3只即将上市的新股

3只即将上市的新股 (美团、海底捞、中国铁塔)

2018年上半年,香港证券交易所有108只新股上市,与去年同期相比增长超过40%。上半年平均每月有18家公司上市,其中仅1月就有30家公司登陆港交所。据彭博社数据,2018上半年,香港IPO筹资约为504亿港元。

据港交所公布的数据,现已有超过140家公司向港交所提出上市申请并等待审核。其中不乏包括美团点评、海底捞和中国铁塔在内的知名科技公司和大市值公司。

截至7月19日,仅7月已经有32支新股上市,这其中影响最大的当属7月9日的小米上市,其上市价格为17港元(设定在17-22港元的较低区间),筹集了约47亿美元。

另外当日上市数量最多的当属本月12日,12日当天港交所有8家公司同时上市, 在这8家新上市公司新股当中有7家上市首日股价上涨,其中恒伟集团首日暴涨98%,而映客12日开盘价为4.32港元,较发行价上涨12%,此后,映客股价上涨到5港元以上,市值突破100亿港元,涨幅超过30%。

市场预测,2018年全年或将有220家公司赴港上市,香港IPO筹资规模有望达到2000亿港元或以上。如果您有意愿申购新股或者交易暗盘, 请微信关注辉立资本新加坡(SGPSPL),并在后台留言。

在此,我们列出了三家你可能感兴趣的即将在香港上市的公司:

美团点评

美团点评是中国领先的电子商务服务平台,主打饭店推荐和外卖配送。

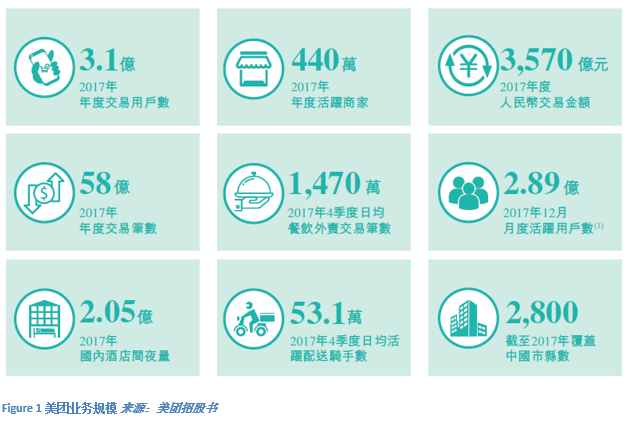

美团在中国消费者的日常生活中扮演着重要角色,仅2017年,美团了服务超过3亿的顾客。同年,美团的按需外卖配送网络平均每天有大约53万位活跃外卖配送车手,完成了大约290万次配送,平均配送时间为30分钟。以规模和速度来看来看,美团点评的外卖配送网络已处在全球领先水平。

美团从佣金、在线营销服务和其他服务中产生收入。2015至2017年间,美团的收入实现了显著的增长,从2015年总收入亿元40亿元增加到2016年的130亿元,增长了223.2%,2017年又增加了161.2%,达到339亿元。

援引新浪财经的报道,市场预期美团点评IPO将集资40亿至60亿美元,最快10月登陆港交所,腾讯为美团的第一大股东。

下面的图表显示了美团的业务规模:

海底捞

海底捞是一家专注于火锅美食的全球领先和快速增长的中国菜馆品牌。

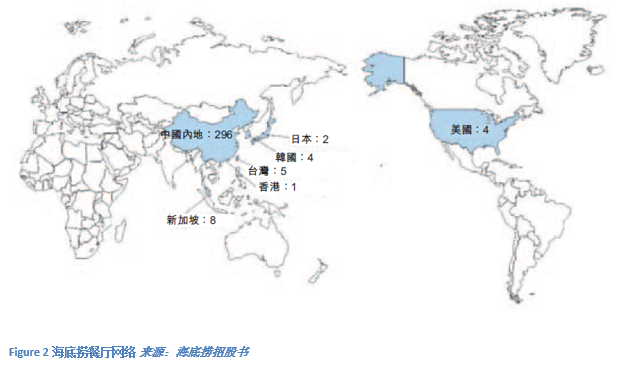

海底捞每年接待超过1亿的客人。全球餐饮网络从2015年的112家发展到2017年的273家。目前,世界上有320家海底捞餐馆,其中296家在中国内地,5家在台湾,1家在香港,其余分别在新加坡、日本、韩国和美国。

值得一提的是,在新加坡总共有8家海底捞餐厅,占海底捞国际餐厅总数的近二分之一。

海底捞的收入来自于其餐厅运营(90%以上)、配送业务和调味品产品销售。海底捞的收入增长了35.9%,从2015年的5.7567亿元增至2017年的10.6.3720亿元。利润增长70.5%,2015年为4.107亿元,2017年为11.943亿元。

下图显示了海底捞餐馆网络的分布情况:

中国铁塔

中国铁塔是世界上最大的电信塔基础设施服务提供商。

2017,中国铁塔在全球电信塔基础设施服务提供商中排名第一,租户数量和收入位居第一。以设备总数计,中国铁塔的市场占有率为96.3%,以营业收入计,中国铁塔的市场占有率为97.3%。

截至2018,中国铁塔的设备站址遍布中国31个省市。

中国塔的收入主要来自塔楼业务和DAS(分布式天线系统)业务。中国铁塔的收入基本来自于中国三大电信服务提供商(中国移动、中国联通和中国电信)。营业收入从2016元的559亿9700万增加到2017的686亿6500万,增长了22.6%。2016的营业利润率为9.1%,2017的营业利润率为11.2%。

根据彭博社报道,中国无线基础设施运营商中国铁塔(China Tower)已经吸引了包括高瓴资本和阿里巴巴集团子公司淘宝中国等成为其计划中在香港IPO的基石投资者

据彭博社获得的文件显示,中国铁塔在香港IPO中将以每股1.26-1.58港元发行431亿股股票,融资有望达到至多86.8亿美元,为最近4年内全球规模最大的IPO。另外簿记建档预计将于7月23日开始,具体定价预计将于8月1日公布。挂牌交易时间预计为8月8日。

数据来源:新浪财经,彭博社,美团招股书,海底捞招股书,中国铁塔招股书

关键字:新加坡股票研报,美股,美股研报,思科系统公司,美股账户,交易美国股票,美国股票开户,免费开户,在线开设美国股票开户,新加坡证券,新加坡券商,投资组合