辉立2020年三季度新加坡策略 | 以压倒性的力量回应

回顾:STI在2020年二季度上涨了4.4%,但在2020上半年仍处于亏损状态,下跌了19.6%。我们在二季度输给了美国市场20%的大幅反弹。这场疫情大流行给新加坡经济造成了沉重的打击。预计2020年的GDP将同比收缩4% – 7%,这是有纪录以来最严重的收缩。与以往的衰退不同,政策性衰退是必要遏制措施的副产品。我们实施了严格的封锁 (熔断机制) 以遏制疫情大流行的蔓延。而且它已经奏效了。在实施熔断机制之前,平均每天有60个社区病例 – 而这个数字已减少到只有6例。我们的经济将迎来复苏。封锁正在缓解,新加坡政府已通过四个预算拨款929亿新元,来抗击新冠病毒。我们的经济对这场疫情大流行的回应,将是2020财年实施15.4%的财政赤字(743亿新元)。根据IMF(国际货币基金组织)的数据显示,按百分比计算,这一赤字将是亚洲各国政府中最大的赤字支出,也是全球第二大的赤字支出。

展望:我们认为,当前的经济正逐步复苏,加上高度刺激的货币宽松政策,对股市来说近乎完美。基本上有三大理由让我们对股市持乐观态度。

- 在货币支持方面,我们可以引用美联储主席鲍威尔的话说,我们“甚至没有考虑过加息”。为了强化宽松货币的立场,FOMC(联邦公开市场委员会)的点阵图显示,利率在2022年底之前将保持在接近零的水平。为了保持低利率,我们正无休止地实施量化宽松 (QE)。目前QE的规模比过去三次QE的总和还要大。大约70%的新国债发行是由美联储以“直升机式”的撒钱资助。美联储也在抢购公司债券。其目的是将更多的流动性注入风险更高的资产。这项刺激措施已将10年期美国公债的收益率压缩至0.64%,而新加坡的公债收益率为0.9%。实际上,我们发现,政府债券除了可以对冲市场崩盘之外,已没有任何内在价值了。

- 在政府支持方面,IMF预测,全球将有11万亿美元的财政措施用于抗击COVID-19(新冠肺炎)。全球财政赤字预计将达到GDP的13.9%。这几乎是全球金融危机期间7.2%的两倍。

- 复苏的轨迹和速度尚不明朗。它将追踪大流行而定。更关键的是,在我们看来,一个底部已经形成。卫生保健当局保持高度警惕和更明智的社会行为,应能防止更严峻的第二波疫情。此外,全球都在竞相研制疫苗。我们每天都在慢慢接近。目前有140多种疫苗处于不同的开发阶段,其中3种处于第三阶段 – 即获得批准前的阶段。

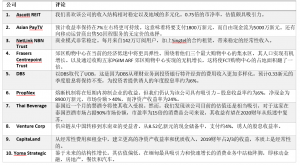

建议:我们的策略是买入那些股息收益率可持续的股票。这样的资产在未来将变得更加稀缺,甚至更有价值。预计在中期内,全球利率将徘徊在历史低位。收益率可持续的行业是REITs和银行。在短期内,大多数REITs将受到这场疫情大流行的不同程度的打击。值得肯定的是,估值将更便宜,利息支出更低,和有限的供应。我们已移除Starhub,并以Yoma Strategic取而代之。在未来12个月内,航空旅行的蒸发将损害移动漫游收入。Yoma相对于公允价值的大幅折扣,和高增长的消费业务,使其颇具吸引力。我们还用Asian Pay TV取代了昇崧 – 凭借其出色的价格表现。这是一个颇具争议的决定。在过去三年里,股息已被削减。但准确地说,我们认为他们最终以每年1800万新元的可持续速度增长,而FCF为5000万新元,提供7%的收益率。DBS凭借其优越的季度股息收益率将取代UOB。另外,新加坡的投票日已定在7月10日。过去的选举对新加坡市场的影响有限,除非发生黑天鹅事件。

2020年二季度,我们的辉立绝对回报10大选股优于STI的表现。这是对18.1%的损失的一个适度安慰。我们对2020年三季度所做的更改包括:

4Q19 – 添加:DBS, APAC Realty; 删除:China Sunsine, Keppel DC REIT

3Q20 – 添加:Yoma Strategic, Asian PayTV, DBS; 删除:Starhub, Sheng Siong, UOB

如果有想了解更多全球股市资讯,请关注微信公众号 “辉立资本新加坡” (SGPSPL)。同时提供在线免费开设股票账户,一个账户轻松交易全球股票和ETF

美股,港股,新加坡股,中国A股,越南股票,韩国股票,德国股票,马来西亚股票,泰国股票,印尼股票,菲律宾股票,日本股票,澳大利亚股票,台湾股票,加拿大股票,英国股票,法国股票,荷兰股票,葡萄牙股票,比利时股票,土耳其股票

如果本文是英文翻译版本,一切请以英文为准