DAILY MORNING NOTE | 8 November 2022

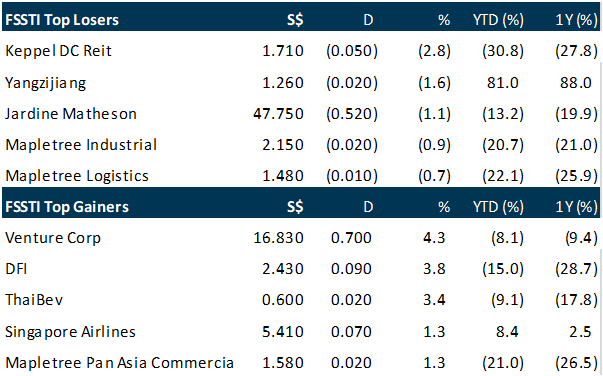

Singapore shares closed higher on Monday (Nov 7), even as China’s decision over the weekend to stick to its zero-Covid policy dampened investor sentiment. The Straits Times Index (STI) gained 11.2 points or 0.4 per cent to close at 3,141.31. In the broader Singapore market, gainers outnumbered losers 322 to 233, with 1.62 billion shares worth S$1.11 billion traded. The top performer on Singapore’s benchmark index was Venture Corporation, after the technology company last Friday (Nov 4) reported a 26.4 per cent rise in earnings for the third quarter ended September, on the back of broad-based revenue growth. Shares of Venture Corp closed 4.3 per cent or S$0.70 higher at S$16.83 on Monday. At the bottom of the table among the index constituents was data centre-focused Keppel DC Reit, which lost 2.8 per cent or S$0.05 to close at S$1.71. Meanwhile, Thai Beverage was the most heavily traded STI counter, with 38.8 million shares changing hands. Shares of ThaiBev closed 3.5 per cent or S$0.02 higher at S$0.60. The trio of local banks were mixed. DBS dipped 0.1 per cent or S$0.04 to S$34.43, while UOB gained 0.4 per cent or S$0.10 to S$28.50 and OCBC rose 0.7 per cent or S$0.08 to end at S$12.12.

Wall Street stocks rose for a second straight session on Monday as the dollar retreated and markets began to look past midterm US elections. The Dow Jones Industrial Average gained 1.3 per cent to finish at 32,827.00. The broad-based S&P 500 advanced 1.0 per cent to 3,806.80, while the tech-rich Nasdaq Composite Index rose 0.9 per cent to 10,564.52. This week’s calendar also includes consumer price data on Thursday, which will be a key test of whether the Federal Reserve’s interest rate hikes have made a dent in inflation and whether the US central bank will feel the need to enact another supersized increase next month.

SG

Lendlease Global Reit’s portfolio occupancy for the quarter ended Sep 30 fell 0.1 percentage point to 99.7 per cent, down from 99.8 per cent last quarter, said the manager on Monday (Nov 7). Weighted average lease expiry (WALE) – the mean time remaining on its leases – stood at 8.5 years when adjusted by net lettable area (NLA) and 5.5 years when adjusted by gross rental income (GRI). The Reit’s manager, however, highlighted a long WALE for its office portfolio at 12.7 years by NLA and 15.5 years by GRI. This will ensure a stable income for the Reit’s unitholders, said the manager. Meanwhile, Lendlease Reit’s retail portfolio saw a 99.3 per cent occupancy in Q1 FY2023, driven by healthy leasing momentum. “As at the period end, a positive rental reversion of approximately 1 per cent was recorded with a healthy tenant retention rate of approximately 69 per cent. Tenant sales for the first three months of FY2023 continued to surpass pre-Covid-19 average levels,” said the manager, adding that interest in leasing the atrium space of the malls has also risen. In the near term, the manager has plans to optimise the remaining untapped gross floor area of 10,200 square feet from the Urban Redevelopment Authority Master Plan 2019 to maximise the full potential of 313@somerset and create new value for Lendlease Reit’s unitholders. For Jem, while there is no additional plot ratio granted, the manager will look to convert spaces into leasable units to generate additional revenue. The Reit has a gearing ratio of 39.4 per cent with gross borrowings amounting to S$1.415 billion. As at Sep 30, Lendlease Reit has undrawn debt facilities of S$172.2 million to fund its working capital, with over two-thirds of its borrowings hedged to a fixed rate. Kelvin Chow, chief executive of the manager, said he expects the positive momentum driven by tourism recovery and a rising number of the return-to-office crowd to underpin the Reit’s performance for the financial year. “In addition, we are looking to increase non-rental revenue, unlock savings through the adoption of smart technologies to improve the efficiency of the assets and reduce non-core expenses to cushion the impact from rising interest rates and utilities costs,” added Chow.

Defence and engineering group ST Engineering is proposing to divest all of its US marine subsidiaries, namely VT Halter Marine and ST Engineering Halter Marine and Offshore (STEHMO), to Bollinger Shipyards Lockport for US$15 million. The transaction will be on a cash-free, debt-free basis and subject to net adjustments to working capital, if any, post-closing. It is expected to result in a non-cash loss on disposal of about S$13.3 million. STE may also receive post-closing earnout payments of up to some USS$10.3 million should Halter Marine be awarded certain future shipbuilding contracts, provided that the contracts meet the requisite operating profit margins. On Monday (Nov 7), the group said its proposed divestment comes as part of its ongoing portfolio review and rationalisation. After conducting a “thorough review” of its two US marine subsidiaries, the group found that the business units incurred a combined net loss before tax of US$256 million in five years spanning 2017 to 2021, with an annual net loss before tax ranging from US$40 million to US$60 million. This has resulted in the group engaging Macquarie Capital as its financial adviser to conduct an auction process involving both strategic investors and private equity funds. Bollinger was determined as the most suitable purchaser given its “good reputation and strong track record in undertaking US Navy and US Coast Guard programmes”, said STE.

Transport operator ComfortDelGro (CDG) has secured three metropolitan bus contracts in Sydney with a total value of A$1.7 billion (S$1.5 billion). On Monday (Nov 7), CDG said the contracts make up a significant part of the city’s public transport network, as it covers regions that are home to over 700 buses transporting 18 million passengers each year. The Greater Sydney Bus Contracts include two regions (four and 14) which CDG currently operates. The new region four contract will commence in April 2023 and run for eight years. Another contract is for a region (12) that is currently being run by another operator. It will be consolidated into contract region 14, which will commence in May 2023 and run for seven years. CDG group deputy chief executive Cheng Siak Kian views the new contract wins as a strong vote of confidence from Transport for New South Wales. The group has been operating in Australia for 17 years now, he notes, and the country continues to be a significant part of the business. CDG currently operates in six states and territories in Australia with a total fleet of over 3,000 vehicles including buses, coaches and ambulances. This represents about 35 per cent of the group’s total fleet of buses and coaches – and is about 80 per cent of the size of its Singapore fleet.

US

Apple’s biggest iPhone maker, Taiwan’s Foxconn, said on Monday (Nov 7) that it was working to resume full production at a major plant in China’s Zhengzhou as soon as possible, with the area hit by Covid-19 curbs. China ordered an industrial park that houses an iPhone factory belonging to Foxconn to enter a seven-day lockdown on Wednesday, in a move set to intensify pressure on the Apple supplier as it scrambles to quell worker discontent at the base. The Zhengzhou Airport Economy Zone in central China said it would impose “silent management” measures with immediate effect, including barring all residents from going out and only allowing approved vehicles on roads within that area. Foxconn, the world’s largest contract electronics maker, said in a statement that the provincial government in Henan, where Zhengzhou is located, “has made it clear that it will, as always, fully support Foxconn in Henan”. “Foxconn is now working with the government in concerted effort to stamp out the pandemic and resume production to its full capacity as quickly as possible.” In a statement released at the same time, Apple said it expects lower iPhone 14 Pro and iPhone Pro Max shipments than previously anticipated as Covid-19 restrictions temporarily disrupt production in Zhengzhou. Customers will experience longer wait times to receive their new products, said Apple, which released the new iPhone 14 for sale in September. Foxconn, formally Hon Hai Precision Industry, is Apple’s biggest iPhone maker, accounting for 70 per cent of iPhone shipments globally. It makes most of the phones at the Zhengzhou plant where it employs about 200,000 people, though it has other smaller production sites in India and southern China. Having previously guided for “cautious optimism” in the fourth quarter, Foxconn said it will “revise down” its outlook given events in Zhengzhou. However, the firm reported October sales had soared 40.97 per cent year-on-year, a record high for the same period, but down 5.56 per cent compared to the previous month. “Benefiting from the launch of new products in October, stable demand for major products, and strong demand in the server market, revenue in all four major product segments grew,” it said, referring to computing products, smart consumer electronics products, and cloud and networking products. Computing products, smart consumer electronics products, and cloud and networking products all showed double-digit growth last month, compared to the same period last year, the company added. The fourth quarter is traditionally the hot season for Taiwan’s tech companies as they race to supply cellphones, tablets and other electronics for the year-end holiday period in Western markets. Foxconn is due to release its third-quarter earnings on Nov 10.

Comments: The lockdown in Zhengzhou would pose a significant challenge for Apple, especially during the holiday season which is the best performing quarter of its financial year. Although supply is likely going to be negatively affected during the current quarter, we view that Apple should be able to re-capture the sales when the supply has stabilized as it enjoys strong loyalty and customers who would be willing to wait despite the extended lead time instead of switching to another smartphone brand.

Maximilian Koeswoyo

Research Analyst

maximilian@phillip.com.sg

Meta Platforms is planning to begin layoffs that will affect thousands of workers from this week, Wall Street Journal reported, citing people with knowledge of the matter. The job cuts could come as early as Wednesday, the newspaper said. The company has already told employees to cancel non-essential travel from this week, according to the report. Chief executive officer Mark Zuckerberg in September outlined plans to reorganise teams and reduce headcount for the first time, following a sharp slowdown in growth at the parent of Facebook and Instagram. Zuckerberg said then that Meta will likely be smaller in 2023 than it was this year. The layoffs come as Meta struggles with growing losses and as it invests heavily in developing its metaverse business. Its shares have fallen 73 per cent this year. The cuts will add to already mounting job losses in Silicon Valley. Twitter last week slashed nearly 3,700 positions after Elon Musk completed his US$44 billion takeover of the social media platform. Other companies that have also reduced their workforce or announced plans to include ridehailing firm Lyft and hard drive maker Seagate Technology Holdings.

Comments: The layoffs come as no surprise after Zuckerberg’s frosty comments during Meta’s 3Q22 earnings call, it seemed to be merely a matter of time before the company followed other tech companies in freezing or cutting headcount. With total expenses piling up to the tune of US$22bn last quarter – a lot of which are long term commitments, and net margins cut in half to 16%, it made sense for Meta to reduce headcount to alleviate margin pressures.

Jonathan Woo

Senior Research Analyst

jonathanwookj@phillip.com.sg

Palantir Technologies posted third-quarter sales results that edged Wall Street estimates, while disclosing strong demand from the U.S. defense sector. For the quarter, Palantir reported revenue of $478 million, up 22%, ahead of both the company’s guidance range of $474 million to $475 million. “We beat expectations for revenue growth this quarter and expect to have a strong finish to the year, even in the face of the continued strength of the U.S. dollar,” said Alexander C. Karp, Co-Founder and Chief Executive Officer. US commercial customer count increased 124% year-over-year, from 59 customers in Q3 2021 to 132 customers in Q3 2022; adjusted income from operations was $81 million, representing a margin of 17%; cash from operations was $47 million, representing a 10% margin and adjusted free cash flow (“AFCF”) was $37 million, representing an 8% margin. This also marks the 8th consecutive quarter of positive AFCF. On a trailing 12-months basis, government revenue was $1.02 billion, representing a 20% growth rate year-on-year and surpassing the $1 billion mark for the first time in company history. For full year 2022, the company is reaffirming revenue guidance of $1.9 – $1.902 billion despite a negative $6 million currency impact since prior quarter’s guidance. Excluding such impact, they would expect full year 2022 revenue of $1.906 – $1.908 billion. They raise outlook for adjusted income from operations to between $384 – $386 million. For Q4 2022 after factoring in a negative $5 million currency impact since the prior quarter’s guidance, the company expects revenue of $503 – $505 million. Excluding such impact, they would expect fourth quarter revenue of $508 – $510 million and adjusted income from operations of $78 – $80 million.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

RESEARCH REPORTS

CapitaLand Investment Limited – Growth supported by RevPAU recovery

Recommendation: Accumulate (Maintained), Last done: S$3.24

TP: S$4.12, Analyst: Glenn Thum

• 9M22 revenue of S$2,331mn (+36% YoY) was above our estimates, forming 88% of our forecast.

• RE investment revenue grew 48% YoY, driven by an occupancy recovery in their core markets, Singapore and India. Fee-related revenue was up 16% YoY, lifted by PE fund management (+44%) and lodging management (+48%) as RevPAU recovered to 92% of pre-pandemic 3Q22 levels.

• Maintain ACCUMULATE with an unchanged SOTP TP of S$4.12. We raise FY22e earnings by 8% as we increase RE investment revenue estimates for FY22e. The pick-up in travel and lifting of lockdowns in China will be immediate catalysts for CLI.

Analyst: Zane Aw

Recommendation: Technical Sell

Market Sell: 197.08 Stop loss: 223.80 Take profit: 154.65

Tesla, Inc (NASDAQ: TSLA) A potential breakdown of a key uptrend support line to retest the previous resistance zone now turned support at US$154-168

Upcoming Webinars

Guest Presentation by Elite Commercial REIT [NEW]

Date: 8 November 2022

Time: 12pm – 1pm

Register: https://bit.ly/3FquBCh

Guest Presentation by IREIT Global [NEW]

Date: 2 December 2022

Time: 12pm – 1pm

Register: https://bit.ly/3DRroub

Guest Presentation by Marco Polo Marine [NEW]

Date: 6 December 2022

Time: 12pm – 1pm

Register: https://bit.ly/3h1bowW

Guest Presentation by Zoom Video Communications, Inc [NEW]

Date: 7 December 2022

Time: 9am – 10am

Register: https://bit.ly/3TzxFQ6

Research Videos

Spotify, Airbnb, Apple, DBS, OCBC, CapitaLand Ascott Trust, First Sponsor, Venture Netlink, Technical Pulse, SG Weekly 45

Date: 7 November 2022

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials