DAILY MORNING NOTE | 9 November 2022

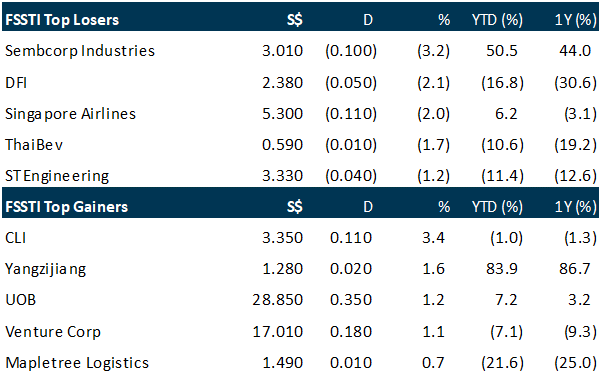

The Straits Times Index (STI) edged up 0.1 per cent or 4.52 points on Tuesday (Nov 8) to finish at 3,145.83 points. In the wider Singapore market, losers outnumbered gainers 288 to 220 with 1.65 billion shares worth S$1.11 billion changing hands. The top performer among the STI constituents was CapitaLand Investment (CLI), which rose 3.4 per cent or S$0.11 to close at S$3.35. At the bottom of the table was Sembcorp Industries (SCI), which fell 3.2 per cent or S$0.10 to S$3.01. The most actively traded STI counter was Yangzijiang Shipbuilding, which finished 1.6 per cent or S$0.02 higher at S$1.28 with 34.1 million shares traded. The trio of local banks all finished higher. DBS rose 0.5 per cent or S$0.16 to S$34.59, UOB climbed 1.2 per cent or S$0.35 to S$28.85 and OCBC gained 0.3 per cent or S$0.03 to S$12.15.

Wall Street stocks rose for a third straight session on Tuesday as the US midterm elections dominated attention ahead of key economic data later in the week. With Republican challengers to President Joe Biden’s Democratic party expected to win at least one house of Congress, market watchers are anticipating gridlock in Washington – traditionally a benign scenario for equities. The Dow Jones Industrial Average finished with an increase of 1.0 per cent at 33,160.83. The broad-based S&P 500 rose 0.6 per cent to 3,828.11, while the tech-rich Nasdaq Composite Index advanced 0.5 per cent to 10,616.20. The gains came as investors looked ahead to Thursday’s critical consumer price report that will likely influence the course of US monetary policy.

SG

Prime US Reit’s distributable income for the third quarter ended Sep 30 fell 4 per cent to US$19.2 million from a year ago, following a 6.1 per cent decrease in net property income (NPI) to US$24.2 million. NPI slid amid year-on-year occupancy declines, said the manager. WeWork vacated in Q4 2021, while Whitney Bradley & Brown vacated in Q3 2022. However, occupancy held steady at 89.6 per cent when compared with the preceding quarter. Gross revenue was up 3.1 per cent to US$40.6 million. The Reit saw increased leasing activity during the quarter, with the leasing volume of 246,200 square feet (sq ft) coming close to the last two quarters’ combined volume of 257,500 sq ft. Rental reversion was 10.1 per cent for Q3, and positive for the 10th straight quarter. The portfolio, which includes 14 prime US office properties, had a weighted average lease expiry of 4.1 years as at Sep 30. The Reit’s gearing stood at 38.7 per cent with an interest coverage of 4.5 times. Its fully extended weighted average debt maturity was 2.9 years. Tenant retention remains a priority, said the Reit’s manager. It plans to enhance assets to maintain buildings’ competitiveness, and expand tenant engagement around ESG initiatives to support corporate ESG goals. The counter closed at US$0.465 on Tuesday (Nov 8), down US$0.01 or 2.1 per cent.

Comment: Despite lower NPI in 3Q22 yoy, occupancy for Prime US REIT remained stable, with strong leasing momentum and high rental reversions for the quarter. On the capital management front, 83% of debts are hedged or on fixed rate with no refinancing obligations till July 2024. We maintain our BUY recommendation with an unchanged target price of US$0.88.

Darren Chan

Research Analyst

darrenchanrx@phillip.com.sg

OKH Global said on Tuesday (Nov 8) that it will sell an industrial building in Tai Seng to Chip Eng Seng Corporation for S$35 million. OHK launched a public tender in July for the sale of the property, located at 12 Tai Seng Link, which closed on Sep 5. The vendor received only one bid at S$35 million from CES Properties (Tai Seng), which is a wholly-owned subsidiary of Chip Eng Seng. A letter of acceptance in relation to the proposed sale of the property via the public tender was issued to the purchaser on Tuesday. The consideration is below the book value of the property of S$38 million, and the company is expected to record a loss on disposal of around S$3 million, OKH said in the bourse filing. However, it noted that the disposal is “expected to benefit the company and its shareholders” as the property has a remaining lease of around 20 years, which could impact its future value. It added that the proposed disposal will allow the group to re-allocate its resources to strengthen its financial position, and said the proposed disposal “demonstrates the group’s commitment to recycle capital for future growth and investments”. The value of the assets being disposed represented around 65.9 per cent of the group’s net tangible assets as at Jun 30, 2022. OKH noted that the transaction is an “interested person transaction”. OKH said its audit committee has reviewed the terms of the proposed disposal, and is of the view that the disposal of the property is on normal commercial terms and is not prejudicial to the interests of the company and its minority shareholders. OKH shares closed unchanged at S$0.025 on Tuesday, while Chip Eng Seng climbed 0.7 per cent to close at S$0.725, before the announcement.

The manager of First Real Estate Investment Trust (Reit) reported on Tuesday (Nov 8) a distribution per unit (DPU) of S$0.0066 for the third quarter ended September, up slightly from the S$0.0065 in the year-ago period. The quarterly DPU of S$0.0066, has been unchanged since the fourth quarter of 2021, and total DPU for the first 9 months of 2022 stood at S$0.0198, up 1.5 per cent from the corresponding period a year earlier. Rental and other income rose 39.2 per cent on year to S$80.9 million for the first nine months of 2022; net property and other income was 40.1 per cent higher, at S$79.1 million, the manager said in a business update on the Singapore Exchange. The distributable amount for the first three quarters of 2022 was also up 23.7 per cent on year, rising to S$38.8 million from S$31.4 million. The manager noted that the increases were largely due to the contribution from the acquisition of 12 properties in Japan in March 2022, followed by the acquisition of two more properties there in September 2022, and recognition of accounting standards for rental straight lining adjustments for Indonesia hospital properties and Singapore properties. The manager of First Reit aims to increase its portfolio in developed markets to more than half of its assets under management (AUM) by 2027. Currently, more than a quarter of the Reit’s AUM are in developed markets. The Reit had 32 assets across Asia as at Sep 30, 2022, with a total AUM of S$1.2 billion. Its properties had 100 per cent committed occupancy, with a weighted average lease expiry of 12.7 years. First Reit had total debt of S$445.4 million and a gearing ratio of 35.6 per cent as at Sep 30, 2022. Its proportion of debt on fixed rates stood at 61.7 per cent. In terms of outlook, the manager said the economic environment remained challenging, amid factors such as tighter financial conditions, ongoing geopolitical tensions, and the lingering impact of the Covid-19 pandemic. “Despite a challenging economic environment, First Reit will continue to harness its ‘2.0 Growth Strategy’, ride on sustainability and demographics megatrends, actively manage currency risk and interest rate risk, and prioritise the sustainability of distributions to its unit holders,” the manager said. First Reit units closed at S$0.245 on Tuesday, down 2 per cent, before the business update.

US

Tesla is recalling just over 40,000 2017-2021 Model S and Model X vehicles that may experience a loss of power steering assist when driving on rough roads or after hitting a pothole. The Texas-based electric vehicle manufacturer has released an over-the-air software update to recalibrate the system after it began rolling out an update on Oct 11 to better detect unexpected steering assist torque. The National Highway Traffic Safety Administration said a loss of power steering assist can require greater steering effort, especially at low speeds, increasing the crash risks. Tesla said it had identified 314 vehicle alerts for this condition among US vehicles that may be related to the recall but said it is unaware of any injuries or deaths related to this condition. The automaker said that as of Nov 1 more than 97 per cent of the recalled vehicles have installed an update that has already addressed the recall issue. Separately, Tesla is recalling 53 2021 Model S exterior side rearview mirrors that were built for the European market that do not comply with US “Rear Visibility” requirements. The mirrors were installed during US service visits. Tesla has issued 17 recall campaigns in 2022 covering 3.4 million vehicles.

Norwegian Cruise Line Holdings Ltd beat Wall Street revenue estimates on Tuesday, as travel demand bounced back following easing of COVID-related protocols. The Miami, Florida-based cruise operator also reported a smaller-than-expected loss, sending its shares up about 3% in premarket trading. While inflation has eaten into savings of lower-income households, more affluent consumers are rushing back to travel, fueling demand at cruise operators such as Norwegian which have now relaxed pandemic-related restrictions onboard. Passengers have also been splurging on food, spas and upscale experiences onboard, helping cruise lines cushion some of the hit from higher fuel and labor costs and pushing them toward normalcy after a near 18-month pandemic-induced lull. Norwegian, which reaffirmed next year’s bookings at record 2019 levels, said occupancy in the third quarter rose to about 82% from 65% in the previous quarter. The company’s upbeat report echoes comments from larger rival Royal Caribbean Group, which last week forecast strong bookings for next year and said it would reach historical occupancy levels by late spring of 2023. For the third quarter ended Sept. 30, Norwegian’s revenue rose to $1.62 billion from $153.1 million a year earlier when cruise operations were just resuming after the pandemic hit, beating estimates of $1.58 billion. The company, which owns the Oceania Cruises and Regent Seven Seas Cruises brands, also forecast total revenue between $1.4 billion and $1.5 billion for the fourth quarter. Analysts were expecting it to be at $1.46 billion. Norwegian, which typically caters to wealthier guests who remain unaffected by inflation, has also been raising prices, helping it post an adjusted loss of 64 cents per share, smaller than analysts’ estimates for a 70-cent loss. The company also said its adjusted quarterly earnings before interest, taxes, depreciation and amortization turned positive for the first time since the start of the pandemic.

Disney fell short of expectations for profit and key revenue segments during the fiscal fourth quarter Tuesday and warned strong streaming growth for its Disney+ platform may taper going forward. The company’s quarterly results missed Wall Street expectations on the top and bottom lines, as both its parks and media divisions underperformed estimates. And Chief Financial Officer Christine McCarthy tempered investor expectations for the new fiscal year, forecasting annual revenue growth of less than 10%. The company reported fiscal 2022 revenue growth of 22%. Revenue in Disney’s media and entertainment division fell 3% year over year to $12.7 billion during the fiscal fourth quarter, as the company’s direct-to-consumer and theatrical businesses struggled. Analysts had expected segment revenue of $13.9 billion. The company also posted lower content sales because it had fewer theatrical films on the calendar and therefore, fewer films to place into the home entertainment market. Disney+ added 12.1 million subscriptions during the period, bringing the platform’s total subscriber base to 164.2 million, higher than the 160.45 million analysts had forecast, however growth is expected to slow in the fiscal first quarter, Disney executives warned on Tuesday’s conference call. Disney CEO Bob Chapek also said in the earnings release that Disney+ will achieve profitability in fiscal 2024. The direct-to-consumer division lost $1.47 billion during the most recent quarter. It also reported a 10% drop in domestic average revenue per user (ARPU) to $6.10. The company is set to hike prices for the service in December and is planning an ad-supported tier, which is expected to boost revenue. The company reported record results in its parks, experiences and products segment, Chapek said. The division, which includes the company’s theme parks, resorts, cruise line and merchandise business, saw revenue increase more than 34% to $7.4 billion during the quarter. Still, Wall Street had slightly higher hopes for the division: Analysts were expecting parks revenue of $7.5 billion.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

RESEARCH REPORTS

Analyst: Zane Aw

Recommendation: Technical Sell

Market Sell: 197.08 Stop loss: 223.80 Take profit: 154.65

Tesla, Inc (NASDAQ: TSLA) A potential breakdown of a key uptrend support line to retest the previous resistance zone now turned support at US$154-168

Upcoming Webinars

Guest Presentation by IREIT Global [NEW]

Date: 2 December 2022

Time: 12pm – 1pm

Register: https://bit.ly/3DRroub

Guest Presentation by Marco Polo Marine [NEW]

Date: 6 December 2022

Time: 12pm – 1pm

Register: https://bit.ly/3h1bowW

Guest Presentation by Zoom Video Communications, Inc [NEW]

Date: 7 December 2022

Time: 9am – 10am

Register: https://bit.ly/3TzxFQ6

Research Videos

Spotify, Airbnb, Apple, DBS, OCBC, CapitaLand Ascott Trust, First Sponsor, Venture Netlink, Technical Pulse, SG Weekly 45

Date: 7 November 2022

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials