DAILY MORNING NOTE | 8 December 2022

**Do note that the last day of Morning Note Issuance is on 15 December 2022. Morning Note will resume in January 2023**

Trade of the Day

Technical Pulse: Keppel DC REIT (SGX: AJBU)

Analyst: Zane Aw

(Current Price: S$1.88) – TECHNICAL BUYBuy price: $1.90 Stop loss: S$1.84 Take profit: S$2.05

Which sectors could outperform in 2023?

Analyst: Zane Aw

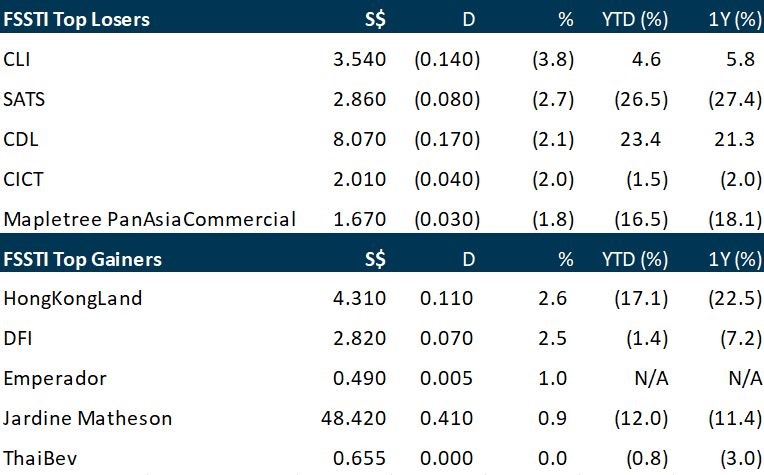

Singapore shares lost ground on Wednesday (Dec 7), mirroring a broader decline in Asian markets and overnight losses on Wall Street. The benchmark Straits Times Index (STI) fell 0.8 per cent or 26.92 points to close at 3,225.45. Elsewhere in the region, key indices in Japan, Shanghai, South Korea and Australia lost between 0.4 per cent and 0.8 per cent. Meanwhile, the Hang Seng Index in Hong Kong tumbled 3.2 per cent, leading losses in Asia, after disappointing trade data in China overshadowed earlier reopening optimism. On the local bourse, most of the STI constituents – including all the local banks and real estate investment trusts (Reits) – ended the day in the red. Shares of CapitaLand Investment finished at the bottom of the index performance table, slipping 3.8 per cent to close at S$3.54. Just four of the 30 STI constituents closed the day in positive territory. Hongkong Land was the top performer on Wednesday, with its shares rising 2.6 per cent to close at US$4.31. Across the broader market, decliners outnumbered gainers 319 to 227, after 1.5 billion securities worth S$1.1 billion were traded. Sembcorp Marine was the most active counter by volume. Its shares fell 2.1 per cent to close at S$0.142, after 104.3 million shares worth S$14.8 million changed hands.

Wall Street stocks finished a choppy session mostly lower on Wednesday (Dec 7) as markets weighed recession worries and awaited key economic data later this month. Analysts described the market movements as reflecting hesitancy, ahead of closely-watched consumer price data next week and a Federal Reserve decision on monetary policy. On Wednesday, the Bank of Canada hiked its key lending rate by 50 basis points to 4.25 per cent but hinted that this was likely to be its last rate increase for now. Markets are hoping for a similar pivot at next week’s Fed meeting. The Dow Jones Industrial Average finished flat at 33,587.92. The broad-based S&P 500 dipped 0.2 per cent to 3,933.92, while the tech-rich Nasdaq Composite Index dropped 0.5 per cent to 10,958.55. Among individual companies, Carvana plunged 42.9 per cent following reports that the e-commerce auto dealer’s creditors signed a pact pledging to negotiate together in a restructuring. The report added to speculation that Carvana could file for bankruptcy protection. Campbell Soup jumped 6.0 per cent as it lifted its full-year targets, citing strong demand for its food products and improvements in managing its supply chain. Lowe’s rose 2.4 per cent as the home-improvement retailer announced a new US$15 billion stock repurchase authorization at an investor conference. It also said it was targeting profit margins of 14.5 per cent in 2025, up from 12.6 per cent in 2021.

SG

Canned food brand Del Monte Pacific on Wednesday (Dec 7) posted a net profit of US$49.5 million for the second quarter ended Oct 31, up 38 per cent from a year ago. The increase was driven by a notable rise in gross margin for its US subsidiary, Del Monte Foods Inc (DMFI), the group said in a filing on the Singapore bourse. DMFI’s gross margin went up from 24.9 per cent to 28 per cent, as a result of selected price increases in line with inflation, reduced sales of low-margin products, and expense reduction initiatives, Del Monte Pacific said. In a call on Wednesday to discuss the earnings, company executives said that the group has been managing its operating expenses and embarked on cost-optimisation initiatives amid the current inflationary environment. Such moves include improving Del Monte’s sales mix and larger sales contributions from higher-margin categories in order to stave off “commodity headwinds” such as higher fertiliser prices and increases in packaging costs, said chief financial officer of Del Monte’s subsidiary Del Monte Philippines Inc (DMPI), Parag Sachdeva. The group’s overall gross margin improved by two percentage points to 29.4 per cent, fuelling a 15 per cent growth in gross profit for the quarter to US$205.3 million. Net profit for the first half fell to US$19 million from US$54.1 million, due to the one-off redemption cost of US$50.2 million booked in the first quarter as DMFI refinanced its loan with a long-term credit facility. Sales for the second quarter went up 7 per cent to US$698.9 million, with better performance in key markets across the US, the Philippines, and other international markets. DMFI logged sales of US$506.3 million, accounting for 72 per cent of the group’s turnover. DMFI’s sales grew 6 per cent on higher retail-branded sales of various canned foods. Its newly acquired Kitchen Basics ready-to-use stock and broth business also contributed to incremental sales of US$12.1 million. Market share has continued to grow across DMFI’s canned vegetable, fruit, fruit cup snacks and tomato product categories, the group said. The Philippine market recovered from first-quarter declines, logging US$107.9 million in sales, up 8 per cent in US dollar terms. The group said that new innovations, such as in dairy and snacks, are gaining traction, and now account for 8 per cent of Philippine sales. Sales in its international markets grew 13 per cent to US$84.9 million, driven primarily by strong performance of fresh pineapple exports. Fresh sales grew 46 per cent on the back of higher demand and consumer promotions in North Asia and the Middle East, coupled with improved supplies this quarter, Del Monte Pacific said. The group added that it expects to maintain revenue and income growth with its portfolio of health and wellness products. It plans to increase its MD2 fresh pineapple production substantially to support premium exports. Del Monte will raise the prices of its products again, said Sachdeva. For the Philippines, the group will hike its prices again in January, while the company’s US unit will see prices go up from February. He noted that Del Monte has taken “multiple price increases” across its businesses this year. The slate of price hikes typically means a company like Del Monte risks losing its market share in the countries it operates in to competitors who are selling the same products at cheaper prices. Greg Longstreet, chief executive of Del Monte’s US unit, said market share is driven primarily by strong commercial execution, an increase in distribution of core products and new products that a company introduces to its offerings. Meanwhile, the group also announced plans to redeem the US$100 million Series A-2 preference shares on Dec 15. These shares have a fixed rate of 6.5 per cent per annum, with a step-up rate if not redeemed. The redemption will be financed by bank loans, it said. Shares of Del Monte Pacific ended Wednesday flat at S$0.315.

Certificate of entitlement (COE) prices fell across all five categories at the second last tender exercise for 2022 that closed on Wednesday (Dec 7) afternoon. The biggest drop was in the category for cars above 1,600cc or 130bhp and electric vehicles (EVs) with more than 110 kilowatts of power. The premium for this type of COE fell by 7.4 per cent to end at S$105,501, down from S$113,881 at the previous tender exercise. The COE price for smaller and less powerful cars and EVs dipped by 2.3 per cent, from S$90,589 to S$88,503. Commercial vehicle COE price came down slightly by 0.37 per cent to end at S$81,501, below the record of S$81,802 posted at the last tender. In the motorcycle category, the COE premium ended at S$12,100, down 3.9 per cent from S$12,589. Open category COEs, which can be used to register any type of vehicles except motorcycles, ended 3.1 per cent cheaper at S$110,524, down from S$114,009.

The five Singapore-licensed digital banks have joined Credit Bureau (Singapore), the credit bureau said in a press release on Wednesday (Dec 7). The two full digital banks, including Grab’s and Singtel’s joint venture GXS bank and Sea’s wholly-owned subsidiary MariBank Singapore, will be required, inter alia, to submit to CBS consumer data related to credit reporting. Trust Bank, a partnership between Standard Chartered and FairPrice Group, will also be required to do so. These banks are allowed to retrieve a consumer credit report from CBS before granting any credit to a customer. The two digital wholesale banks, Ant Group’s subsidiary ANEXT Bank and Green Link Digital Bank, do not have to submit information related to their SME (small and medium-sized enterprise) customers. These digital wholesale banks have to obtain customers’ consent before retrieving credit reports from CBS. CBS now has 36 members, including the new joiners. William Lim, CBS’ executive director, said the five digital banks will enrich CBS’ data repository as they use innovative technologies to reach out to more consumers. The five digital banks are expected to have a material and positive contribution to CBS’ and its parent company Credit Bureau Asia’s revenue and profitability for the financial year ending 2023, CBS said. Shares of Credit Bureau Asia ended Wednesday flat at S$0.95.

US

The US dollar slipped on Wednesday (Dec 7) as traders weighed up an uncertain economic outlook, while China’s yuan firmed as authorities loosened some of the country’s zero-Covid rules. The greenback has dropped in recent weeks on expectations that the Federal Reserve (Fed) might soon pause its interest-rate hikes, and with the euro rising on signs that Europe’s economic downturn may be less bad than previously feared. Yet upbeat US employment, services and factory data has in recent days called into question the idea of a Fed slowdown, complicating the outlook for the US dollar. It struggled for direction on Wednesday, with the euro falling earlier in the session before rising 0.28 per cent against the greenback to US$1.05. The US dollar was up 0.35 per cent against the Japanese yen at 137.48, but down 0.25 per cent against sterling at US$1.216. Some investors believe fears about the global economy will boost the US dollar due to the currency’s perceived safety. Against a basket of currencies, the US dollar index was down 0.15 per cent to 105.39 on Wednesday, but remained around 10 per cent higher for the year. Others think the greenback’s decline – the US dollar index has fallen around 8 per cent since September – will continue as global inflation recedes. In Asia, China’s yuan firmed as the government announced measures that marked a sharp change to its tough zero-Covid policy that has battered its economy and triggered historic protests. China’s national health authority said asymptomatic Covid-19 cases and those with mild symptoms can self-treat while in quarantine at home. The announcement was the strongest sign so far that China is preparing its people to live with the disease, though analysts say the path to fully reopening the economy will be long and bumpy. The onshore yuan rose 0.25 per cent to 6.978 per US dollar. However, markets were also digesting dismal data which showed China’s exports and imports shrank at their steepest pace in at least 2-1/2 years in November. The Aussie dollar was down 0.1 per cent to US$0.668. The kiwi rose 0.19 per cent to US$0.633.

The price of oil fell to its lowest level this year on Wednesday (Dec 7), forfeiting all of the gains since Russia’s invasion of Ukraine exacerbated the worst global energy supply crisis in decades. The world’s most actively traded commodity surged to nearly US$140 a barrel in March, close to an all-time record, following the launch of what Moscow called a “special operation” in Ukraine that has raged ever since. The market has been steadily declining in the latter months of the year as economists brace for weakened worldwide growth in part due to high energy costs. Wednesday’s losses were driven by bigger-than-expected increases in US fuel stocks. Brent futures fell US$2.18, or 2.8 per cent, to US$77.17 a barrel, settling comfortably below the year’s previous closing low of US$78.98 a barrel touched on the first day of 2022. US West Texas Intermediate crude fell US$2.24, weakening further from Tuesday’s close, which was already a yearly low, to US$72.01 a barrel. The recent declines have come against what should be a supportive backdrop for prices. China, the world’s biggest crude importer, announced the most sweeping changes to its anti-Covid regime since the pandemic began. The country’s crude oil imports in November rose 12 per cent from a year earlier to their highest in 10 months, data showed. G7 nations kicked off implementation of a price cap to restrict Russian exports that could cause that nation to reduce output in the coming year. US distillate stocks posted a build of 6.2 million barrels, according to the Energy Information Administration, far exceeding estimates for a 2.2 million barrel rise. Petrol inventories climbed 5.3 million barrels against expectations for an increase of 2.7 million barrels. The build in fuel stocks outweighed a 5.2 million barrel draw in crude stocks. The American Petroleum Institute had reported a crude stocks draw of around 6.4 million barrels, according to market sources. Meanwhile, at least 20 oil tankers queueing off Turkey face more delays to cross from Russia’s Black Sea ports to the Mediterranean as operators race to adhere to new Turkish insurance rules added ahead of a G7 price cap on Russian oil, sources said on Tuesday. Russia, the Vedomosti daily reported on Wednesday, is considering options including banning oil sales to some countries to counter the price cap imposed by Western powers.

Mobileye Global beat estimates for revenue and earnings on Wednesday (Dec 7) in its first quarterly report after going public in October, as the Intel unit benefited from strong demand for its self-driving technology from carmakers. Shares of the company were up about 2 per cent at US$31 in premarket trading, after it also forecast a revenue range for the current quarter that came in well above expectations. A push to incorporate assistive-driving capabilities to bolster safety features in cars has led to greater adoption of self-driving technology, helping companies such as Mobileye. Total revenue at Mobileye grew 38 per cent to US$450 million in the third quarter ended Oct 1. Analysts were expecting revenue of US$447 million, according to Refinitiv data. Net loss, however, widened to US$45 million from US$26 million. On an adjusted basis, the company earned 15 cents per share, above analysts’ estimates of 12 cents. It forecast fourth-quarter revenue of between US$527 million and US$545 million. Analysts were expecting revenue of US$483.7 million for the quarter. Mobileye, which counts BMW, Nissan, Volkswagen, among others as its customers, listed on the Nasdaq on Oct 26 after raising US$861 million in an initial public offering. Its stock has risen 45 per cent from the IPO price of US$21, valuing the company at US$24.45 billion.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

RESEARCH REPORTS

Singapore Exchange Limited – Growth = derivatives volumes + pricing + treasury income

Recommendation: BUY (Maintained), Last done: S$9.20

TP: S$11.71, Analyst: Glenn Thum

– Securities volume softening while derivatives volumes trending at 10% growth rate, and derivatives pricing climbing to record levels.

– Pick up in treasury income to accelerate in FY23 as higher interest rates kick in. We estimate Treasury income to rise at least 8% YoY in FY23.

– We maintain BUY with an unchanged target price of S$11.71. Our estimates remain unchanged, and our target price remains pegged to +2SD of its 5-year mean or 26x P/E. Catalysts include continued growth from derivatives volumes and fees, and higher treasury income as the higher interest rates start to kick in.

StarHub Limited – More DARE, less PLUS until FY24

Recommendation: ACCUMULATE (Maintained); TP S$1.15, Last close: S$1.07; Analyst Paul Chew

TP: S$11.71, Analyst: Glenn Thum

– Under StarHub’s DARE+ transformation (2022-26) to reduce cost and create new revenue streams, S$310mn of investments are required from FY22-24e. Around S$75mn has been spent with the bulk (est. S$150mn) to be spent in FY23e.

– EBITDA is expected to return to the FY21 baseline of S$500mn by FY24 (FY22e: S$415mn).

– The 3-5 month delay in project implementation and higher cost in cloud infrastructure will elevate the operating cost and Capex in FY23e. We have not modelled the higher cost pending FY23e guidance, but there is upside risk. Our FY22e and FY23e forecasts are unchanged, but the target price is maintained at S$1.15, pegged at 7x FY22e EV/EBITDA, in line with other mobile peers. We maintain an ACCUMULATE recommendation.

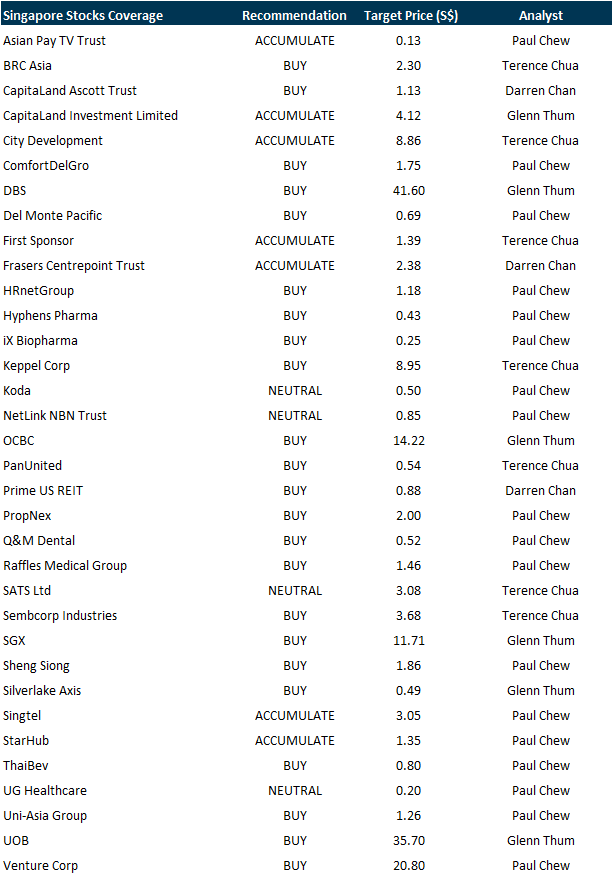

PSR Stocks Coverage

For more information, please visit:

Upcoming Webinars

Guest Presentation by Sabana Industrial REIT

Date: 8 December 2022

Time: 12pm – 1pm

Register: https://bit.ly/3UIuyXl

Guest Presentation by NoonTalk Media Limited [NEW]

Date: 13 December 2022

Time: 12pm – 1pm

Register: https://bit.ly/3gYzGI2

Guest Presentation by Keppel Infrastructure Trust ( KIT) [NEW]

Date: 15 December 2022

Time: 12pm – 1pm

Register: https://bit.ly/3UBLxd4

Guest Presentation by iWoW Technology

Date: 16 December 2022

Time: 12pm – 1pm

Register: https://bit.ly/3EqFiDT

Research Videos

Weekly Market Outlook: Salesforce Inc, ThaiBev, BRC Asia, Tech Analysis, SGBanking, SGWeekly & More

Date: 5 December 2022

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials