昇崧集团: 表现极佳的季度应会持续下去

新加坡 | 消费 | 2020年一季度汇报

-

-

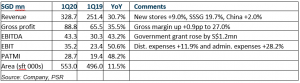

- 2020年一季度的营收和盈利超出了我们的预期。一季度的税后净利同比飙升48%至2900万新元。

- 2020年一季度,受益于节日期间消费者情绪普遍改善,以及当DORSCON 升级至橙色时,食品储藏量充足。

- 积极的销售势头应将持续到2020年二季度,因为自新加坡从4月7日起启动熔断机制,并可能于6月1日结束以来,家庭在家就餐的情况有所增加。

- 我们将2020财年末的税后净利提高了12%,原因是我们已将收入预期提高到1亿新元。我们修订后的2020财年末的收益,甚至超过了我们之前对2021财年末的收益预测。我们认为疫情的爆发使2020年一季度的收入增加了5000万新元。而二季度的收入将额外增加5000万新元。我们的增持建议维持不变,并上调目标价至1.58新元 (之前目标价是1.41新元)。我们还预计2020财年末的派息率将提高26%至4.5分,因为我们使用70%的派息率作为指导。

-

业绩一揽表

积极方面

-

- 受同店销售复苏的推动,2020年一季度的收入同比激增30.7%。一季度的同店销售额同比增长19.7% (2019年一季度:-1%)。销售额的飙升归因于节日期间,消费者情绪有所改善,疫情爆发后的食品储藏的库存,以及新开门店的贡献 (+9.0%)。

- 自主品牌成为新利润率的驱动力。在2020年一季度,SSG 成功地发展了其生活必需品的自主品牌 (如大米,食用油,洗涤剂)。这类自主品牌的利润率可能比传统的非新鲜产品的利润率高出30%。

消极方面

- 管理费用的变化比预期高。管理费用同比跳增28%至5400万新元,主要归因于员工成本。员工成本增加,是因为工作时间增加以及奖金拨备增加所致。我们对费用的变化感到有点惊讶,并期待这一成本项目将有更多的运营杠杆。

- 新门店的开张速度放缓。由于疫情的爆发,SSG无法真正签署租约,或者装修通过招标获得的新门店。此外,熔断机制也意味着推迟了新网点的招标。1月份新增两家门店,总面积为23,540平方英尺。另外三家新店将获得22,140平方英尺的面积,但尚未开业。综上所述,在2020财年,额外的零售空间将至少达到45,680平方英尺 (或者5家新店)。这意味着门店面积增长了8.6%。

前景

(i) 线上销售:在疫情期间,SSG主要关注实体店,因实体店对资源的需求更为迫切。尽管如此,管理层理解这一渠道的重要性,并将大幅提高这一渠道的容量。但由于许多独立的电子杂货商尚未实现盈利,因此有必要平衡线下和线上的举措。

(ii) 中国:两家门店均已实现盈利。在中国疫情爆发期间,也出现了类似的家庭囤积食品和在家用餐的现象。在环境稳定下来之前,SSG不太可能开设新的门店。

维持增持评级,并上调目标价至1.58新元 (先前目标价为1.41新元)。

确定不包括此次疫情的正常化收益是一个挑战。2020年一季度的收益比我们预期高出了约5000万新元。这是一季度约½个月的增量收入。我们假设二季度会出现类似的增量收入增长。因此,我们将对2020财年末的预测上调1亿新元左右。由于我们将公司的历史平均市盈率定为25倍,所以我们的目标价提高至1.58新元。

值得注意的是,2020财年的收益实际上有两个一次性因素 – 食品储藏库存和家庭在家就餐增加,加上政府补贴预计将在2020年二季度发放。我们没有将工作支援补助纳入到收益中。