deployment times and cost efficiencies for operators looking to enter new markets, they added.

Banks in Singapore are taking a more active approach in combating scams, working closely with the police at the Police Cantonment Complex. In a media release on Tuesday (Sep 6) to announce the Singapore Police Force (SPF)’s anti-scam command office (ASCom), the police said 6 banks have assigned representatives to work at the complex to combat scams since Jul 25 this year. Representatives from DBS, OCBC, UOB, Standard Chartered, HSBC and CIMB have been involved in efforts to trace funds and freeze bank accounts suspected to be involved in scammers’ operations.

US

Labour Secretary Marty Walsh said the US will eventually need to overhaul the nation’s immigration system, calling the lack of available workers to fill jobs a “bigger threat” to the economy than inflation. “We don’t have enough workers in the United States of America to fill all the job openings that are out there,” Walsh said on Tuesday (Sep 6) in an interview with MSNBC. “It’s a bigger threat to our economy than inflation is at this point, than a recession, because we need to fill these jobs.” Walsh pointed to immigration reform as a long-term solution to the issue. Lawmakers need to develop additional legal pathways for immigrants to apply for visas, and focus on how to use immigration “in a positive manner,” he said.

A high-profile push by Congress to rein in the nation’s biggest Internet companies is at risk of failing with time running out to pass major legislation ahead of midterm elections. Alphabet’s Google, Apple, Amazon.com and Meta Platforms and their trade groups have poured almost US$95 million into lobbying since 2021 as they seek to derail the American Innovation and Choice Online Act, which has advanced further than any US legislative effort to address the market power of some of the world’s richest companies. After a nearly two-year battle, the Bill is now at a critical juncture as the Senate returns this week for a final stretch before the November midterms. Backers of the measure swear they have the necessary votes, yet it’s unclear if they do, and the Senate will be busy with other must-pass spending legislation.

The Department of Commerce on Tuesday (Sep 6) unveiled its plan for dispensing US$50 billion aimed at building up the domestic semiconductor industry and countering China, in what is expected to be the biggest US government effort in decades to shape a strategic industry. About US$28 billion of the so-called CHIPS for America Fund is expected to go toward grants and loans to help build facilities for making, assembling and packaging some of the world’s more advanced chips. Another US$10 billion will be devoted to expanding manufacturing for older generations of technology used in cars and communications technology, as well as speciality technologies and other industry suppliers, while US$11 billion will go toward research and development initiatives related to the industry.

The US service sector expanded in August at the fastest pace in 4 months amid a pickup in business activity and new orders, while price pressures continued to ease. The Institute for Supply Management’s (ISM) services index edged up to 56.9 from 56.7, data showed on Tuesday (Sep 6). The median forecast in a Bloomberg survey of economists called for the gauge to soften to 55.3. Readings above 50 signal growth. Measures of business activity and new orders both advanced to their strongest readings of the year, reflecting both an ongoing shift in spending habits and steady wage gains. Demand strengthened abroad as well, with export orders expanding at the fastest pace in nearly a year.

Source: SGX Masnet, The Business Times, Bloomberg, Channel NewsAsia, Reuters, CNBC, PSR

RESEARCH REPORTS

Sembcorp Industries – Strategically important sale of SEIL

Recommendation: ACCUMULATE (Upgraded), Last Done: S$3.48

Target price: S$3.68, Analyst: Terence Chua

• Acquisition consideration of S$2.059bn implies S$0.8bn/GW of gross installed capacity, which is higher than average comparable transactions of S$0.5-1bn/GW. We view the transaction as fair given the weak market environment for coal assets.

• Debt-capitalisation ratio improve to 62% from 66% for pro forma 1H22. We believe the Group will leverage its balance sheet and re-invest the proceeds into green assets.

• Sembcorp Industries (SCI) will still be exposed to operational risks of Sembcorp Energy India Limited (SEIL) after the sale through its 15-year exposure to the Deferred Payment Note (DPN).

• We upgrade to ACCUMULATE from NEUTRAL with higher target price of $3.68 (prev. $3.27). We lower FY23e PATMI by 11% as we strip out SEIL’s contribution and lower contribution from urban developments. Our target price is raised to $3.68, still based on 1.2x P/BV, the average of its peers as we roll forward estimates to FY23e.

Technical Pulse: Marco Polo Marine Ltd

Analyst: Zane Aw

Recommendation: Technical SELL

Sell limit: 0.043 Stop loss: 0.046 Take profit 1: 0.039 Take profit 2: 0.035

Marco Polo Marine Ltd (SGX: 5LY) A potential bearish reversal to the downside.

Upcoming Webinars

Guest Presentation by United Hampshire US REIT [NEW]

Date: 7 September 2022

Time: 7pm – 8pm

Register: https://bit.ly/3SgiZFV

Guest Presentation by Credit Bureau Asia [NEW]

Date: 14 September 2022

Time: 12pm – 1pm

Register: https://bit.ly/3Rj2MP4

Guest Presentation by AIMS APAC REIT [NEW]

Date: 15 September 2022

Time: 12pm – 1pm

Register: https://bit.ly/3KAETjD

Guest Presentation by ComfortDelGro Corporation Limited [NEW]

Date: 29 September 2022

Time: 12pm – 1pm

Register: https://bit.ly/3Ql57J7

Research Videos

Weekly Market Outlook: Singtel, Salesforce Inc, Silverlake Axis, Phillip On The Ground, SG Weekly…

Date: 5 September 2022

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials