研报 | Penguin International Ltd:又一个净现金创纪录的丰收季

推介日期 2019年11月8日

买入 (维持)

收盘价:SGD 0.660 | 预测DIV:SGD 0.0125

目标价:SGD 0.930 | 总回报:42.8%

摘要

盈利和营收双丰收。我们将2019/2020财年末的收益提高约10%。

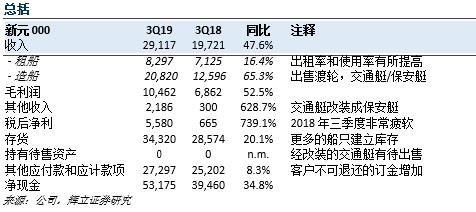

由于去年经历季节性疲软的季度,与去年同期相比,业绩显得有些言过其实。连续四个季度 (或年度) 的盈利增长处于健康水平,为2100万新元。

净现金头寸创下5310万新元的新高,而其它资产负债指标显示,未来一季度将保持健康。

我们将目标价上调至0.93新元 (不包括净现金,5倍市盈率),因为我们将目标价延续至2020财年末的净收益。我们维持买入评级建议。

积极方面

两个业务部门的收入增长。经常性租船收入越发增加,同比增长16%,而造船收入同比激增65%。Penguin 希望建立自己的租赁船队,正如他曾提及的,出租率和使用率正在不断提高。

净现金创下5310万新元的新高。手头的净现金达到5310万新元,为Penguin创下新高。这些现金占市值的1/3,能支持Penguin建立更多的船舶库存。

库存,待售资产和其他应付款,合计同比增长14%至6100万新元。如前所述,没有披露订单纪录。我们使用这三个资产负债项目的组合作为订单纪录状态的一个代表。我们认为,库存同比激增20%,将意味着下一季度的造船收入强劲增长。

消极方面:

待售资产为零。这意味着没有改装的交通艇,即将到来的2019年四季度末,其他收入将会减少。

前景

从资产负债表的状况来看,前景看起来很乐观。库存创纪录新高,出奇地积极。管理层态度保守,当订单有足够的可见性时,才建立库存。库存包括保安艇,交通艇,客轮和近海风电场船员转运船 (Penguin的新类别)。Penguin 两个主要的油气船舶市场是马来西亚和尼日利亚。经过一轮平静后,在两国部署的海上钻井平台数量又回到了四年来的高位。

维持买入评级,上调目标价至0.93新元 (先前目标价为0.61新元)。

Penguin的增长来源有几个:(i) 乘坐海上油气活动复苏的顺风;(ii) 将直升机更换为交通艇;(iii) 渗透到新船舶类型 (即巡逻艇,海上风电场支援船以及消防安全船)。不包括现金,2020财年末,该股的市盈率为3倍。

本文为英文翻译版本,仅供参考,一切请以英文版本为准。如果有想了解更多全球股市资讯,请关注微信公众共 “辉立资本新加坡” (SGPSPL)。同时提供在线免费开设股票账户,一个账户轻松交易美股,港股,新加坡股,中国A股,越南股票,韩国股票,德国股票,马来西亚股票,泰国股票,印尼股票,菲律宾股票,日本股票,澳大利亚股票,台湾股票,加拿大股票,英国股票,法国股票,荷兰股票,葡萄牙股票,比利时股票,土耳其股票