研报 | A股入摩7月表现回顾与展望

北上资金成为MSCI标的中国A股的主要购买者,并对个别股增持

中国股票尤其是中概股对新兴市场指数影响进一步加大

北上资金推动个别板块涨幅

北京时间8月14日凌晨,MSCI明晟公司发布了2018年8月指数评估报告。报告显示明晟公司将实施将中国A股部分纳入明晟MSCI中国指数的第二步,将纳入因子从2.5%提升至5%,提升后中国A股占明晟新兴市场指数的权重为0.75%。

据路透社估计,追踪MSCI 新兴市场指数的基金规模约为1.9万亿美元,由此估计,预计按今年纳入的5%将带来1215亿人民币增量资金。按照两步走的流程,预计6月和9月分别有约100亿美元(约合人民币689亿)资金流入。

衔接之前辉立证券新加坡(SGPSPL)的A股入摩6月表现回顾,辉立证券新加坡(SGPSPL)将从资金流向和指数及行业表现两个个角度分析自7月份该事件对中国A股市场的影响。

A股入摩7月份表现回顾 – 资金流入情况

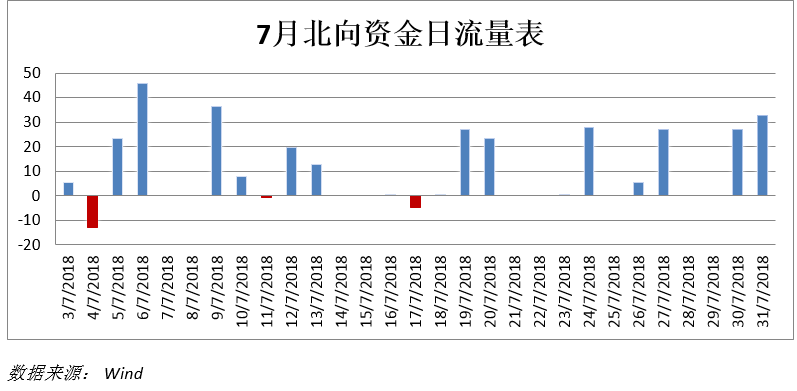

北向资金7月份净流入284.7亿元人民币,与6月份净流入基本持平。综合6月7月的资金流入,对比之前预测的100亿美元(约合人民币689亿)的资本注入仍有较大差距。

细分来看:

从日流量上看,7月份以来,沪股通有3个交易日出现净流出状态,深股通有6个交易日出现净流出状态。综合沪股通与深股通的日流量,该月北向资金仅有三个交易日出现净流出状态。

从个股来看,下表列出了北向资金交易最活跃的前10只股票。其中可以看出,北向资金对包括中国平安(601318),海螺水泥(600585)等7只股票进行了增持。

从增持金额来看,北向资金对中国平安(601318)的增持金额最大,7月买入中国平安(601318)43.6亿元,占7月份总北向资金净流入的15.32%。

10只月交易活跃股票中,北向资金对中国平安(601318),海螺水泥(600585),伊利股份(600887),招商银行(600036),宝钢股份(600019),贵州茅台(600519),上海机场(600009)进行增持,资金净流入超99亿元,占7月资金总流入的34.77%。

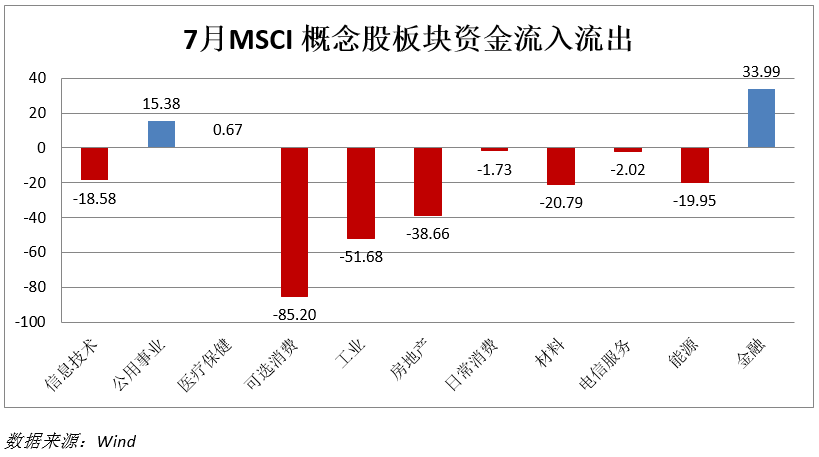

从行业来看,7月份234只MSCI 新兴市场指数标的中国A股对应的11个行业中仅有3个行业保持资金流入,资金流入最多的板块为金融板块,净流入33.9亿元。

综合个股资金流入与板块流入,7月北向资金向属于金融板块的中国平安(601318)净注入43.62亿元,对于该个股注入的资金已经超过板块整体净流入。同月中国平安(601318)资金净流入达15.6亿元,海螺水泥(600585)资金净流入2.7亿元,伊利股份(600887)资金近流入0.1亿元,对比北上资金的净注入,可以看出北向资金已经成为MSCI标的股的主要购买者,对个别股或者板块权重加大。

A股入摩7月份表现回顾 – 指数及行业表现

指数表现:

7月份MSCI 新兴市场指数结束连续5个月的跌势,较6月份上涨1.9%。同期,上证指数7月上涨2.95%,MSCI新兴市场指数中6只高权重中概股中,腾讯(0700)下跌9.8%,阿里巴巴(BABA)微涨0.92%,建设银行(0939)涨3.04%,百度(BIDU)涨1.72%,中国移动(0941)涨1.57%,工商银行(1398)涨4.22%。

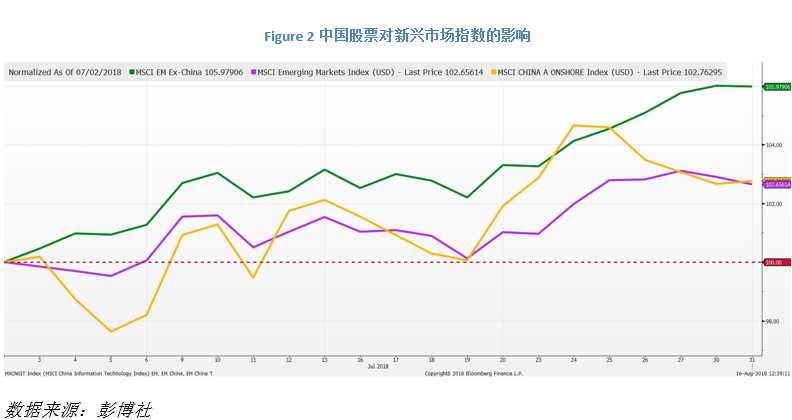

尽管中国A股在MSCI 新兴市场指数中的权重仅为0.4%,但是中概股与红筹股在该指数中的比重总和为30.7%,仅腾讯(0700)与阿里巴巴(BABA)两只股票的权重和已超过8%,为MSCI新兴市场指数中权重最大的前两只股票。

如下图所示,7月份由于占新兴市场指数30.7%权重的中概股表现不佳,对新兴市场指数的上扬有所拖累,影响了大约3%的增幅,(6月份不到1%的影响)。对于跟踪MSCI新兴市场指数的投资者,需要更加关注中概股的行情。有需要的客户可以关注辉立资本新加坡(SGPSPL)获得中概股的最新资讯与研报。

行业表现:

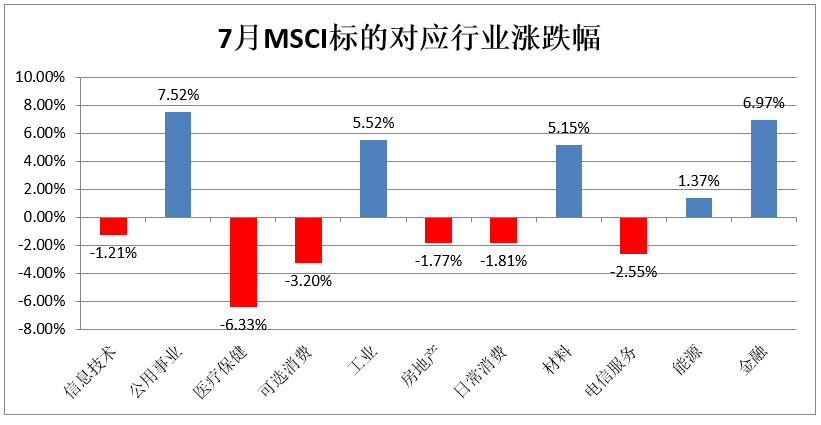

7月份,234支MSCI 标的股对应的11个行业涨跌不一,其中公共事业(代表股:华能国际(600011)),工业(代表股:中国交建(601800)),材料(代表股:海螺水泥(600585)),金融(代表股:中国平安(601318))4个行业的涨幅均超过5%,跑赢同期大盘。

比较北向资金对于该类板块的资金流入,以金融板块和材料板块为例,北向资金7月份向中国平安(601318)注入43亿元,中国平安7月净注入15亿元,涨幅达5.2%,为金融板块贡献大约0.4%(市值加权)的涨幅。

同样是北向资金增持的海螺水泥(600585),七月北向资金向海螺水泥净注入16亿元,海螺水泥7月净注入2.7亿元,涨幅达15.1%,为材料板块贡献2.2%(市值加权)的涨幅。

由此可见,北向资金的注入很大程度上提振了MSCI标的对应行业的股价增长。

展望

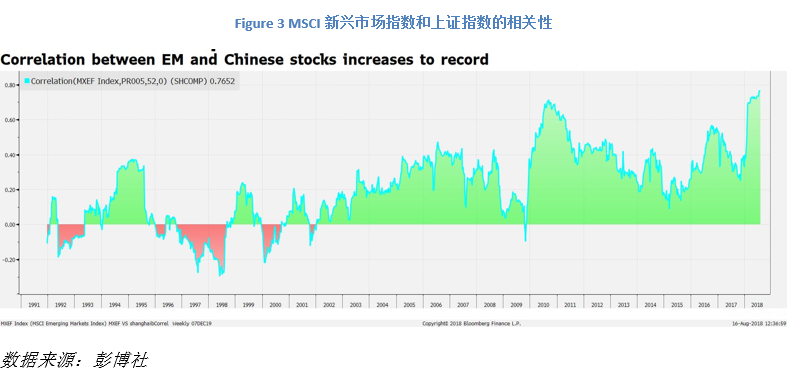

尽管中国A股仅占新兴市场指数权重的0.39%,但是由于中国股市与中概股(美国,香港)的行情有很大的联动性,同时对台湾市场和周边国家产生一定的影响,因此我们可以看出MSCI新兴市场指数和上证指数的相关性越来越高。

中国A股从部分纳入到全面纳入是一个长期过程,不会一蹴而就。对比来看,韩国和中国台湾从初步纳入到最终全面纳入分别经历了 6 年和 9 年。

对此,摩根士丹利资本国际(MSCI)表示,进一步加入将受到中国政府是否放松对其资本市场的管制的影响,包括开放国外投资者进入市场,在交易停牌方面取得持续进展,以及进一步放宽对与指数相关的投资工具的限制等。

而随着中国A股在MSCI新兴市场指数中纳入因子的不断提高,如果将中国A股以100%的纳入因子完全纳入,中国A股的权重将达到18%,以目前追踪MSCI新兴市场指数的基金规模计算,将会有约3000亿美元的资金进入中国内地市场。

目前,全球约有1.9万亿美元资产更总新兴市场指数,其中很多以交易所基金(ETF)的形式来跟踪新兴市场指数。其中,规模最大几只基金的有iShares MSCI Emerging Markets ETF (EEM),UltraShort MSCI Emerging Markets(EEV)。

除此之外,国内外有数支交易所基金追踪MSCI中国A股国际指数(MSCI China A International),相关基金有MSCI 中国ETF,KraneShares Bosera MSCI China A Share ETF等。

辉立证券可以交易全球各地上市的3000多种ETF,同时您可以通过便捷的ETF搜索过滤系统根据费用比率、股息收入和市场表现等进行搜索比较。同时辉立证券会定期举办相关研讨会,有需求的客户可以在辉立证券新加坡(SGPSPL)留言咨询。

关键字:新加坡股票研报,新加坡股,新加坡研报,新加坡账户,交易新加坡股票,新加坡股票开户,免费开户,在线开设新加坡股票开户,新加坡证券,新加坡券商,投资组合