研报 | 凯德置地有限公司(CapitaLand):一齐准备就绪

2019年8月19日

买入 (升级)

收盘价:SGD 3.40 | 预测DIV:SGD 0.12

目标价:SGD 4.20 | 总回报:27.1%

摘要

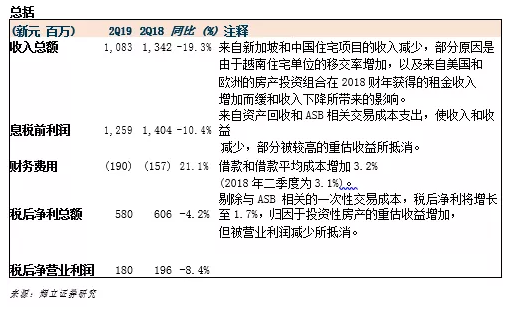

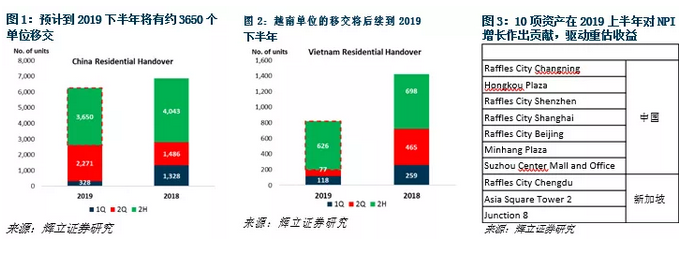

2019年二季度同比下降-19.3% ,这是因为中国和越南住宅移交的时间差异所致 (后续要到2019下半年,见图1和2)。中国逐步放宽价格上限,致使今年二季度的销售价格环比上涨19% – 销售势头保持健康。通过基金管理平台,以及公寓租赁部门(雅诗阁)的管理合约,扩大经常性收入流。

去杠杆化是近期的焦点。积极剥离非核心资产将有助于CAPL 提前实现2020年0.64倍的去杠杆目标。由于CAPL-ASB的合并,我们升级至买入建议,目标价上调至4.20新元。

积极方面

去杠杆化已步入正轨。CAPL-ASB 合并后组合杠杆倍数达到0.73倍的历史新高 (2017/2018财年,杠杆倍数分别为0.49倍和0.5倍),符合管理层预期。管理层已制定了一项计划,计划通过每年实现30亿新元的资产回收目标,到2020年底前将净债务/股本比率降至0.64倍。2019上半年,撤资总额达到34亿新元,其中12亿新元已完成撤资。CAPL 有望在2020年底以前达到0.64倍的去杠杆目标。按实际利率计算,年初至今,8个月里,净投资撤资达到12亿新元。资本努力回收已释放1.35亿新元(1.71亿新元,不包括ABS相关交易成本的3600万新元) 的资本收益。

NPI增长驱动重估收益。2019年二季度,重估收益为税后净利总额贡献了3.465亿新元(60%),然而,这些重估收益只是运营方面的驱动 – 其中10个物业(图3)占所公布的NPI较高收益率的重估收益中约为58%。2019上半年,平均投资组合的NPI收益率为4.5%,高于2018财年的4.2%。

消极方面:

2019年二季度,中国推出单位的售罄率下降至80% (一季度约为90%)。然而,就所有的发售单位而言,整体的销售率保持在93%的健康水平,管理层表示,来自住宅升级用户和首次置业用户的需求依然强劲。CAPL 的策略是调整发售的速度, 以等待价格上限的放宽,在今年二季度,销售价格环比增长了19%。这是紧跟在一季度的销售价格环比增长53%之后。在半年的基础上,销售量和销售额同比分别增长73% 和31%。

前景

前景乐观。随着中国在价格上限的逐步放宽,2019年一季度和二季度的销售价格环比分别上涨53%和19%。我们对将于2019下半年发售,余下的3,078 个单位,保持乐观。

在新加坡,CAPL 于2019年7月推出的One Pearl Bank ,实现了72.5%的健康的卖出率 (或占总项目的27%) ,并将于三季度推出Sengkang Central 混合用途开发项目(与CDL合作)。

CAPL的经常性收入投资组合继续以健康的运营指标为基础,并将日益成为其盈利的基础。与ABS 合并后,私募基金的数量从17只增加到23只。管理的基金资产增长28.1%,从551亿新元增加至706亿新元。

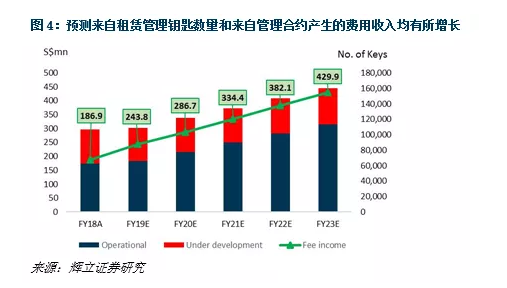

今年迄今,签约的管理钥匙数量约有7,100 条,使管理钥匙数量达到107,154条。如果签约的势头持续,CAPL的公寓租赁部门将有望在2023年之前实现其取得160,000 条钥匙的关键目标。租赁部门占2019上半年的息税前利润的14.4%(2.91亿新元/20.61亿新元), 其中41% (1.18亿新元) 来自管理合约产生的经常性费用收入。目前,44% (47,480 个单位) 仍在开发中,并不会带来费用收益。我们预计,随着更多的公寓上线,租赁部门将在支持CAPL 的经常性收入方面,发挥越来越重要的作用。管理层此前曾指出,一旦稳定下来,每10,000 条钥匙将产生2500万新元的费用收益。

除了Liang Court的可能再开发外,连同CDL 和两家上市信托(ART 和CDLHT),CAPL 还提到,集团将研究Jurong area 工业资产复兴的可行性。

升级至买入评级,目标价上调至4.20新元 (先前目标价为4.00新元)。

我们更新预测,以反映与ASB 合并后的情况,并上调目标价至4.20新元。我们的目标价转化为2019财年末的股价与资产净值比率为0.75倍。

本文为英文翻译版本,仅供参考,一切请以英文版本为准。如果有想了解更多全球股市资讯,请关注微信公众共 “辉立资本新加坡” (SGPSPL)。同时提供在线免费开设股票账户,一个账户轻松交易美股,港股,新加坡股,中国A股,越南股票,韩国股票,德国股票,马来西亚股票,泰国股票,印尼股票,菲律宾股票,日本股票,澳大利亚股票,台湾股票,加拿大股票,英国股票,法国股票,荷兰股票,葡萄牙股票,比利时股票,土耳其股票