新加坡股票研报 | 老曾记有限公司 – 强劲的终结,标志着转折点

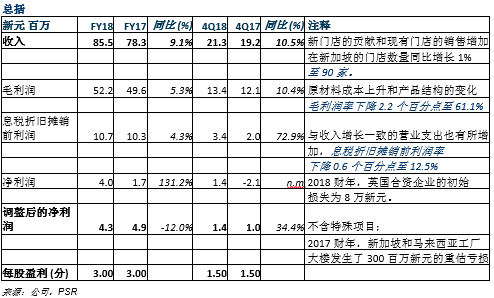

在产品创新的驱动下,2018财年的收入同期增长了9.1%,与我们的预期相符。

由于经营杠杆率的提高以及英国合资企业启动成本低于预期,2018财年的盈利超过我们预期的13%。

增长势头延续至2019财年末,同时工厂产能的扩张和新工厂设备的收益应该会开始大幅增长。

末期股息为1.50分,与去年持平。

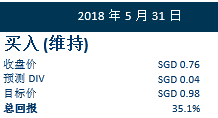

维持买入评级,基于现金流量贴现法- 衍生的目标价不变,仍为新元0.98

积极方面

2018财年的收入增长是过去5年以来最强劲的,主要来自潜在的销售增长。零售门店的销售额同比增长了9.2%,这主要是受到每家门店平均销售额同比增长8.0%所驱使,并在较小的程度上,这等于在2018财年净增加了一家门店的计量。

此外,角类食品销售同期增长了3.3%,并一直为收入作主要贡献 (占2018财年收入的约30%)。我们相信这些数据是集团的产品创新成功的有力证明。

2018年四季度的毛利率恢复至约63%;这应该是可持续的。在过去三个季度里,毛利率一直处于低迷状态。2018年4月,平均售价已作出调整,以将原材料成本的上升转嫁给消费者。在工厂扩张之后,受益于批量采购带来的更有利的投入价格。

消极方面

在开业前,英国合资企业承担了8万新元的启动成本。2018年6月,集团计划在英国伦敦的Covent Garden 开设第一家旗舰店。

前景

随着增长的势头延续至2019财年末,喻表着前景是乐观的。新店开业和产品创新将继续推动业绩增长。新工厂将增加产能 (在品种和数量方面),以推动其扩张战略,并提高其边际利润,通过 (a) 提高生产效率,以及 (b) 通过批量采购以节省成本。

投资活动

维持买入评级,基于现金流量贴现法-衍生目标价不变,仍为新元0.98

我们已将2019财年末的销售增长预期从4.1%上调至6.0%。我们还在他的报告中,介绍了2020财年的估值。由于集团将继续加大产品创新的力度,同时从新工厂的设施和设备中获得更好的运营效率,所以预计2019/20财年末的核心净利润将增长21.6%/22.8% 。

目前,OCK 较其同业平均市盈率的28.1倍折让19% 。我们的目标价意味着2019/2020财年末的市盈率分别为22.6倍和18.5倍。

我们喜欢这只股票,期望OCK 能像我们预测的那样:

(a) 在自由现金流增加的支持下,继续把2019财年末的盈利超过90%用于分红。由于2018财年的自由现金流由160万新元增加至520万新元,我们预测2019财年末的股息将从1.0分上涨至4.0分。

(b) 2019财年末将享有高净资产收益率达到18.0% 。

关键字:新加坡股票研报,新加坡股,新加坡研报,新加坡账户,交易新加坡股票,新加坡股票开户,免费开户,在线开设新加坡股票开户,新加坡证券,新加坡券商,投资组合,新加坡证券交易所(SGX),泰国酿酒