资讯 | 特斯拉国产Model3表现抢眼,相关概念股表现强势

资讯摘要

美股资讯

周二美股震荡收高,早间道指最低下跌至23690.34点,尾盘最高上涨至25020.99点,震荡区间超过1300点。

特朗普寻求推出刺激政策的消息推动今日美股大幅高开,道指一度上涨超过900点。一些美国政府官员及参议员对此发出质疑言论,令股指在午盘短暂转跌。而在美国财政部长姆努钦表示“两党需要抓紧行动通过经济刺激政策”后,美股尾盘强力拉升并大幅收高。

道指30成分股悉数收高,摩根大通(100.7, 7.26, 7.77%)公司、家得宝(225.7, 15.24, 7.24%)公司、苹果(285.34, 19.17, 7.20%)公司等涨幅均超过7%,麦当劳(199.86, 13.00, 6.96%)、微软(160.92, 10.30, 6.84%)、迪士尼(111.46, 7.11, 6.81%)、维萨卡(182.6, 11.47, 6.70%)公司、3M(153.3, 9.24, 6.41%)、英特尔(53.98, 3.13, 6.16%)等均大涨6%以上。

疫情蔓延威胁经济前景 美日欧酝酿刺激措施

据美国约翰-霍普金斯大学统计的数据,截至3月9日,全球确诊新冠病毒感染病例达114578例,死亡4028例。美国至少确诊755例,死亡26例。

美国总统特朗普周一提出下调薪资税并向受新冠疫情冲击的行业提供“极具实质性的纾困措施”,以抵消冠状病毒传播带来的负面影响。在此之前,特朗普刚刚签署了83亿美元的抗疫紧急支出计划。

在市场暴跌之际,美国总统特朗普此前表示,周二将就经济应对措施召开新闻发布会,宣布有关措施的更多细节,并称将要实施的经济措施将会是“重大的”。此外,美国财长姆努钦也称,正与美联储主席鲍威尔进行日常会谈,总统承诺为了经济将使用一切工具。

然而,据媒体援引美国政府官员称,白宫还远没有准备好为应对新冠肺炎疫情影响扩大而推出特殊经济措施。在白宫内部,一些官员对美国总统特朗普宣称将在周二举行发布会来宣布经济刺激计划感到惊讶,因为该计划的细节尚未敲定。

特朗普周二与美国参议员们举行会晤。特朗普称:“会议进展良好,共和党很团结,会议的焦点是经济刺激计划,工资税也是会议讨论的刺激措施之一。”

焦点个股

蔚来今日公布2020年2月份交车数据:2月整体交付量707台,其中ES6交付671台,ES8交付36台,全新ES8将在今年4月开启交付。截止到2020年2月29日,蔚来ES8、ES6累计交付34218台,其中2020年累计交付2305台。

特斯拉计划在中国工厂增加汽车零部件产能。据路透社报道,特斯拉计划在其价值20亿美元的中国工厂增加某些汽车零部件的产能,以推动其在全球最大汽车市场的供应链本地化。

此外,来自国内的一份新报告显示,特斯拉计划提升其上海工厂的产能,并且计划在该工厂内生产新车型。

受疫情影响,2月国内新能源车产量1.19万辆,同比下降77%,环比下降75%。但特斯拉国产Model3表现亮眼,2月产量3898辆,环比提升48%,并占行业总产量超3成。据透露,特斯拉2月在国内共交付3958辆新车。

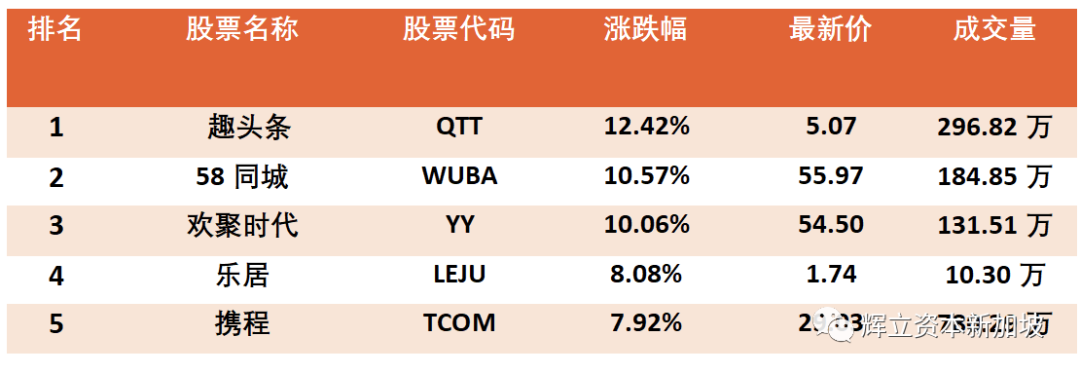

热点中概股

港股资讯

热点板块

石油股反弹,其中,中海油(9.05, 0.26, 2.96%)涨2.96%,中石化涨1.05%,中石油涨2.57%。

消费股集体走高,其中,滔博涨6%,佐丹奴、李宁(21.8, 1.15, 5.57%)等涨近6%,国航、东航、南航涨逾4%,海底捞(34, 1.45, 4.46%)涨4.45%,银河娱乐(50.6, 1.85, 3.80%)涨逾4%。

明星科技股集体走高,其中,阿里巴巴、美团点评涨3%,中芯国际(14.32, 0.36, 2.58%)、中兴通讯(31.45, 0.55, 1.78%)涨2%,腾讯控股(383, 5.60, 1.48%)涨1.5%。

武汉地区股走高,长飞光纤光缆(17.1, 1.26, 7.96%)涨7.95%,东风集团涨7.47%,中电光谷(0.4, 0.02, 5.26%)、周黑鸭(4.21, 0.19, 4.73%)涨5%。

中国飞鹤(12.4, 0.74, 6.35%)(6186.HK)再度大涨,昨日获纳入港股通,股价逆市涨0.87%,今日飙升6.35%,报价12.4港元,创上市以来新高。

SOHO中国(4.1, 1.12, 37.58%)(0410.HK)早盘直线拉升,股价暴涨37.58%后临时停牌。市场消息称黑石集团正与SOHO中国就后者私有化进行谈判,交易价值40亿美元。知情人士称,黑石集团(BX.N)向SOHO中国提出的私有化报价为每股6港元(较该股现时股价高约一倍)。预计交易事宜将在未来数周内宣布。

全天涨幅最大的5支港股通

中国A股资讯

从盘面上看,半导体、5G、券商居板块涨幅榜前列,口罩、超级真菌、家纺板块跌幅榜前列

消息面上记者从相关部门获悉,国家市场监督管理总局已向浙江、江苏等8省市的市场监管局下发紧急通知,要求开展熔喷无纺布价格专项调查,确保价格稳定。

5G板块恒强,新高兴、武汉凡谷(31.220, 1.79, 6.08%)(维权)、万马科技(20.790, 1.89, 10.00%)、亨通光电(21.520, 1.96, 10.02%)、超频三(16.560, 1.51, 10.03%)、大富科技(20.000, 0.43, 2.20%)、博杰股份(160.200, 2.51, 1.59%)等多股涨停。

消息面上日前,工信部召开加快5G发展专题会,工信部副部长陈肇雄指出:要着眼当前疫情防控和经济社会发展形势的复杂性,充分认识加快5G发展的重要性、紧迫性,科学把握5G发展面临的新形势新要求,务实推动5G加快发展

全天涨幅最大的5支沪港通