股市资讯 | 美朝首脑峰会取消。30%!是什么让阿里影业涨30%?A股3年来最大IPO,271亿元富士康募资额确定

美国股市

截至北京时间5月24日凌晨,美股周四收跌,地缘政治风险令市场承压。特朗普取消美朝首脑峰会,并表示美军已做好应对朝鲜的行为的准备。

截止收盘,道指跌75.05点,或0.3%,报24,811.76点;标普500指数跌5.53点,或0.2%,报2,727.76点;纳指跌1.53点,或0.02%,报7,424.43点。

个股财报解读:

哔哩哔哩:移动游戏收入占大头,仍处在亏损期

公司简介及主营业务:原创视频,移动游戏

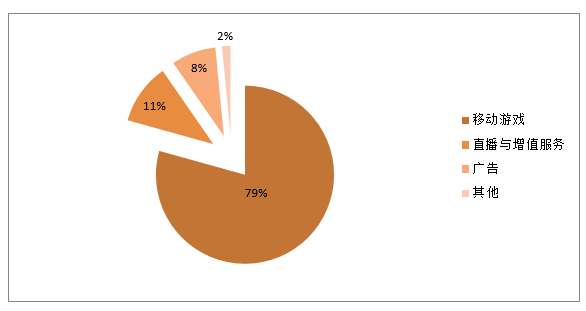

营收结构:

来自移动游戏的营收为6.885亿元,占总营收的79.32%,与去年同期相比增长97%。来自直播和增值服务的营收为人民币9580万元,占总营收的11.04%。来自广告的营收为人民币7040万元,占总营收的8.11%。

用户水平:

哔哩哔哩第一季度平均月度活跃用户人数(MAU)达7750万人,与去年同期相比增长35%。哔哩哔哩第一季度移动月度活跃用户人数在月度活跃用户总数中所占比例为82%;

哔哩哔哩第一季度平均月度付费用户人数达250万人,与去年同期相比增长190%。哔哩哔哩第一季度移动游戏平均月度付费用户人数达80万人,与去年同期相比增长79%。

股市反应:

哔哩哔哩公司与北京时间5月24日早间公布财报,美东周三哔哩哔哩股价在纳斯达克常规交易中下跌0.7美元,报收于12.44美元,跌幅为5.33%。在随后截至美国东部时间23日下午7点50(北京时间24日早上7点50)的盘后交易中,哔哩哔哩股价上涨1.04美元,至13.48美元,涨幅为8.36%。

公布财报后,周四哔哩哔哩公司股价高开15.35%,报14.35美元(前收盘12.44美元),随后交易整日震荡下跌。截止收盘,哔哩哔哩回吐部分涨幅,涨11.33%,报13.85美元。

业绩展望:哔哩哔哩目前预计,公司2018年第二季度净营收将在人民币9.7亿元到人民币10亿元之间。这一展望是基于当前市场状况而作出的,反映了公司对市场和运营市场以及客户需求的初步预期,未来可能会有所改变。

港股

北京时间5月24日,美股周三收高,扭转了盘初下跌局面。美联储纪要称欢迎适度超出2%的通胀目标。市场认为6月加息几乎已成定局。地缘政治与国际贸易关系继续受到关注。昨日开盘,港股恒生指数高开0.17%,之后走势反复,截止收盘,恒生指数涨0.31%,报30760.41点。国企指数涨0.51%,报12152.62点。红筹指数涨0.02%,报4633.05点。大市成交898.77亿港元。

沪港通资金流向方面,沪股通净流入8.15亿,港股通(沪)净流出为7.47亿。

深港通资金流向方面,深股通净流入13.65亿,港股通(深)净流入为3.68亿。

阿里影业:受阿里集团回归A股刺激 ,单日股价涨30.43%

继阿里健康6个交易日内累计暴涨近70%后,阿里旗下的另一家公司,阿里影业的股价于5月24日突然爆发,盘中涨幅一度超过39%。当日,公司股价收于1.2港元/股,单日涨幅30.43%。创出2015年7月以来最大涨幅。

不少评论认为,阿里影业在基本面上没有重大利好,股价突然暴涨应该是受到阿里系其它公司带动。

“援引证券日报消息,阿里集团可能成为首批回归A股的科技公司之一,目前正在筹备发行CDR(中国存托凭证)。因此包括云峰金融、阿里健康在内的阿里系一干股票都很活跃;另外,阿里鱼IP授权的业务能力和市场空间,今年开始逐渐显现出来。”

富士康:A股3年来最大IPO

5月23日,富士康工业互联网股份有限公司在上证路演中心举行了首次公开发行A股网上投资者交流会。22日晚间该公司更新招股书披露,将以每股13.77元的价格发行19.7亿股股票,募集总额约为271.2亿元。

从A股历史IPO情况来看,此次工业富联募资额排名第12位,是近3年来最大规模的IPO。

中国A股

北京时间5月24日,三大股指表现低迷,开盘后于盘中窄幅震荡,午后震荡下跌。截至收盘,沪指报3154.65点,跌14.31点,跌幅0.45%,成交1606.58亿元;深成指报10564.13点,跌66.99点,跌幅0.63%,成交2215.67亿元;创业板报1838.40点,跌7.57点,跌幅0.41%,成交788.52亿元。

盘面上,海南板块逆势大涨逾6%,赛马、自贸港、无人零售、农业服务等概念板块涨幅居前;国防军工、飞机、蓝宝石、人脸识别、采掘服务等概念板块跌幅居前。。

海南橡胶、信达地产因重要事项未公告临停;沃施股份因拟披露重大事项临停。

来源:东方财富网,新浪财经,同花顺,21世纪经济报道,彭博,华尔街见闻,辉立证券,A股,中兴,中美贸易战