新加坡研报 | 全民牙科集团(Q & M Dental Group)

投资概要

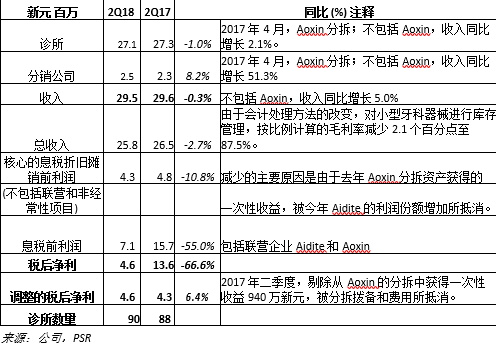

2018上半年的营收/税后净利达到我们全年预期的39.3%/ 49.7% ;二季度的有效税率低于我们的假设。

2018上半年新开3家诊所。下半年将在新加坡新开4家诊所,以及在马来西亚新开3家诊所。

采用股息政策,支付至少30% 的核心营业利润。中期股息下降至每股0.4分 (同比下跌43%)。

升级至买入评级,目标价为新元0.65 (先前是新元0.63),这是基于2018财年每股盈利预测为新元2.3分,以及2018财年末的市盈率为28倍。我们对盈利的预测不变

总括

积极方面

在新加坡和马来西亚正在进行激进的扩张计划。管理层重申他们激进的扩张计划,即到2018财年末,在新加坡和马来西亚新增10家诊所,其中在2018上半年,新加坡正新开3家诊所,并有另外4家即将开业。下半年,马来西亚将新增3家诊所。

新加坡和马来西亚的分销业务实现有机增长。分销收入剔除Aoxin后,同比增长了51%,这主要是由于来自马来西亚分销公司的收入增加。

再融资带来的利息节省。集团于2018年3月19日偿还了4.4%的中期票据,并于2018年1月25日使银行担保工具减少了6000万新元。新银行工具的优惠利率(<4.4%) 将提供每年的利息储蓄。

消极方面

在马来西亚面临一些挑战。年初至今,马来西亚没有新的诊所开业。管理层指导,2018年在马来西亚增设至少10家牙科诊所。然而,由于在下半年签订了3份新的租赁协议,管理层仍需要在下半年新增7家诊所。

前景

我们对新加坡和马来西亚的扩张计划持谨慎乐观的态度。集团在中国的主要收入来源被分拆后,正在加强其在新加坡和马来西亚的区域扩张,以填补这一收入的缺口(从之前的目标,开设5家新诊所,到今年内开设20家新诊所)。在过去的3-4个月里,招募了24名牙医,我们对这个扩张计划保持乐观。

我们不排除集团将通过与其联营企业Aoxin全民牙科集团 (集团目前持股43%),以合资和有机增长的方式向中国华南地区扩张的可能性。Aoxin 全民牙科在中国北部地区有着很强的影响力。

投资行动

升级至买入评级,目标价为新元0.65 (先前为新元0.63)。2018财年末的每股盈利为新元2.3分,包括来自新加坡和马来西亚的目标新增设20家诊所的贡献。我们把市盈率从27.3倍增加至28.3倍,这与同行业(不包括医院)的2018财年末的平均市盈率保持一致。

潜在的重新评级催化剂将是 (i) 成功的盈利增值收购;以及 (ii) 联营企业的业绩优于预期。

关键字:新加坡股票研报,新加坡股,新加坡研报,新加坡账户,交易新加坡股票,新加坡股票开户,免费开户,在线开设新加坡股票开户,新加坡证券,新加坡券商,投资组合