新加坡煤炭每月快讯

中国进口更多的煤炭

中国进口激增:据路透社报道,中国的海运煤炭进口量在2018上半年同比激增14%,估计达到1.266亿吨。印尼成为最大的进口来源国,交付煤炭6180万吨,同比飙升33.5%。同时,从澳洲进口的煤炭在此期间持平在4280万吨 (2017上半年:4260万吨)。

进口限制放宽:2018年6月,由于对价格上涨和地区电力短缺的担忧,中央政府减少了对国家主要港口的煤炭进口限制,因为在夏季用电高峰期,电力需求急剧增加。山东,福建和广州的港口已将清关时间从15个工作日加快至10日,同样,全国各地的其他港口也被要求优先处理煤炭发电的清关。

减少煤炭污染的计划:7月3日,国务院宣布了国家2018至2020年反污染计划的最终版本。在2016至2020年期间,北京,天津,河北,山东和河南等地区将被要求将煤炭消耗量减少10%,而同时,长三角地区将必须将煤炭消耗量减少5%。至2020年,这些地区将不允许新增钢铁,焦炭和原铝的产能。

中国对煤炭的需求超过供应

中国的国内产量继续持平,如图1所示。与此同时,对电力的需求依然强劲,尤其是对火力发电的需求,在2018年5月,恢复至两位数,如图3所示。正如我们上个月的快讯所述,预计对海运煤炭进口限制的放宽,中国港口的库存增加,见图6。2018年6月,港口煤炭总库存量同比增加49%,这表明夏季的火电需求将大幅增加,预计今年将会更长 (超过4个月)。

显然,煤炭供应的安全性,在短期内,成为了当局对任何煤炭价格压制方面的优先事项。在过去的两个月里,煤炭价格又回到了异常区域,见图5。考虑到海运煤炭将继续填补高峰季节的供应缺口,预计煤炭价格将在2018年三季度保持在高位。

印尼煤炭市场预计在2018下半年保持乐观

在生产方面,国内矿商从2018年1月至5月,共生产了1.45亿吨,占能源和矿产资源部设定的年度目标4.85亿吨(同比增加5.2%)的31.7%。在价格方面,HBA在2018年7月创下6年来的新高,触及104.7美元/吨,如图4所示。2018上半年,HBA的平均价格为96.5美元/吨,同比增长17%。我们认为,中国对海运煤炭的强劲需求,将使煤炭价格随后保持上涨。

煤炭股的每月更新

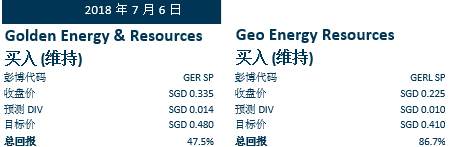

Golden Energy and Resources (目标价:新元0.48 / 买入)

• 受益于2018年一季度的煤炭价格上涨

• 提升港口装载能力

• 2018年一季度现金成本高于预期

• 截至2018年一季度,现金头寸达到3.05亿美元

Geo Energy Resources (目标价:新元0.41/ 买入)

• 1100吨的生产目标正在按计划进行

• 今年的现金成本激增

• 对任何近期的收购保持乐观

• 截至2018年一季度,现金头寸达到2.48亿美元

投资行动

我们对该行业仍然保持乐观态度,因为我们预计煤炭价格 (2018财年末 平均售价为4,200 GAR: 42美元/吨,2018年一季度 平均售价为4,200 GAR: 52.4美元/吨) 将对矿商有利。与此同时,生产的增长仍在按计划进行中。我们维持对煤炭行业的增持评级。

关键字:新加坡股票研报,新加坡股,新加坡研报,新加坡煤炭 ,新加坡账户,交易新加坡股票,新加坡股票开户,免费开户,在线开设新加坡股票开户,新加坡证券,新加坡券商,投资组合,新能源汽车,补贴新政