DAILY MORNING NOTE | 9 March 2023

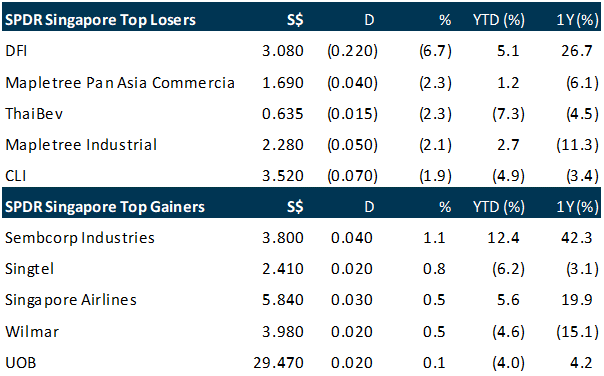

The US Federal Reserve chair’s testimony last night has not only opened the door to more interest rate hikes, but has also sent investors in Asian markets – including Singapore – scurrying for the exit on Wednesday (Mar 8). Across the broader Singapore market, decliners beat gainers 334 to 199, with 1.5 billion securities worth a total S$1 billion transacted.

Wall Street stocks were mixed at the end of a choppy session on Wednesday as markets weighed recession fears while a Federal Reserve report described inflation as persisting. The Dow Jones Industrial Average finished down 0.2 per cent at 32,798.40. The broad-based S&P 500 added 0.1 per cent at 3,992.01, while the tech-rich Nasdaq Composite Index advanced 0.4 per cent to 11,576.00.

SG

More funds deposited by its sponsor for loan repayment have been released from escrow to help pay for some of the Reit’s outstanding mandatory repayments, EC World Real Estate Investment Trust’s (Reit) manager said on Tuesday (Mar 7). Around S$5.7 million and US$1.9 million were used to partially repay existing offshore bank loans on Mar 2, while 29.3 million yuan (S$5.7 million) was used to repay existing onshore bank loans partially on Mar 7. The outstanding amount of relevant deposits stands at 29.9 million yuan, which the onshore facility agent continues to hold in escrow. The deposits held in escrow with the offshore facility agent have been fully utilised.

Yangzijiang Financial Holding has resumed buying back shares after a hiatus of around five months. On March 8, the company paid 38 cents each for 5 million shares, bringing the total bought back to 264.6 million shares, equivalent to 6.698% of the total share base. The most recent share buyback was on Oct 31, when it paid 33 cents each for one million shares. It has spent just over $100 million to date. When YFH launched its buyback programme, it committed to spending up to $250 million to buy back up to 10% of its shares.

US

TDCX reported profit of S$25 million for the fourth quarter ended December 2022, representing a 13.3 per cent decline from its Q4 FY2021 earnings of S$28.8 million. The customer solutions provider said that this was largely due to foreign exchange losses of S$6 million as the US dollar weakened in the last quarter of the fiscal year, resulting in higher other operating expenses of S$9.5 million compared to S$2.5 million previously. Earnings per share (EPS) stood at S$0.17 in Q4, down from the prior year’s EPS of S$0.20

The US dollar scaled multi-month highs against most other major currencies on Wednesday (Mar 8), after Federal Reserve (Fed) chair Jerome Powell warned that US interest rates might need to go up even faster and higher than expected to rein in stubborn inflation. Higher rates benefit the US dollar by improving its yield and as traders look for safety while global stock markets drop. The US dollar hit a two-month high against the euro of US$1.0524, extending Tuesday’s 1.2 per cent jump while also braking above its 200-day-moving average against the yen for the first time this year, rising as far as 0.5 per cent to a nearly three-month high of 137.9 yen.

Adidas slashed its dividend and offered no concrete plans to dispose of US$1.3 billion worth of Yeezy gear. The company’s sales in the Asia-Pacific region plunged 31 per cent in 2022, in large part because it failed to overcome the country’s widespread boycotts of Western brands. It said on Wednesday (Mar 8) that it would recommend slashing its annual dividend for 2022 to 70 euro cents from 3.30 euros in 2021. The end of Covid lockdowns in China is expected to drive up sales for major retail brands, but for Adidas, that boost will likely be wiped out by the impact of its split with Yeezy collaborator Ye (formerly known as Kanye West)

Alphabet’s Google said on Wednesday (Mar 8) it will launch a T$300 million (S$13.2 million) fund over the next three years to help boost the Taiwanese media’s continuing operations and digital competitiveness. The fund will help Taiwan local media “hone digital skills, gain expertise and support the sustainable development of Taiwan’s news industry”, the company said. Google said Taiwan’s media industry has been facing major competitive challenges in adapting to the digital age, pointing out that advertising revenues for traditional media outlets have dropped 70 per cent from 2003 to 2020.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

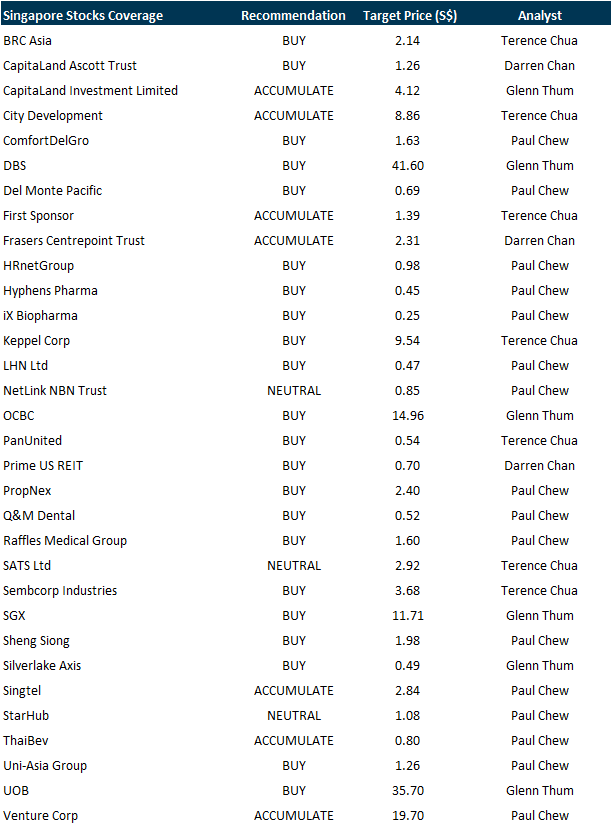

RESEARCH REPORTS

Hyphens Pharma International – Assembling multiple growth engines

Recommendation: BUY (Maintained); TP S$0.445 Last close: S$0.35; Analyst Paul Chew

– FY22 results exceeded expectations. FY22 revenue and PATMI were 109%/118% of our forecasts. Revenue jumped across all segments in 2H22, in part driven by pent-up demand after the re-opening. Dividends surged by 66% to 1.11 cents.

– We believe the re-opening saw the return of surgeries deferred during the pandemic, and increased visits drove specialty pharma revenue. Around 86% of FY22 earnings is from specialty pharma.

– We raise FY23e earnings by 31% to S$13.2mn and the DCF target price is nudged up to S$0.445 (prev. S$0.43). Our BUY recommendation is maintained. We underestimated the rebound in sales post re-opening. Hyphens has assembled multi-franchise drivers in the medium term, namely DocMed, proprietary skincare brands and specialty pharma distribution into public sector verticals. A near-term headwind is the upfront costs to develop the DocMed healthcare platform.

PSR Stocks Coverage

For more information, please visit:

Upcoming Webinars

Guest Presentation by Enviro-Hub Holdings Ltd [NEW]

Date: 14 March 2023

Time: 12pm – 1pm

Register: https://bit.ly/3KBprpA

Guest Presentation by Luminor Financial Holdings Ltd [NEW]

Date: 15 March 2023

Time: 12pm – 1pm

Register: https://bit.ly/3kj6LjP

Guest Presentation by Meta Health Limited [NEW]

Date: 16 March 2023

Time: 3pm – 4pm

Register: https://bit.ly/41oikGX

Guest Presentation by Keppel Pacific Oak US REIT (KORE) [NEW]

Date: 23 March 2023

Time: 12pm – 1pm

Register: https://bit.ly/3XY2n7v

Research Videos

Weekly Market Outlook: Block Inc, PropertyGuru, Sheng Siong, PropNex, Raffles Medical, Tech Analysis

Date: 6 March 2023

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials