星展集团控股有限公司(DBS):强劲而可持续的表现

投资概要

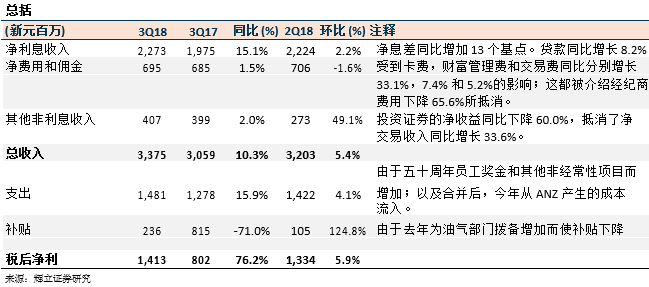

2018三季度的税后净利为14.1亿新元,比我们的预期低8%;在强劲的交易收入支持下,营收与我们的预期相符。支出高于预期。

净息差同比扩大13个基点至1.86% (2017三季度为:1.73%),而环比扩大1 个基点 (2018二季度为:1.85%)。

受到非贸易企业贷款和消费贷款的推动,贷款保持高个位数增长,同比增长8.2% 。

由于去年的油气拨备增加,补贴同比下降71%。不良贷款率稳定在1.6% (2017三季度为:1.7%)。

维持买入评级,并下调目标价至新元29.00 (先前是新元33.32)。我们将估值转延至2019年末,并在一个更动荡且低增长的环境下进行建模。我们还将2018/19财年的盈利削减了3-5%。

积极方面

净息差处于两年来的高点。2018年三季度的净息差触及1.86%,同比扩大13个基点。这是九个季度以来的最高点。净息差的扩大与新加坡和香港的加息是一致的,这两个地区的贷款收益率增长速度快于存款成本。贷款收益率同比增长47个基点,同业收益率同比增长41个基点,以及证券收益率同比增加32个基点;而资金成本同比上涨了37个基点。管理层为2018年四季度设定的指导值为1.86-1.87%,如预期将进一步加息和 有60-65% 的通过率,则净息差达到目标似乎触手可及。

贷款增幅同比稳定在8.2%。非贸易企业贷款和消费贷款推动了贷款增长。由于定价不具吸引力,贸易贷款增长放缓。星展银行在新加坡的住宅贷款市场份额仍然强劲,保持在31%。管理层对2019年的贷款增长指引将达到中个位数。尽管经济仍然相当强劲,但由于宏观经济的不确定性,较为适度的增长是符合预期的。

香港9个月的盈利同比激增43%。受利率上升的推动,香港的净利息收入同比增长27%,净息差上涨24个基点至1.97%。随着CASA基数的不断增长,以及贷款增长同比飙升16%,香港HIBOR 上升的幅度更大。香港的贡献占总收入的20%。

信贷成本正常化为21个基点,而一年前为195个基点。补贴同比下降71.0%,原因是去年对油气部门的拨备大幅增加。进入2019年,资产质量预计将保持稳定,但随着利率上升,中小企业投资组合的贷款质量可能会恶化。然而,与整个贷款组合相比,中小企业的投资组合规模较小,潜在的拖欠和拨备也不会很重要

消极方面

CIR 由2017年三季度的41.8% 上升至43.9%,原因是包括员工50周年奖金,品牌重塑活动成本和诉讼成本等的一次性项目。除去这些非经常性项目,2018年三季度 的CIR 为43%,与2018上半年一致。2018年三季度的运营费用同比增加15.9%,高于运营收入10.3%的增长;由于ANZ带来的成本高于收入,这占了支出增长的6%。随着星展银行向德里和孟买扩展业务,预计2019年可能会产生更多的成本。

前景

随着利率上升,净息差将会继续改善。管理层预期2 -4 次加息将会继续进行,平均通过率为60-65%。星展银行的贷款约有一半与SIBOR 挂钩,而另一半则与固定利率挂钩。虽然SIBOR 通常需要几个月才能重新定价,但固定利率则需要几年的时间才能完成。因此,利率上升的很大一部分尚未流入新加坡的账面,预计到2019年还会有更多的资金流入。随着美联储继续加息,我们可能会看到净息差扩大的滞后将会更为明显。

关于贸易战,管理层认为最大的影响将是市场情绪,而不是直接影响经济。市场情绪和焦虑已导致股票和债券活动放缓。

星展银行已看到了房产降温措施对其抵押贷款增长的影响。2018年三季度,新增的抵押贷款下降50%,而管理层已将2018年初设定的抵押贷款目标从40亿新元修订至25亿新元。因此,随着措施收紧,我们预计抵押贷款增长将会放缓。

对星展银行来说,资金成本上涨还不是问题。虽然融资成本上升是不可避免的,但星展银行的CASA 市场份额仍保持强势,占据53% (尽管新加坡的CASA 不断萎缩,并转向定期存款和债券)。凭借其充足的CASA 基础,星展银行不需要像其他银行那样增加其昂贵的定期存款资金。

投资行动

尽管由于市场逆风而导致的贷款增长预期疲软,但由于贸易问题对贸易额的影响更为严重,将超过对整体利润率的影响,净息差仍将处于积极的轨道上。随着美国继续加息,银行业将享有更大的定价权。展望未来,预计资产质量将保持健康,较低的拨备将为盈利提供上行空间。星展银行仍具有吸引力,股息收益率为4.5%。

本文为英文翻译版本,仅供参考,一切请以英文版本为准。如果有想了解更多全球股市资讯,请关注微信公众共 “辉立资本新加坡” (SGPSPL)。同时提供在线免费开设股票账户,一个账户轻松交易美股,港股,新加坡股

关键字:新加坡股票研报,新加坡股,新加坡研报,新加坡账户,交易新加坡股票,新加坡股票开户,免费开户,在线开设新加坡股票开户,新加坡证券,新加坡券商,投资组合