股票研报 | 联美控股 (600167.SH) – 内生外延驱动未来高成长

投资概要

全年净利润增长超出市场预期

供暖主业驱动业绩高增长

战略佈局3D成像,外延扩张加速

全年净利润增长超出市场预期

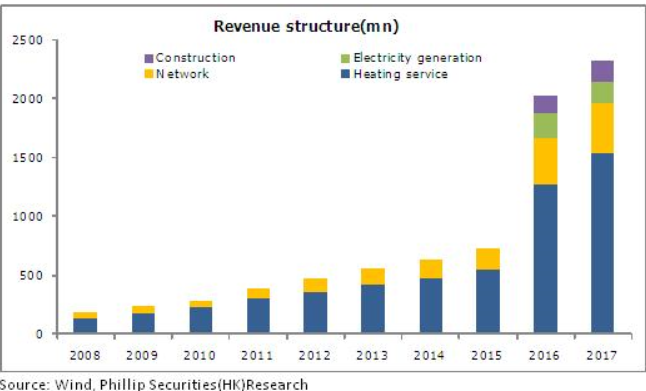

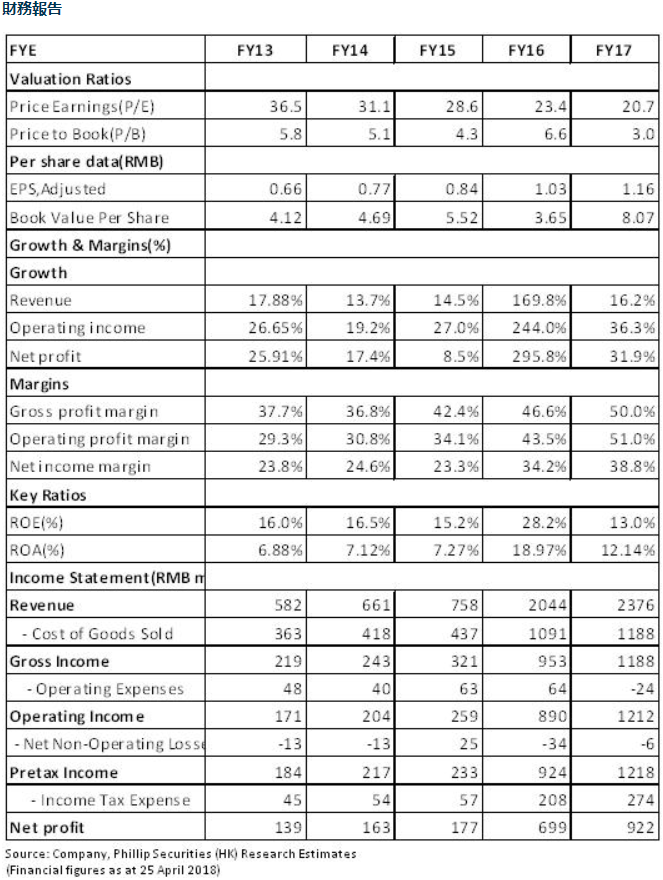

2017年联美控股实现营业收入23.76亿元,同比增长16.24%,归母净利润9.22亿元,同比增长31.93%,对应每股收益1.157元,同比增长12.6%。其中Q1/Q2/Q3/Q4归母净利润分别为4.52/-1.43/1.72/4.55,一季度和四季度贡献全年主要业绩。基于强劲的业绩表现,公司拟每10股转增10股并派息4.2元,全年分红率达40.08%。

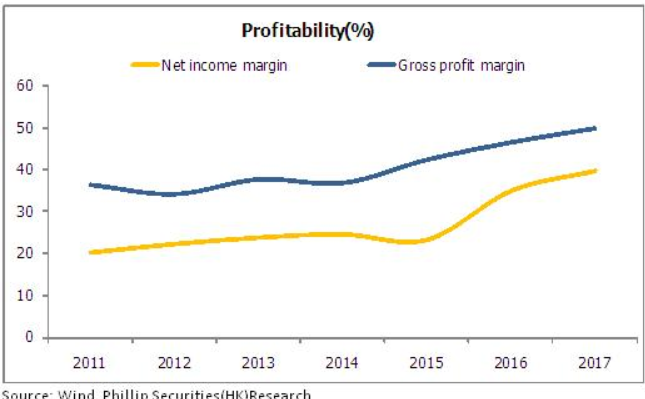

受主业毛利率大幅提升的带动,综合毛利率和净利率分别提升3.38pct、4.72pct至50%、39.73%,盈利能力表现非常强劲。期内公司资金管理效率也有所提升,通过签订银行存款协议,获得1.5亿元的利息收入,带动财务费用率同比下降6.74pct至-6.32%。此外销售费用率、管理费用率也维持较低水平,分别为0.29%(+0.14%)、4.93%(-0.32%),整体费用管控能力出色。

供暖主业驱动业绩高增长

三大主营业务贡献约90%的收入和95%的毛利,有力支撑公司整体的盈利水平。具体而言,供暖及蒸汽业务收入15.32亿元(+20.34%),毛利率为37.52%,同比上升3.7pct;工程业务收入1.81亿元(+19.5%),毛利率达80.23%,同比上升6.54pct;接网收入4.21亿元(+6.27%),毛利率达95.86%,同比上升4.82pct。而发电量和利用小时数的下降导致发电收入同比下降6.48pct至1.89亿元,毛利率同比下降7.04pct至14.64%。

公司供暖面积及接网面积的稳步增长拉动全年业绩增长,2017平均供暖面积约5600万平方米,同比增长21.7%,联网面积7360万平方米,同比增长19.5%。 公司积极寻找异地复制项目的机会,沉阳皇姑区特许经营租赁项目实现了以轻资产模式的复制扩张,包头供暖业务体现了公司异地复制供暖业务的能力。未来公司“自建+收购+能源管理”的三重模式将加速业务扩张步伐,壮大业务规模,提升盈利能力。

战略佈局3D成像,外延扩张加速

期末公司账面资金达到54亿元,充裕的资金为公司战略佈局金融行业、新兴科技等行业提供保障。2017年10月,公司以6.51亿元受让信达财险4亿股股份,受让后占信达财险总股本的19.33%,成为信达财险第二大股东。2018年1月,公司与以色列3D成像解决方桉及演算法研发公司MV公司签署股权投资协议,拟投资3600万美元,其中 2800万美元认购MV公司D轮融资优先股,800万美元受让MV公司原股东持有的股票,投资完成后,公司以17.36%的股份晋升为MV公司第一大股东。在主营业务稳健增长的同时,公司战略投资金融行业和新兴科技有助于增强整体抗风险能力和可持续发展能力,培育未来新的盈利增长点。。

风险提示

煤炭价格上涨;

供暖及接网面积不及预期;

外延扩张不及预期;

并购整合风险;

关键字:新加坡股票研报,新加坡股,新加坡研报,联美控股 (600167.SH),新加坡账户,交易新加坡股票,新加坡股票开户,免费开户,在线开设新加坡股票开户,新加坡证券,新加坡券商,投资组合,新能源汽车,补贴新政