资讯 | A股水泥板块维持高景气,房地产龙头走高

周三美股冲高回落,道指盘中一度上涨超过460点,最高上涨至27542.78点。

美国国债收益率继续下滑。美国10年期国债降至1.30%,再创历史新低。

周三之前,美股三大股指均已录得连续第四个交易日下跌,其中周一周二两日连续暴跌,道指连续两日累计下跌超1900点,超六成的标普500成分股跌入盘整区间,能源板块年初至今下跌19%。投资者疯狂涌入避险天堂,金价续创7年来新高,美国10年期国债收益率跌至历史新低1.32%,美国WTI原油期货跌破每桶50美元。

考虑到疫情影响,标普全球评级首席经济学家保罗-格林沃尔德将今年全球经济增速下调0.3个百分点,预测中国经济全年增长5.0%。他认为疫情对经济的影响主要发生在一季度。在下半年以前,经济有望实现全面反弹。据此预测,他认为目前美联储降息可能性不高。

冠状病毒导致穆迪大幅削减2020年全球汽车销量预测。由于新型冠状病毒的爆发减少需求并扰乱了汽车供应链,穆迪公司大幅下调了其全球汽车销售预测。穆迪现在预计2020年全球汽车销量将下降2.5%,此前预期为下降0.9%。穆迪指出,新冠病毒爆发以及更严格的排放法规,将使今年全球汽车销量从9030万辆下降至8800万辆。

当地时间26日,世卫组织总干事谭德塞在日内瓦表示,25日中国境外上报的新冠肺炎新增病例数首次超过中国新增病例数,这标志着疫情的转变。

世界卫生组织表示,目前意大利、伊朗、韩国的病情令人担忧。巴林、伊拉克、科威特和阿曼出现与伊朗相关的新冠肺炎病例,阿尔及利亚、奥地利、克罗地亚、德国、西班牙和瑞士出现与意大利相关的新冠肺炎病例。

“昨天,中国境外报告的新增病例数量首次超过了中国境内的新增病例数量,”世卫组织总干事谭德塞26日在瑞士日内瓦说。

法新社表示,根据世卫组织公布的数据,中国境内25日新增确诊病例数为411例,而中国境外报告的新增病例数为427例。

分析师表示,全球确诊病例和死亡人数继续上升的状况令人担忧,意大利、伊朗、日本和韩国等尤为突出。截至发稿,全球报告确诊新冠肺炎病例达81191例,死亡2768例

焦点个股

谷歌26日宣布,今年在美国办公室和数据中心方面将投资逾100亿美元。谷歌表示,这些新投资将集中在美国的11个州,包括马萨诸塞州、纽约州和俄亥俄州等。

劳氏发布的2019年第四季度业绩显示,可比销售额增长2.5%,低于预期,且发布的2020财年调整后EPS指引也弱于预期。

力拓公司预计第一季度业绩可能受到新冠肺炎的影响。

跟谁学股价走低。做空机构Grizzly Research于2月25日晚间发布一份长达59页的沽空报告,称跟谁学存在夸大财务数据、存在虚假刷单等问题。

网易将于今日美股盘后公布2019年第四季度业绩。

热点板块

科技股集体大跌,联想集团跌近6%,中兴通讯跌4.69%,华虹半导体跌4.46%,金山软件跌4%,阿里巴巴、小米、美团等跌逾1%。

地产股集体走高,金地商置涨8.4%,中国奥园涨5%,融创中国、世茂房地产等涨3%,龙光、旭辉等涨2%。

教育股集体走高,中教控股大涨6.2%,希望教育涨4.65%,新高教集团涨4.4%,民生教育涨3.17%。不过,此前暴涨的线上教育新东方在线回调,大跌5.41%

联想集团大跌5.73%,此前会计调查机构Bucephalus指其疑似欺诈。Bucephalus 今日在社交媒体称联想集团疑似欺诈,并将发布视频:联想,它开始看起来像欺诈。同时其表示,公司在病毒扩散前的第三季度结果有一些非常令人担忧的迹象

从盘面上看,水泥、农业、中字头居板块涨幅榜前列,半导体、云办公、数字中国板块跌幅榜前列。

热门板块

水泥板块走强,亚泰集团、四川金顶、海南瑞泽、冀东水泥、尚峰水泥、海螺水泥、青松建化等多股走高。

消息面上工信部公布2019年建材行业经营数据显示,2019年全国水泥产量23.3亿吨,同比增长6.1%;水泥主营业务收入1.01万亿元,同比增长12.5%,利润1867亿元,同比增长19.6%,全行业连续多年实现高位增长,基本面维持高景气。

房地产板块拉升,光大嘉宝、合肥城建、华丽家族、上实发展、泰禾集团、金地集团、中交地产等多股拉升走强。

消息面上本次疫情对全年房地产销售形成负面影响,但优质房企的优势将更加凸显。在疫情影响下,地方政府密集出台支持政策,逆周期调控力度或将进一步加大。目前板块2020年业绩确定性强、主流房企估值创新低、股息国债利差创新高,政策弹性的打开将带动估值弹性

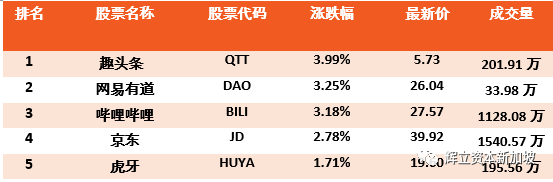

全天涨幅最大的5支沪港通