新加坡股票研报 | 中国光大水务有限公司

投资概要

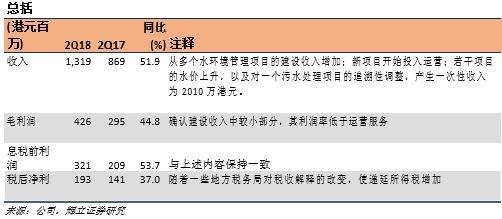

2018年二季度的营收和税后净利均达到了预期。

截至2018年6月,CEWL 有100个项目组合,86个正在运营,7个在建工程,以及7个尚在筹备阶段。

通过上调水价和项目升级持续实现有机增长。

镇江海绵城市项目的竣工可能要推迟至2019年。

登陆香港上市时,预计会有更高的估值。

我们将2018财年末的每股盈利调整至新元5.0 分 (先前为新元4.8 分)。我们将目标价下调至新元0.53 (先前为新元0.55),原因是同业的估值较低,为10.6倍(先前是11.4倍),并且维持买入评级的建议。

积极方面

持续进行的项目升级:2018年二季度,公司有6个污水处理项目(WWT) 确保水价的上调幅度从1% 至165%,其中4个项目已完成升级改造,其余的项目则属于正常的水价向上调整。在此期间,集团收到2010万港元的一次性追溯水价调整,该调整是由于2018一季度春节期间的一笔延迟付款。

消极方面

镇江海绵城市项目升级:由于管道网络建设出现了一些问题,使项目的完成可能会再次推迟到2019年 (此前预计在2018年完工)。集团一直在努力解决,并与当局进行谈判。希望它能加快检查和建设的进程。

前景

截至2018年二季度,污水处理总量超过500万吨/天。预计以现有项目的升级改造为基础的有机增长,每年的产能将提升至10%到20%。然而,到2020年,它仍然没有达到日处理量为1000万吨的污水处理产能。因此,集团可能会寻求更多的项目收购。集团继续优先考虑项目的质量,而不仅是追求数量。

2018年8月,集团申请在香港进行双重上市。管理层认为,鉴于许多同行都在香港上市,香港投资者对污水处理业务应更为熟悉。根据图1所示,香港同行以较高的市净率进行交易,但部分是由于拥有较高的净资产收益率。

投资行动

维持买入评级,目标价下调至新元0.53

我们将2018财年末的每股盈利调整为新元5.0 分 (先前是新元4.8 分)。我们将目标价下调至新元0.53 (先前是新元0.55),原因是同行的估值较低,为10.6倍(先前的估值为11.4倍),并维持买入的评级建议。

关键字:新加坡股票研报,新加坡股,新加坡研报,嘉德置地商业信托 ,新加坡账户,交易新加坡股票,新加坡股票开户,免费开户,在线开设新加坡股票开户,新加坡证券,新加坡券商,投资组合,新能源汽车,补贴新政