股市资讯 | 从世界AI芯片格局看未来中国的造芯之路还有多远 BAT有可能成为芯片救国的主力军 中兴回应美国商务部的制裁

美国股市

北京时间20日凌晨,美国股市周四收低,纳指和标普500指数终结了三连涨走势。原因是亚洲重要芯片厂商台积电的业绩展望悲观,令科技股全面承压。与此同时,投资者还对美国国债收益率上升的形势感到担心。

美东时间4月19日16:00(北京时间4月20日04:00),道指跌83.18点,或0.34%,报24,664.89点;标普500指数跌15.51点,或0.57%,报2,693.13点;纳指跌57.18点,或0.78%,报7,238.06点。

台积电业绩展望悲观,苹果股价应声下跌。台积电周四称,该公司预计其第二财季营收将在78亿美元到79亿美元之间,远低于华尔街分析师此前平均预期的88亿美元。台积电是全世界最大的芯片代工厂,也是苹果应用处理器的最重要代工企业,台积电对于二季度的预期值,也被认为和苹果芯片代工订单需求存在直接关联。据凤凰网科技报道,由于诸多分析师都把台积电下调营收预期解读为智能手机,特别是iPhone需求疲软的信号,星期四苹果及其供应商股价应声下跌。

美国国债收益率上升。市场同时还在关注美国国债收益率上涨问题。周四早间,美国的10年期国债收益率突破2.9%。今年年初,10年期国债收益率上涨并维持在这一水平,引起美股大幅回调,因为国债收益率的上涨使投资者担心美国通胀率上涨速度可能超出预期。

高盛:美第二轮关税清单在即 这次关注消费品冲击。与4月3日公布的第一份清单相比,预计第二份清单将更多的关注消费品而非资本品。使用美国在公布第一份清单时同样的方法,认为服装、各类电器产品和设备、汽车零部件、塑料和化学制品可能在第二份清单中受到最大影响;而手机、网络通讯设备受到影响的可能性最低。如果美国公布这样一份清单,中国可能会很快跟进并公布一份类似的清单。

Facebook加入AI芯战局 芯片救国可能要靠BAT。国内正在热议“缺芯”的时候,Facebook传出正在招人,计划自己研发AI芯片,其目的是降低对高通、英特尔等芯片巨头们的依赖。

至此,美国的四巨头谷歌、苹果、Facebook、亚马逊都与AI芯片产生了交集。亚马逊正在为其Echo音箱设计AI芯片,而苹果与谷歌已经研发并应用了自己的AI芯片。

与此同时,高通举步维艰,到了被群雄分食的地步,对中兴禁售也可能是压垮它的最后一根稻草。这也恰恰证明芯片公司本身面临非常大的挑战,未来主导AI芯片的或许并非芯片公司,而是谷歌、亚马逊这样的AI巨头,它们重整生态,用云服务来挤压底层硬件供应商的战略布局已经很明显。

视线转回中国,目前,BAT三家都没有(直接)造芯片,但也在积极研发当中,并具备一些相关的技术。除了技术之外,BAT对AI芯片公司主要以投资为主,其中,阿里投资5家芯片公司,数量最多。

根据腾讯研究院的报告,从基础层的芯片企业数量来看,中国拥有 14 家,美国 33 家,中国仅为美国的 42%。美国厂商遍布AI芯片的各个流派,IC设计环节的产业结构非常均衡,并且在GPU和FPGA两个领域,美国企业是完全垄断的,中国企业只在FPGA编译、ASIC和类脑芯片方面略有作为。

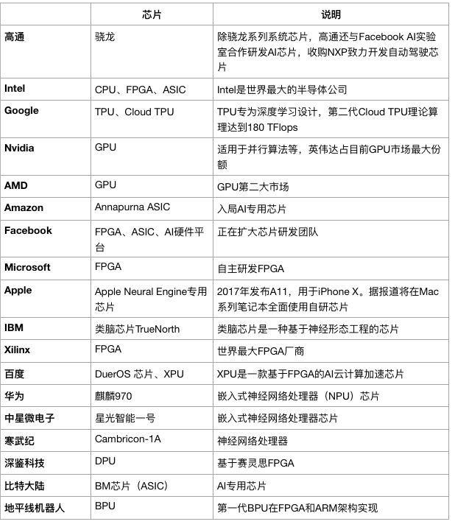

我们一起来看看目前世界的AI芯片格局(不完全统计)。

香港股市

4月19日开盘,港股恒生指数高开0.82%,随后涨幅扩大,在30660点上下震荡,截至收盘,恒指涨1.4%,报30708.44点。国企指数涨2.12%,报12239.84点。红筹指数涨2.28%,报4487.15点。大市成交1149.33亿港元。

石油股大涨。中海油田服务涨8.16%,中国石油涨5.69%,中国海洋石油涨4.42%,中国石油化工涨2.67%。

中资金融股大涨。工商银行涨2.99%,建设银行2.51%;中国财险3.86%,中国平安涨1.11%,中信证券涨2.94%。

受益于国家政策支持,芯片概念和半导体概念股集体大涨,中芯国际再度大涨2.88%,华虹半导体大涨10.11%,紫光控股涨9.95%。

汽车股反弹,华晨中国涨8.84%,广汽集团、和谐汽车、北京汽车涨超5%,永达汽车、润东汽车涨超4%。

俄铝在磋商中国交易,以减轻制裁压力。俄铝此前市值一度蒸发70%,高达500亿港元,现股价回升,涨26.06%,报价1.79港元。

中国股市

4月19日,沪指全天维持震荡走势,有色、钢铁等周期板块集体发力,午后创业板指数冲高回落。最终,沪指涨0.84%,报收3117点;深成指涨1.02%,报收10598点;创业板跌0.11%,报收1820点。从板块上看,有色、大飞机、新材料、军工、钢铁、超级品牌等板块涨幅居前,数字中国、区块链、无人零售、电子发票、互联网保险等板块跌幅居前。沪股通净流入35亿,深股通净流入18亿。

中兴通讯:不能接受美国商务部制裁。

中兴通讯(00763)公布,美国商务部工业与安全局(BIS)签发了一项命令,根据该命令,依据和解协议原暂缓执行的为期7年的拒绝令(包括限制及禁止该公司及全资子公司深圳市中兴康讯电子有限公司申请、使用任何许可证或许可例外,或购买、出售,或从事任何涉及受美国出口管制条例约束的任何物品、软件、或技术等交易)自2018年4月15日(美国时间)起 被激活 直至2025年3月13日(美国时间)止。

中兴通讯发布声明称,拒绝令不仅会严重危及中兴通讯的生存,也会伤害包括大量美国企业在内的中兴通讯所有合作伙伴的利益。在相关调查尚未结束前,BIS执意对公司施以最严厉的制裁,对中兴通讯极不公平。

中兴通讯今日声明提到,BIS无视中兴通讯过去两年在遵循出口管制合规方面的艰苦努力、巨大投入和长足进步;无视上述两份函件中的问题是公司自查发现,及时主动通报;无视公司第一时间处理了对此可能有疏忽的责任人,并快速纠正问题,并聘请权威美国律所独立调查。

关键词:股票,香港股市,港股,恒指,香港IPO,交易港股,美股,中国A股,股市资讯, 美国上市, 阿里巴巴股票,行业板块,银行股,特斯拉,暗盘,上市,高盛,美国IPO, 蚂蚁金服,蚂蚁金融,高盛,黑石,中方博鳌论坛,华尔街,特朗普的推特,股市警报,万科集团,碧桂园,融创中国,芯片,苹果股票,美国国债,高盛股票

来源:东方财富网,新浪财经,同花顺,21世纪经济报道,彭博,华尔街见闻,辉立证券