回顾篇:6月A股入摩(MSCI)表现回顾

预告:对话MSCI,A股 入摩一月表现与展望

2018年7月4日,综合MSCI 新兴市场指数纳入中国A股的的背景与入摩一个月的表现,辉立资本新加坡于7月4日(周三)与MSCI 的客户经理 Rajarshi Sen 进行了会面讨论。

会议中,Raj 就8月的第二步纳入计划,纳入因子的扩展,被动与主动基金的大体数目等议题进行了详细得介绍。

由于相关材料和结论仍待MSCI公司的进一步更新,辉立资本新加坡将在获取的最新材料于之后推送中更新本次会议的结果。

展望篇会后续发出

A股入摩(MSCI)背景:

2017年6月20日,MSCI(摩根士丹利资本国际公司)宣布将222支中国A股以5%的纳入因子(index inclusion factor)纳入MSCI 新兴市场指数(MSCI Emerging Market Index),计划称将分两步实施以缓冲沪港通和深港通的每日限额限制。

2018年5月1日,中国证监会宣布将沪港通,深港通每日配额扩大4倍,至520亿元人民币。

2018年5月14日,MSCI发布2018年5月指数回顾结果,宣布在6月1日正式实施第一步纳入计划,将234支股票以2.5%的纳入因子纳入MSCI 新兴市场指数,占总指数的0.39%。第二步纳入计划将在八月的指数回顾中宣布。

A股入摩(MSCI)一月的表现回顾

资金流入情况:

北上资金6月份累计净流入近285亿元。相比5月份净流入的近508亿元,下降将近44%。与之前预测的106亿美元(约合人民币704.43亿)的被动型基金的资本注入有较大差距。

细分来看:

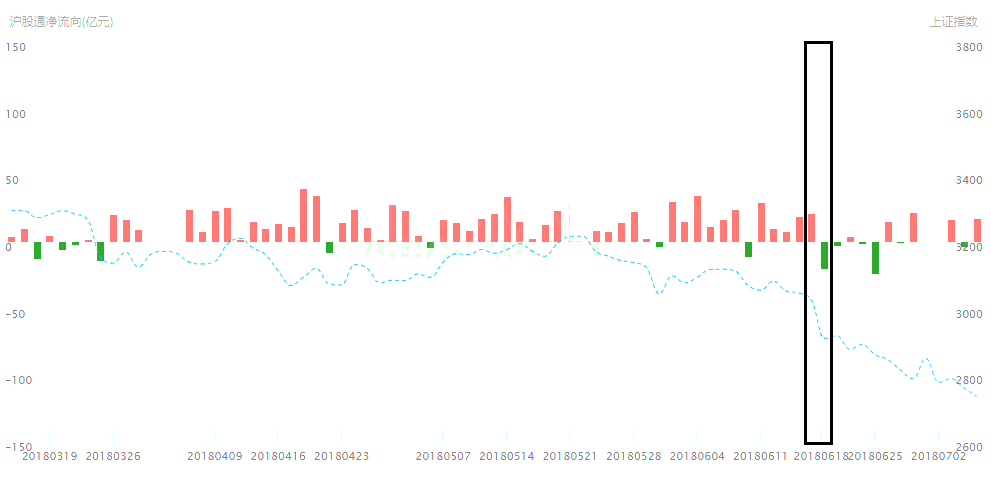

从日流入量来看,6月份以来,沪股通仅有5个交易日出现净流出状态,其他时间均为资金净流入。如图1所示,6月份北上资金的流向情况以6月19日为分水岭。受A股被纳入MSCI提振,从5月至6月中旬,北上资金持续大幅净买入。但由于受到贸易战等国际因素影响,6月19日以来,北上资金净买入额显著减少,并不时出现净卖出与净买入隔日交替的情况。

从个股来看,MSCI成份股依然是北上资金增持的主要方向,从6月以来持股占流通A股比例增减情况来看,北上资金期间对146只成分股进行了增持,约占成分股总数的65%。其中,北上资金对大族激光、完美世界、徐工机械、美的集团等4股持股比例均增加超过1个百分点。

Figure 1沪股通日净流量 – 数据来源:港交所

日交易额度余额:

在2017年6月MSCI发布的2017年度市场分类评审结果中,MSCI表示若沪股通和深股通的每日额度被取消或者大幅提升,MSCI 不排除将A股的纳入修改为一次性实施的计划,即一次性以5%的纳入因子纳入A股。

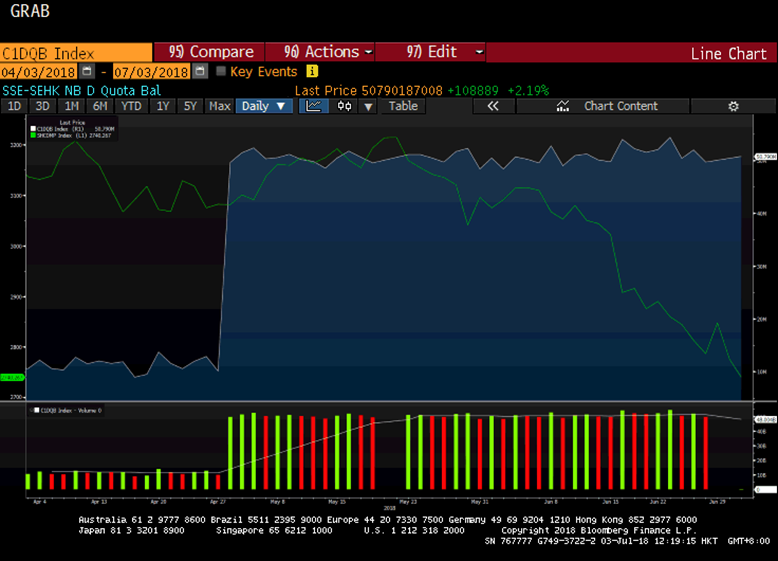

自5月1日扩大单日交易限额之后,五月日平均交易额度余额与六月日平均交易额度余额均在500亿人民币以上。如图2所示,图中白线以及阴影区域代表每日交易额度余额,绿线代表上证指数的变化。由图可知,当前仍有较大的额度空间。

Figure 2 沪股通日额度余额 – 来源:Bloomberg

指数表现:

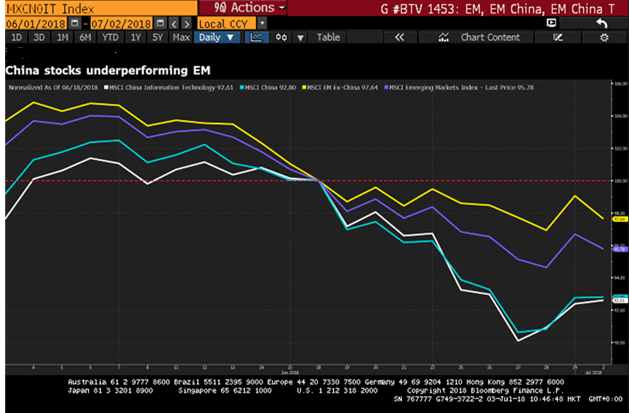

2018年6月,MSCI 新兴市场指数月跌8.7%,对比近三年年的数据,该次跌幅仅次于2015年9月超过15%的跌幅。6月,中国上证指数6月月跌超9%。

细分来看,如图3所示,图中黄线,紫线,蓝线,白线分别代表 MSCI 新兴市场指数(排除中国市场),MSCI新兴市场指数,MSCI 中国指数,MSCI中国科技指数六月以来的表现。由图3可以看出,自6月19日以来,中国股市对MSCI新兴市场指数的表现有所拖累。

Figure 3 MSCI 各指数表现 – 来源:Bloomberg

关键字:新加坡股票研报,新加坡股,新加坡研报,新加坡煤炭 ,新加坡账户,交易新加坡股票,新加坡股票开户,免费开户,在线开设新加坡股票开户,新加坡证券,新加坡券商,投资组合,新能源汽车,补贴新政