股市资讯 | MSCI成份股确定,234支中国A股或成投资热点(附名单)。富士康光速上市,IPO意在转型

中国股市

北京时间5月14日,两市小幅高开,早盘白酒、金融股走强,趋动沪指高位运行,午后,军工、钢铁、煤炭等板块跳水,沪指受此影响,逐渐下行,尾盘小幅拉升;创业板指全天围绕平盘线红绿震荡。乐视网(4.230, -0.16, -3.64%) 今日举办2017年度业绩说明会,公司存在被暂停上市的风险,午后大盘小幅跳水,最深跌幅超7%。截至收盘,沪指报3174.03点,涨0.34%;深成指报10671.46点,涨0.35%;创业板指报1830.98点,跌0.21%。

从盘面上看,富士康、白酒、苹果、银行、5G、乳业等板块涨幅居前;海南、军工、钛白粉、ST、区块链等板块跌幅居前。

热点板块:

1、富士康概念股

富士康正式披露《首次公开发行A股股票招股说明书》等公告,股票简称“工业富联”,总投资额272.53亿元,与此前披露的募集金额相比,未有变化。消息一出,富士康概念股全天持续领涨两市,安彩高科、科创新源、昊志机电、广信材料涨停,京泉华、劲拓股份、奥士康、宇环数控、合力泰等涨幅居前。

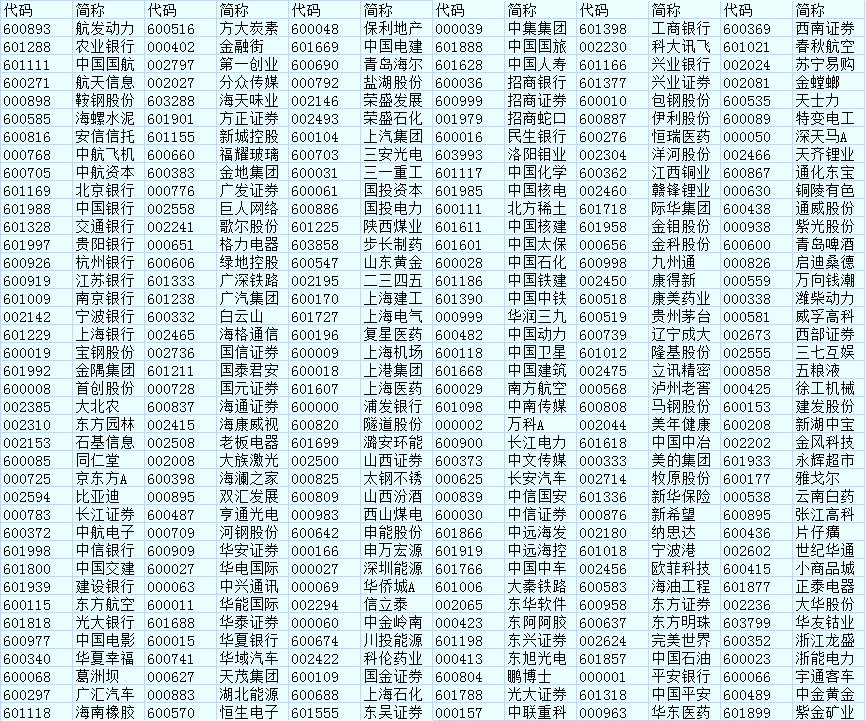

MSCI 成份股出炉, 234支中国A股被纳入(附名单)

自从2017年6月21日,A股第四次闯关MSCI新兴市场指数修成正果之后,今天2018年5月15日又迎来一大超重磅的消息。MSCI15日凌晨公布半年度指数调整结果,同时揭晓下月6月1日获纳入MSCI新兴市场指数的A股名单。

根据公告内容,234只A股被纳入MSCI指数体系,纳入比例为之前宣布的2.5%,今年8月明晟公司将会提升纳入比例至5%。

在MSCI 新兴市场指数中。三家市值最大的被纳入的公司分别是A股的中国工商银行,中国建设银行和中国石油,具体A股纳入名单如下:

来源:新浪财经

富士康:光速上市,郭台铭称此举意在转型

5月11日晚,证监会发布消息称,按法定程序核准了富士康工业互联网股份有限公司(以下简称FII)的首发申请。富士康及其承销商将于上交所协商确定发行日程,并刊登招股文件。

5月14日,富士康工业互联网股份有限公司正式披露《首次公开发行A股股票招股说明书》、股票发行安排及初步询价公告。

招股说明书显示,富士康拟发行约19.70亿股,占发行后总股本的10%,全部为公开发行新股,不设老股转让。网下、网上申购时间为5月24日,中签号公布日为5月28日。股票简称“工业富联”。中国国际金融股份有限公司担任发行保荐人(主承销商),股票简称“工业富联”。具体发行价格公司将在5月22日刊登的《网上路演公告》中进行确认,5月17日-5月18日,公司将通过上交所网下申购电子平台进行初步询价。

据悉,此次IPO,将为富士康下一代项目募集272.53亿元人民币的投资,资金将用于工业互联网平台构建、包含云计算、5G、物联网、智能制造等多个业务。

与此同时,此次IPO是富士康转型的关键一步。与以往代工制造定位不同,富士康董事长郭台铭一度想将公司塑造为一大数据为导向、AI分析为驱动,以及机器人运作为基础的工业互联网企业。

美国股市

截至北京时间5月15日凌晨,美股周一收高,道指录得连续第8个交易日上涨。中美贸易关系出现解冻迹象,令市场对贸易战的担忧情绪趋于缓和。一位美联储成员称需要加息至3%之上,以实现通胀稳定与低失业率的目标。

截止收盘,道指涨68.24点,或0.27%,报24899.41点;标普500指数涨2.41点,或0.09%,报2730.13点;纳指涨8.43点,或0.11%,报7,411.32点。

香港股市

北京时间5月14日,昨日开盘,港股恒生指数高开1.21%,之后维持窄幅震荡,截止收盘,恒生指数六连升大涨1.35%,报31541.08点。国企指数涨1.61%,报12544.55点。红筹指数涨1.27%,报4667.87点。大市成交1066.98亿港元。舜宇光学科技大涨7.87%,报153.5港元,领涨蓝筹。

恒指上周出现五连升,单周升幅超千点,自四月中以来首次重返31000点上方。

沪港通资金流向方面,沪股通净流入34.8亿,港股通(沪)净流出为10.42亿。深港通资金流 向方面,深股通净流入23.64亿,港股通(深)净流入为7.3亿。

中兴:特朗普”解禁”中兴,中兴通讯或迎来转机

5月13日,特朗普发推文称,我们正在为中兴通讯提供一种快速恢复业务的途径。(因中兴业务无法正常开展使得) 中国有太多的工作岗位流失,我已告知商务部要尽快完成这项工作。

随后,美国商务部长罗斯对此回应:“中兴确实做了一些不合适的事情。 他们已经承认这一点”。“问题是:我们最初提出的措施是否有其他替代方案? 这将是我们将非常、非常迅速地研究的地方。”

关键词:股票,香港股市,港股,恒指,香港IPO,交易港股,美股,中国A股,股市资讯, 美国上市, 阿里巴巴股票,行业板块,银行股,特斯拉,暗盘,上市,高盛,美国IPO, 蚂蚁金服,蚂蚁金融,高盛,黑石,中方博鳌论坛,华尔街,特朗普的推特,股市警报,万科集团,碧桂园,融创中国,芯片,苹果股票,美国国债,高盛股票,上市制度改革,微软,百度,爱奇艺

来源:东方财富网,新浪财经,同花顺,21世纪经济报道,彭博,华尔街见闻,辉立证券,A股,虎牙