港股研报 | 云南白药 (000538.SZ)

投资概要

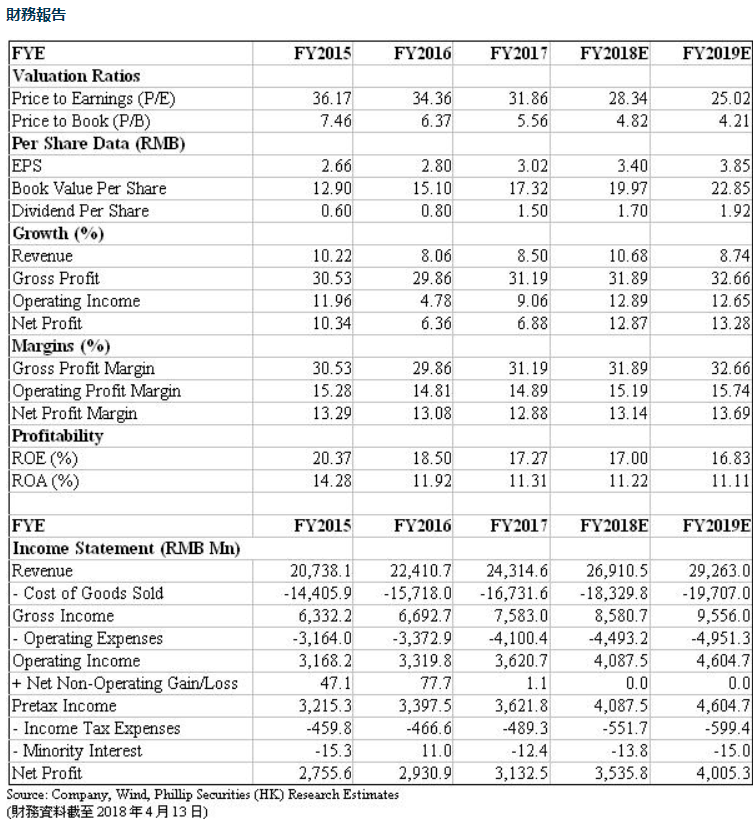

公司医药商业实现平稳增长,医药工业方面,健康产品增长显着。销售费用大幅上升,行销力度不断加大。溷改进一步落地,有望进一步激发未来增长动力。考虑到销售费用等支出可能增加,我们调低2018年EPS预测至3.4元/股(原3.55元/股)。对比历史市盈率和行业市盈率水准,我们给予33倍目标市盈率,目标股价112.0元。(现价截至4月13日)

溷改加速发展

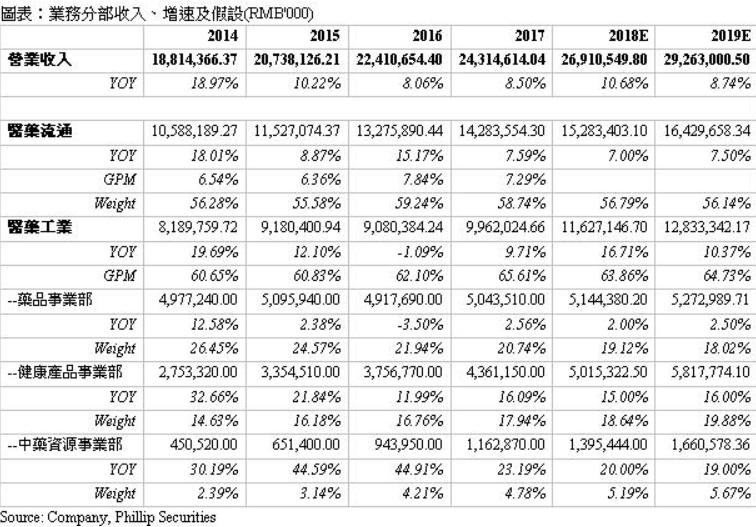

省医药公司实现收入14,494百万元,同比增长7.5%。我们预计,2018年随着两票制的影响进一步消化,商业板块有望优化。医药商业基本实现云南县级以上及部分发达乡镇医院全覆盖;同时探索线下零售药店业务、药房託管、网上售药等线上线下管道协同发展。公司目前实现主要电商平台全覆盖,同时,开展在微商等领域内的管道建设探索。

医药工业个别发展

医药工业收入整体实现同比增长9.7%。(1)药品事业部收入达到5,043.5百万元,同比增长2.56%,表现相对疲弱。公司根据两票制等医改政策调整分销模式,确保产品分销的合规性。产品方面,针对药用消费品消费需求增长的趋势,筛选内部批文资源,推动药用消费品产品体系建设;加快蒸汽眼罩等护理类工业产品的研发和推广。(2)健康产品部实现收入4,361.1百万元,同比增长16%,健康产品管道已实现全国覆盖,部分发达地区实现县乡一级覆盖。同时,公司积极发展电子商务,在杭州成立互联网行销中心,以旗舰店形式入驻各大电商平台。

把握时代行销特点

公司的销售费用同比上升30%,主要是由于市场维护和推广费用增加。公司重点部署在互联网管道、楼宇管道以及年轻消费群体关注的活动赛事冠名等新型媒体传播管道,提升公司品牌在年轻消费人群中的知名度。採用事件型行销增加产品曝光度,结合热门IP,推出相应产品,2017年公司借助热门影视剧集“三生三世十裡桃花”和“春风十裡不如你”推出云南白药养元青十裡桃花限量定制系列和云南白药春风十裡定制款洗漱包;自主打造大IP运动赛事“云南白药爱跑538”,陆续与长沙、重庆、武汉等地的合作伙伴共同组织开展活动。随着在行销方面的投入增大,我们预计2018、2019年的销售费用仍可能呈上升趋势。

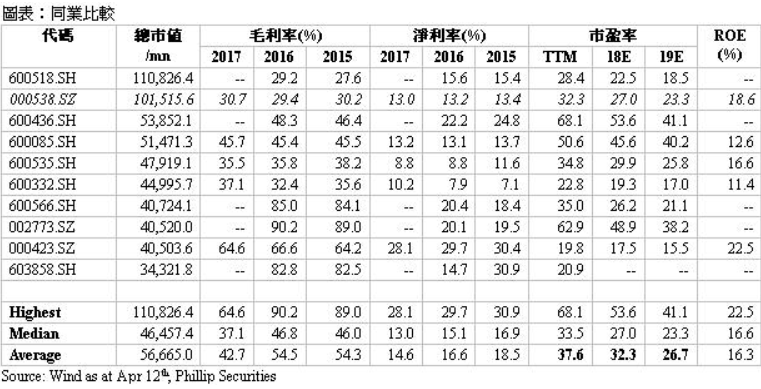

估值和风险

我们的模型显示目标价为112.0元。我们预测未来各分部业务增速,并且考虑到销售费用等支出可能增加,调低2018年EPS预测至3.4元/股(原3.55元/股)。中药行业目前合理估值水准在33.5-37.6倍左右(市盈率中位数、平均数),对比历史市盈率和行业估值,我们给予云南白药33倍目标市盈率,目标股价112.0元。风险包括:流通业务受两票制影响;健康产品竞争激烈;溷改效果不及预期。

关键字:新加坡股票研报,港股,港股研报,云南白药, 000538.SZ,港股账户,交易港股,新加坡股票开户,免费开户,在线开设新加坡股票开户,新加坡证券,新加坡券商