研报 | 凯德置地有限公司(Capitaland):踏上另一个庞大的台阶

凯德置地宣布拟议110亿新元收购腾飞-星桥集团 (ASB) 的计划。

这笔交易将增加凯德置地对工业和物流资产以及如印度等新兴市场的风险。它还将进一步提高该集团的经常性收益。

立即使每股盈利增加 (+4%) 以及净资产收益率增加 (+9%), 但对资产净值略有摊薄 (-4%)。

维持增持评级,目标价为新元4.00。

有什么新鲜资讯吗?

凯德置地正在收购腾飞私人有限公司和星桥私人有限公司的全部股权,收购后合称为腾飞-星桥集团 (简称ASB)。

总交易额为110亿新元 – 其中股权价值为60亿新元,净债务和少数股东股益为49亿新元。将由50% 的凯德置地股权 (每股3.50 新元),以及50% 的现金来出资。

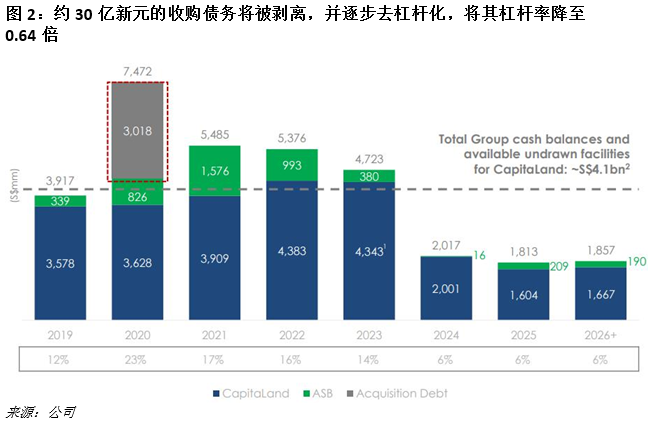

资产管理规模合计1160亿新元,共有8只房产投资信托基金以及23只私募基金。

目标特别股东大会:2019上半年,目标完成:2019年三季度。

积极方面

通过新的资产类别和新的地理位置形成新的增长支柱。CAPL 将拥有工业和物流两个新的垂直业务。这将使其收入来源多样化,并提高其经常性收入。此外,CAPL 还将增加其在印度等新兴市场的风险 – 此前集团在该地还没有设立投资管理平台。

更高的经常性收益。我们一直看好CAPL,因为它的经常性收益将有所增加(2018年9个月里,占其息税前利润近90%),这一收益将从这笔交易中得到进一步的提振,从ASB的运营性税后净利将达到3亿新元左右。

消极方面

资产净值被稀释。虽然该笔交易使每股盈利和净资产收益率立即增加,但问题的症结在于资产净值稀释了4%。CAPL 的管理层曾表示有信心提升其资产净值,主要是通过合并基金管理平台以及拓展渠道。

前景及投资行动

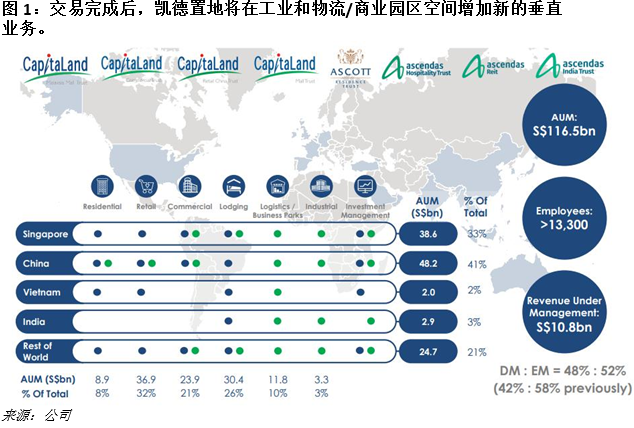

为了提前实现其2020年资产管理规模达到1000亿新元的目标,我们认为这宗交易在长期内是积极的,因为我们目睹了这家房产企业正在发展其临界规模,并且产生越来越多的弹性和经常性收益。按照集团2020年12月的目标,下一步要做的是去除30亿新元的杠杆,使CAPL 的资产负债表恢复至0.64倍的杠杆率 (形式上为:0.72倍) – 我们可以在这里看到更多的资产循环。

维持增持评级,目标价为新元4.00。

我们维持增持的评级,并设定目标价为新元4.00。我们的目标价转化成2018财年末的股价与资产净值比率为0.75倍。我们的目标价不变,因为该交易仍在等待股东的批准。

本文为英文翻译版本,仅供参考,一切请以英文版本为准。如果有想了解更多全球股市资讯,请关注微信公众共 “辉立资本新加坡” (SGPSPL)。同时提供在线免费开设股票账户,一个账户轻松交易美股,港股,新加坡股

关键字:新加坡股票研报,新加坡股,新加坡研报,新加坡账户,交易新加坡股票,新加坡股票开户,免费开户,在线开设新加坡股票开户,新加坡证券,新加坡券商,投资组合