凯德商务产业信托(CapitaLand Commercial Trust)

投资概要

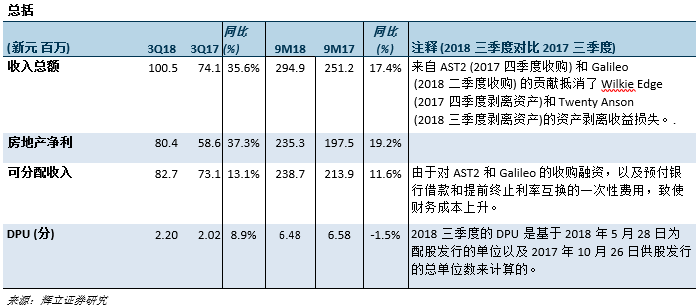

三季度和9个月的NPI/DPU 符合我们的预测。

来自Galileo 的全季度贡献,占CCT今年三季度NPI的5%。

通过提高固定利率的债务比例,使杠杆比率降低了35.3% 。

亚洲广场2座(AST2)提高了近乎整个投资组合的入驻率。

负租金的逆转仍困扰着关键房产。

维持增持评级,目标价为新元1.90 (先前为新元1.88)。

积极方面

通过提高固定利率的债务比例,以降低杠杆比率。8月29日通过使用Twenty Anson 的剥离资产所得偿还银行借款后,债务杠杆比率目前为35.3% (今年二季度为:37.9%)。目前,固定利率债务占借款总额的92% (今年二季度为:85%),债务的全部成本降低2.6%。

AST2 提高了近乎整个投资组合的入驻率。由于AST2 的入驻率上升(三季度为98.1% 对比二季度为91.9%),致使投资组合的入驻率环比从97.8%上升至99.2%。

消极方面

负租金的逆转仍困扰着关键房产。AST2, Capital Tower 和Six Battery Road 的平均到期租金均高于2018三季度所承诺的租金。我们预计,逆转将转为正面,这是因为在写字楼租赁活动健康发展,以及CBD 核心区写字楼的供应逐渐减少的背景下,到期的租金仍将继续下滑。

前景

由于GRI(办公楼投资组合),CCT的最大贡献者AST2在本季度的入驻率有所上升,因此前景是乐观的。此外,从2019年4月起,从汇丰银行就汇丰大厦的一年租约展期中,CCT 将录得36%的租金增长,这将使NPI收益率由4%上升至6%。此后的建筑计划包括翻新/租赁,撤资和重建。额外的经常收入还将来自于从2019年4月起,由国家为Bugis Village 提供为期一年的新租约,租金约为100万新元。凯德置地曾在10月份,投资2700万新元与The Work Project Kingdom 联合运营,将出租Capital Tower 和Asia Square Tower 2的空间,从这些大楼中追求核心-弹性的模式。经理表示,有信心通过这个核心-弹性空间的组合,将有助于长期的租户保留。

投资行动

维持增持评级,同时上调目标价至新元1.90 (先前是新元1.88)。

这相当于2018财年末的收益率为5.1%,以及股价与资产净值比为0.99倍。我们调整了对DPU的估值 – 并相应地,把目标价也上调,考虑到AST2 (CCT 2018年9个月的NPI为18%)显示出有更好的入驻率。此外,在分析师变换后,我们对租金和成本假设也有所调整。

关键字:新加坡股票研报,新加坡股,新加坡研报,新加坡账户,交易新加坡股票,新加坡股票开户,免费开户,在线开设新加坡股票开户,新加坡证券,新加坡券商,投资组合