Daily Morning Note – 9 May 2022

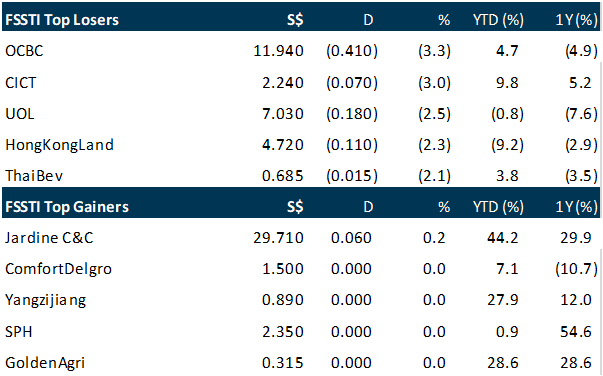

Singapore shares had little to no chance for an upside on last Friday as worries ratcheted up over a slowing China, the Russia-Ukraine war, inflation shock, rising rates, as well as talk of a potential recession in Europe. The Straits Times Index tumbled 51.68 points or 1.55 per cent to 3,291.89. Week on week, the bourse shed 65 points or nearly 2 per cent, having recorded losses every day since last Wednesday on a shortened trading week. Major Asian equity gauges, except for Japan which finished 0.7 per cent higher on its return from a three-day holiday, posted steep losses.

Wall Street’s main indexes opened lower last Friday as stronger-than-expected jobs data amplified investor concerns over bigger interest rate hikes by the US Federal Reserve to tame surging prices. The Dow Jones Industrial Average fell 224.09 points or 0.68 per cent at the open to 32,773.88. The S&P 500 opened lower by 18.70 points or 0.45 per cent at 4,128.17 while the Nasdaq Composite dropped 70.86 points or 0.58 per cent to 12,246.83 at the opening bell.

SG

Azalea Asset Management, an indirect subsidiary of Temasek Holdings, is launching a new series of bonds back by 38 private equity (PE) funds. The indicative total size of the new issuance – called Astrea 7 – is US$755 million. It is around 39.6 per cent of the underlying PE portfolio valued at US$1.9 billion. The issuance will have 3 classes of bonds, A-1, A-2 and B, but only Class A-1 and Class B bonds will be made available to retail investors, according to a preliminary prospectus lodged on Friday (May 6) at the Monetary Authority of Singapore’s Opera site.

Currently on 1 out of the 7 assets in OUE Commercial Real Estate Investment Trust’s (OUE C-Reit’s) portfolio is outside Singapore, but the company has plans to acquire more overseas assets to grow the trust, with a focus on office assets in Sydney, Melbourne and London. “These are key gateway markets with a lot of liquidity for transactions in the S$200 million to S$400 million range; so you can enter and exit the market fairly quickly,” said Han Khim Siew, the chief executive officer of OUE Commercial Reit Management. “The UK and Australia also have very good market transparency and governance.” While all 7 existing assets of the Reit were from its sponsor, OUE, the overseas assets that the Reit is looking to buy will be third-party acquisitions.

Demand for Singapore Savings Bonds (SSBs) has risen to the highest it has been since July 2019, as yields continue on an upward trend. Investors applied for S$231 million worth of SSBs last month – a 65 per cent increase over the value of applications in the month prior. This tranche of SSBs, which were issued on May 4, have an average return of 2.09 per cent over their 10-year tenure. For the next tranche, now open for application and to be issued in June, the average 10-year return is 2.53 per cent. That is higher than the rate of 2.5 per cent paid by the Central Provident Fund Board on funds in the ordinary account. SSBs are issued and guaranteed by the Singapore government. A new tranche is issued each month with fixed rates that step up for each year they are held. The bonds are also redeemable at par in any given month without any penalties.

US

Microsoft has an initial US$1.3 billion at stake in a test beginning later this month on whether its HaloLens augmented-reality goggles can be turned into an effective combat system for the US Army. The month-long test from May 23 to Jun 17 will be evaluated by the Pentagon’s testing office to determine whether the headset is ready for full production and initial deployment. The project by the Redmond, Washington-based company aims to develop a “heads-up display” for US ground forces, similar to those for fighter pilots. The Integrated Visual Augmentation System would let commanders project information onto a visor in front of a soldier’s face and would include features such as night vision. So far, the Army and the testing office have indicated the goggles show promise but aren’t ready for combat deployment, and the service delayed putting them in the field in favour of this month’s evaluation.

A US labour board official believes Amazon violated federal law during mandatory staff meetings it held in New York City to discourage unionizing, a board spokesperson said on Friday (May 6), in what could lead to a new legal precedent. The Amazon Labor Union (ALU) alleged the retailer forced workers at an Amazon warehouse on Staten Island to attend the so-called captive audience trainings and said staff were threatened with dismissals if they joined the ALU, according to an amended complaint and an audio recording the union shared with Reuters. The regional director of the Brooklyn-based office of the National Labor Relations Board (NLRB) has found merit to the allegations, in a potential first regarding captive-audience practices, board spokesperson Kayla Blado said. If the parties do not settle, the Brooklyn division will issue a complaint against Amazon that could be litigated up to the NLRB at the federal level.

Elon Musk is aiming to increase Twitter’s annual revenue to US$26.4 billion by 2028, up from US$5 billion last year, the New York Times (NYT) reported, citing a pitch deck presented by the world’s richest man to investors. Advertising will fall to 45 per cent of total revenue under Musk, down from around 90 per cent in 2020, generating US$12 billion in revenue in 2028, while subscriptions are expected to pull in another US$10 billion, according to the report. The social media company would bring in US$15 million from a payments business in 2023, the NYT reported, that would grow to about US$1.3 billion by 2028. Musk clinched a deal last month to buy Twitter for US$44 billion in cash, in a move that will shift control of the social media platform populated by millions of users and global leaders to the Tesla chief. Musk is expected to become Twitter’s temporary CEO after closing the takeover, a person familiar with the matter told Reuters on Thursday, as the billionaire seeks to add investors to the deal. Subscription revenue from Twitter Blue is expected to generate US$69 million in revenue by 2025, the NYT reported.

Source: SGX Masnet, The Business Times, Bloomberg, Channel NewsAsia, Reuters, CNBC, PSR

CapitaLand Integrated Commercial Trust – Recovery in full swing

Recommendation: BUY (Upgraded), Last Done: S$2.24

Target Price: S$2.46, Analyst: Natalie Ong

– 1Q22 Revenue (+1.5% YoY) and NPI (+0.5% YoY) were in line; NPI formed 23.7% of our FY22 forecast.

– Negative retail reversions continue to narrow while higher discretionary spending lifted tenant sales.

– Strong leasing quarter for Singapore office portfolio; pencilling in 9.3% in reversions.

– Upgrade from ACCUMULATE to BUY, DDM-based (COE 6.41%) TP raised from S$2.39 to S$2.46 as we increase FY23e-26e DPUs by 3.1-3.3% to factor in acquisition of 70% stake in CapitaSky (fka 79 Robinson Road). CICT is positioned to benefit from the economic reopening given its exposure to downtown malls and returning office leasing demand. Catalyst for CICT include AEIs, potential development, and acquisitions.

Lendlease Global Commercial REIT – Reopening tailwinds to lift tenant sales

Recommendation: BUY (Upgraded), Last Done: S$0.81

Target Price: S$1.05, Analyst: Natalie Ong

– No financials provided in this operational update. Portfolio occupancy was stable at 99.9%.

– 313@Somerset delivered positive reversions for the third consecutive quarter, but tenant sales, which are at 90% of pre-pandemic levels, dipped 3.3% YoY due to dine-in cap of five pax in 3Q22 (3Q21: 8 pax).

– Acquisition of remaining stake in JEM was completed on 22 April 2022. We understand that reversions have been positive and tenant sales are at 110% of pre-pandemic levels.

– Upgrade to BUY from ACCUMULATE; DDM target price raised from S$0.94 to S$1.05. FY22e-262 DPUs by 0.6-3.8% to factor in the issuance of perpetual securities. We lower our COE from 7.7% to 7.0% to reflect the lower risk associated with a predominantly Singapore-focused portfolio post-acquisition of JEM. Return to office and tourist visits are immediate catalyst for LREIT.

Click the link to join: https://t.me/stocksbnb

Date: 25 April 2022

For any research-related matters, email: research@phillip.com.sg

For general enquiries, email: talktophillip@phillip.com.sg

or call 6531 1555.

Read the research report(s), available through the link(s) above, for complete information including important disclosures Important Information

Disclaimer

The information contained in this email is provided to you for general information only and is not intended to create any binding legal relation. The information or opinions provided in this email do not constitute investment advice, a recommendation, an offer or solicitation to subscribe for, purchase or sell any investment product. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise.

You should obtain advice from a financial adviser before making a commitment to invest in any investment product or service. In the event that you choose not to obtain advice from a financial adviser, you should assess and consider whether the investment product or service is suitable for you before proceeding to invest.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.