新加坡银行业每月快讯 | 漫长和渐进式的复苏即将到来

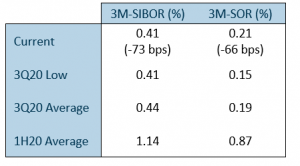

- 目前的3月期-SIBOR 和 3月期-SOR分别为0.41% 和0.21%,在今年整个第三季度保持稳定水平。

- 新加坡连续第二个月出现贷款负增长 (同比下降0.3%)。商业贷款增长反弹至1.48%,但疲软的消费贷款 (-3.13%)继续拖累贷款前景。

- 信用评级机构Fitch(惠誉),因为当前的经营环境较差,考虑对三家本地银行降至 ‘AA-’ 评级。然而,Fitch在今年一季度的展望指引与各银行提供的展望指引一致。

- 7月推出的富时台湾指数期货,是新交所8月成交量第六大的股指期货合约

- 对新加坡银行业维持中性评级。尽管长期的低利率可能会拖累利息收入,但商业活动的恢复将提振非利息收益。

8月份利率保持不变

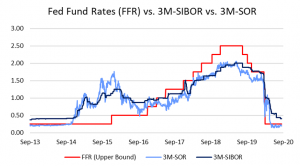

三季度,3月期-SIBOR 和3月期-SOR分别稳定在0.41%和0.21%。然而,由于今年二季度报告的NIMs(净息差)处于历史低点,我们不太可能看到NIMs在未来的几个季度进一步下跌,因为银行通过重新定价和从资产负债表循环中剔除过剩的流动性来积极监控其利润率。

图1:3月期-SIBOR 和 SOR 保持稳定并接近历史低点

Source: Bloomberg, Company, PSR

图2:利率在2020年三季度保持稳定

Source: Bloomberg, PSR

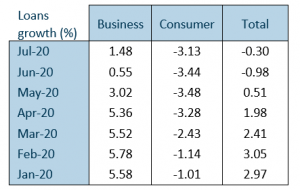

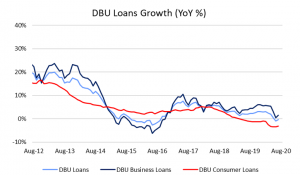

图3:7月贷款增长略有回升

Source: MAS, PSR

7月贷款增长改善,但仍为负

贷款连续第二个月负增长,7月同比收缩0.3%。然而,商业贷款和消费贷款的数据均比6月份有所改善 (图3)。

7月,商业贷款同比增长1.48%,其中商业服务 (+21.7%),建筑(+4.9%),运输、仓储和通信(+3.6%)以及金融机构(+1.8%)扭转了观察到从农业、采矿和采石业(-23.4%),专业人士和个人(-8.9%),制造业(-4.6%),一般商业(-2.0%) 和其他行业 (4.3%)所带来的疲软。

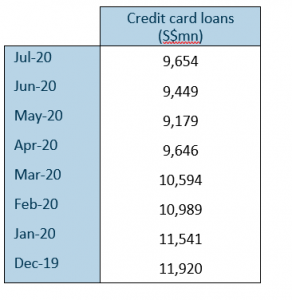

观察到消费贷款继续全线疲软(同比下跌3.13%)。尽管如此,信用卡贷款环比增长了2%,在经历了连续五个月的萎缩后,已连续第二个月实现增长(图4)。 信用卡支出的增加可能会让银行的信用卡手续费收入有所复苏。

图4:自2019年12月以来,信用卡贷款连续两个月实现增长

Source: MAS, PSR

图5:7月贷款增长略有改善

Source: MAS, PSR

Fitch给出的‘负面评级观察’ (RNA) 并不是对银行业的担忧

8月31日,信用评级机构Fitch发表了一份报告,提出可能对三家本地银行下调至 ‘AA-’ 评级,令人担忧。

Fitch在其 “新加坡银行:有限的评级空间”报告中提到,较差的经营环境给各银行的盈利能力构成压力。这将导致“利润率变得更薄,信贷成本上升和信贷增长放缓”,进而可能会致使整个银行业的资本充足率恶化。

然而,这份RNA状态是自4月份发布的,而在报告中突显的较差的经济环境符合此前银行业提供的指引。因此,在经营环境没有发生任何根本改变的情况下,我们认为各银行的财务状况仍然是健康的。

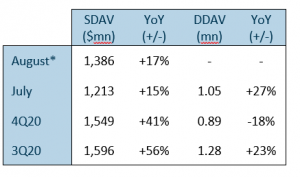

证券成交量持续增长,而衍生品交易量保持波动。

初步的SDAV数据显示,8月份同比增长17%,从一年前的11.88亿新元增至13.86亿新元 (图6)。第三季度,证券业务持续增长。

然而,衍生品交易量仍不稳定。月度股指期货合约在前五大股指期货中占比95%以上的成交量,自7月录得同比增长27%后(图6),8月的成交量同比平均下降了12% (图7)。

图6:2020 SDAV 和DDAV 的表现

Source: SGX, Bloomberg, PSR

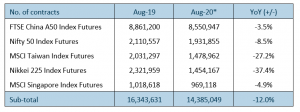

图7:前五大股指期货合约的成交量

富时台湾指数期货有望取代摩根士丹利资本国际台湾指数期货

新推出的富时台湾指数期货在8月录得超过350,000份交易合约。该合约成为新交所成交量第六大的股指期货,抵消了摩根士丹利资本国际台湾指数期货合约下降带来的影响,而旧合约将于2021年2月停止交易(图8)。

富时台湾指数期货作为摩根士丹利资本国际指数期货的同类替代品很受欢迎,这让我们相信,鉴于将推出更多的FTSE合约作为替代,那即将到期的MSCI合约将不会影响新交所的股票衍生品业务的前景。

投资行动

对新加坡银行业维持中性评级。虽然利率将继续拖累NIMs,但商业活动的恢复将提振非利息收入。我们仍然认为,银行已从今年二季度的盈利打击中,进入一个逐渐复苏的时期。

如果有想了解更多全球股市资讯,请关注微信公众号 “辉立资本新加坡” (SGPSPL)。同时提供在线免费开设股票账户,一个账户轻松交易全球股票和ETF

美股,港股,新加坡股,中国A股,越南股票,韩国股票,德国股票,马来西亚股票,泰国股票,印尼股票,菲律宾股票,日本股票,澳大利亚股票,台湾股票,加拿大股票,英国股票,法国股票,荷兰股票,葡萄牙股票,比利时股票,土耳其股票

如果本文是英文翻译版本,一切请以英文为准