美国大选后焦点(1/2):疫苗带来一线曙光

选举后的动向会是什么呢?

选举后,美国新冠肺炎的病例继续激增。拜登已成立一个特别工作组来负责控制疫情。但这些举措,他只有在明年1月下旬正式上任后才能执行。与此同时,比起控制疫情,特朗普可能更专注于对选举结果产生的争议。由于到那时为止,几乎没有任何措施到位,病例可能会进一步升级。

- 病毒死灰复燃可能令情况更糟糕 – 疫苗成为焦点

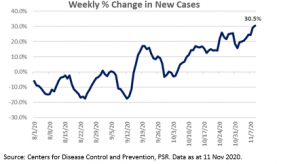

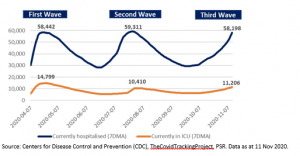

敢问路在何方?每周新增病例的百分比继续呈上升趋势,完全没有遏止的迹象(图1)。这表明病毒的传播不断在加剧。当前的秋季和即将到来的冬季,可能会为传染病的漫延创造了条件,因为人们被寒冷的天气和变短的日照止步于室内。住院和重症患者也已呈现第三波的趋势,并正逐步超过了前两波的严重程度(图2)。

图1:每周新增病例的百分比持续攀升

图2:住院和重症患者的人数正逐步超过前两波疫情的严重程度

美国会否像欧洲一样进行封锁?我们认为,美国不太可能出现全国范围的封锁。短期内,特朗普仍在掌权,他绝对没有心情实施封锁。拜登上台后,他打算授权CDC(美国疾控中心)根据“病毒传播的程度”,指导各州采取限制措施。他倾向于以州为基础实施限制,以最大限度减小对企业造成的经济疼痛。拜登还倾向于向福奇博士寻求建议,而福奇博士支持采取公共卫生措施,而不是实施全国封锁。

在最糟糕的情况下,可能会在几个高风险的州实施限制或有选择性的封锁。目前有12个州处于高风险状态。如果对病毒传播猖獗的州实施封锁,那财政刺激对减缓经济的影响就至关重要了。如果没有财政刺激措施,那么经济的复苏可能会停滞不前,标准普尔500指数的股市可能会回落至更接近3,200点。

一线曙光。到目前为止,对Pfizer(辉瑞)/BioNTech的疫苗问世的乐观情绪已盖过了病毒复苏的阴影。投资者对该疫苗持乐观态度:

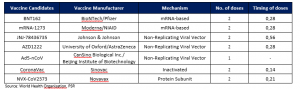

- 可能领先于类似的mRNA(核糖核酸)技术的成功。Pfizer/BioNTech 问世的是一种mRNA疫苗。它的成功可能将反映在Moderna (第三阶段) 和 CureVac (第二阶段)正在开发的其他mRNA疫苗的试验结果中。

- 有效率达到90%。这有效率超过了普通流感疫苗的40-60%,也高于FDA获批标准的50%。虽然收集到更多的患者数据可能会扭曲未来的结果,但90%的有效率确实为满足FDA的标准提供了足够的回旋余地。

- 可以加速进入寻找下一个赢家的竞赛(图3)。其他疫苗企业将面临交付疫苗的压力,以避免“成为输家”以及失去营收的机会。当前美国疫情重现的态势,也凸显了对更多疫苗的需求。这可能会加快疫苗开发的步伐,任何积极的消息流出都可能推动进一步转向价值型股票。

图3:第三阶段试验中选定的候选疫苗

投资者必须坚守长线投资。我们认为,疫苗带来的积极影响可能要到明年的第一季度末或第二季度初才能实现。我们的理据是:

- 有限的生产能力。Pfizer(辉瑞)希望在2020年生产5000万剂疫苗,并在2021年产量达到13亿剂。由于疫苗需要每人接种两剂,到2020年,全球仅有2500万人有可能获得疫苗的接种。制造和分销均需要时间。群体免疫需要70%的人口接种疫苗。我们可能要到2021年中才能实现这一目标。

- 获得保护的时间表。对新冠肺炎的保护在接种疫苗后的28天内开始生效。新冠肺炎的潜伏期平均为5-6天。如果没有适时采取恰当的控制措施,那病毒的传播速度在短期内仍将超过疫苗接种的速度。

- 疗效尚处于早期阶段。将需要更多的时间来收集更多的数据,以便更准确地反映疫苗的安全性和有效性。疫苗的保护期能持续多久目前尚不清楚。Pfizer/BioNTech疫苗在第一阶段的临床试验也显示,对老年人的免疫效果较低。由于目前尚处于早期阶段,还有许多问题有待解决。

建议

在我们看来,投资者最好采取平衡的投资策略。他们可以将部分资金分投到价值型股票,同时保持对科技等成长型股票的敞口。为什么选择价值型股票?随后任何有关疫苗的积极消息,都可能会突显应对新冠肺炎将比预期更快的解决方案,并进一步加强向价值型股票转向。自3月底以来,价值型和成长型股票已从新冠肺炎后出现不同程度的反弹。两者间巨大的差异,可能会让价值型股票在市况“正常化”的状态下,赶上价格表现(图4)。

也就是说,投资者必须做长线投资。疫苗的大规模分销需要一段时间,其积极影响可能要到明年一季度末或二季度初才能体现出来。在此之前,病毒重现和科技股的弹性在这次大流行期间可能会继续获得动力。

从长远来看,价值型和成长型之间的权衡可能不太合理,因为两者仍然是正相关的。基于标准普尔500价值和成长指数,其5年和3年的相关性分别为0.8和0.4。

图4:新冠肺炎以来,成长型和价值型股票开始出现不均衡的复苏

如果有想了解更多全球股市资讯,请关注微信公众号 “辉立资本新加坡” (SGPSPL)。同时提供在线免费开设股票账户,一个账户轻松交易全球股票和ETF

美股,港股,新加坡股,中国A股,越南股票,韩国股票,德国股票,马来西亚股票,泰国股票,印尼股票,菲律宾股票,日本股票,澳大利亚股票,台湾股票,加拿大股票,英国股票,法国股票,荷兰股票,葡萄牙股票,比利时股票,土耳其股票

如果本文是英文翻译版本,一切请以英文为准