新加坡研报 ——金光能源与资源(Golden Energy and Resources Ltd )

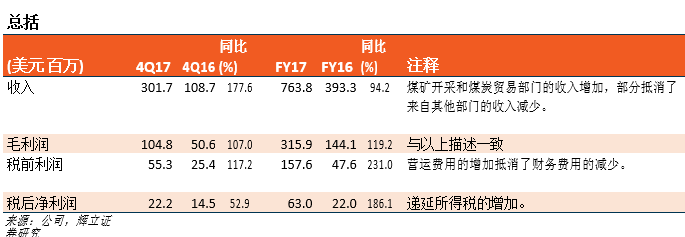

由于销量和平均售价(ASP)高于预期,营收超过我们的预测,达到23.5%。另一方面,由于现金成本和所得税费用的增加,净利润下降了6%。

2017财年的产量为1560万吨,同比增长了64.2%。2017财年的平均售价同比健康增长至25.7%。

2017年四季度的现金成本高于预期,同比增长了139.5%。

由于预期的现金成本和利息负担增加,我们将2018财年末的每股盈利下调至3.5美分 (先前为4.3美分)。基于12个月的远期市盈率为10倍(区域同业的平均水平)和汇率(美元/新元)为1.36均保持不变,我们将2018财年的目标价下调至0.48新元(先前是0.59新元),并且重申我们的建议为买入评级。div>

积极方面

在高涨的煤炭价格中超过了年度目标:

请看以下列表,2017财年的惊人业绩主要归功于产量的增长。特别是在2017年四季度,产量达到高峰,大大有利于集团超过全年1440万吨的生产目标。同时,在中国热煤供应持续短缺的推动下,2017财年的平均售价实现了25.7%的健康增长。

确保2018财年的订单总量为1500万吨:在2018财年初,GEAR与包括国内电厂和贸易公司在内的客户签署了13份承购协议。从这一总量来看,9个出口协议将锁定集团1130万吨的煤炭销售,其余4个国内供应协议将锁定另外的380万吨的煤炭销售。综上所述,GEAR在2018财年的销量达到了1510万吨,占全年目标2000万吨的75%。

消极方面

2017年四季度的现金成本高于预期:

在2017年四季度,由于煤炭运费,开采费和专利使用费用的增加,致使现金成本的增加超过了产量。展望未来,预计在今年和明年的现金成本将维持在23美元/吨至24美元/吨。

前景

最近,能源和矿产资源部 (MEMR) 宣布了几项针对印尼煤炭行业的国内市场义务 (DMO) 的调整:

在2018年,煤炭开采商必须将总产量的25%供应给国内市场。

如果现行价格高于70美元/吨,电力行业为了公众的利益,煤炭的售价必须固定为70美元/吨(以离岸价格为基准)(6,322 GAR,总水分为8%,总硫量为0.8%,以及含灰量为15%)。

我们认为,这一修订后的监管规定对GEAR 的影响有限,因为它已经在国内供应超过了年产量的25%(2016财年为58%,2017财年为30%)。固定价格将主要用于提供给PLN (印尼的国有电力公司)的部分。我们认为,假设2018财年的煤炭价格为43美元/吨,那GEAR煤炭价格的前景将保持稳定。这主要表现的驱动因素将仍然是产量的增长(2018财年末同比增长28%)。此外,该集团已发行1.5亿美元的优先票据。在偿还了5000万美元的设备费用后,GEAR目前手头的现金达到2.9亿美元。我们相信,在短期内,它将获得更多的资产或投资,通过利用该专款来提高收益率。

维持买入评级,下调目标价至0.48新元

由于预期的现金成本和利息负担增加,我们将2018财年末的每股盈利下调至3.5美分(先前为4.3美分)。基于12个月的远期市盈率为10倍(区域同业的平均水平)和汇率(美元/新元)为1.36均保持不变,我们将2018财年的目标价下调至0.48新元(先前是0.59新元),并且重申我们的建议为买入评级。

关键字:新加坡股票研报,新加坡股,Golden Energy and Resources Ltd ,金光能源与资源,新加坡股票开户,免费开户,在线开设新加坡股票开户,新加坡证券,新加坡券商