研报 | 博纳房地产公司(PropNex Ltd): 盈利几乎增长了3倍,但前景黯淡

-

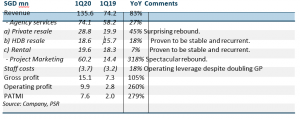

- 2020年一季度的税后净利同比跳增近3倍,至760万新元。其增长超出了我们的预期。这一增长来自项目营销(即新项目发售)实现3倍的收入激增。

- 今年的前景将是疲软的。熔断机制,经济状况疲软和项目定价较高,将导致交易量收缩。我们将2020财年末的收益削减了19%。收益影响仅将记入2020下半年。

- 2020年一季度,净现金继续累积达到8980万新元 (同比增长1000万新元),几乎占市值的50%。

- 我们维持买入建议。目标价下调至60新元 (先前目标价为0.70新元)。疫情降低了我们对该公司的任何增长预期。PropNex(博纳)保持着50%左右的健康市场份额,我们预计股息 (每年1300万新元) 可通过8980万新元的大量现金储备来维持。

业绩一揽表

积极方面

+ 现金继续累积。连同收益的增长,来自运营的现金在2020年一季度增加了870万新元。一季度的资本支出不到10万新元。资产负债表上的净现金增长达到创纪录的8980万新元。+ 巨大的经营杠杆。本季度,该业务的经营杠杆是显而易见的。毛利润同比增长了两倍,达到1500万新元,而员工成本仅增加了56万新元 (或同比增长17.8%)。这一成本的增加是由于加薪和额外增加一名员工,员工总人数达到175名。

消极方面

前景

管理层分享了他们对2020财年交易的展望。简而言之,这一估计糟透了:

a. 新项目发售:2020年一季度,行业成交量同比增长17%,至2149个单元。这将对二季度的收益起到支撑作用。然而,2020财年的行业交易量可能会下降约20%,至7900*个单元。这些水平甚至比2018年7月之后的12个月的交易量还要糟糕。

b. 私人转售:2020年一季度的成交量同比增长12%,至2080个单元。二手市场受到的冲击将比新发售的还要严重。在没有实地考察这些单元的情况下,如果它们出现问题,买家将面临更高的风险。转售单元与新发售单元不同,新发售的开发商信誉良好,并且通常有一年的缺陷责任。预期成交量至少将下降32%,至6100*个单元。

c. HDB(政府组屋)转售:2020年一季度,成交量同比增长22%,达到5893个单元,为9年以来的最高水平 (3月份的季度)。熔断机制将导致近期的购买有些推迟,并且,2020财年的整体交易量可能将下降10%至21,500个单元。我们预计这些交易将是需求驱动的房产购买。

*PropNex 估计,私人转售和新项目合并后的销售量降幅达到27%,从2019年的19,150个单元降至2020年的14,000个单元。

COVID-19熔断机制的影响范围包括暂停房产的参观和营销路演,暂时关闭项目销售展厅,以及推迟新项目的启动。

维持买入评级,并下调目标价至0.60新元 (先前目标价为0.70新元)

我们将2020财年末的收益降低了14.1%,因为我们考虑到提供的租金回扣带来的收入下降,以及酒店收入的疲软。我们的目标价,是基于RNAV 20%的折让,以及在纳入对REITs较低的修订估值后,目标价从4.20新元降至3.94新元,削减幅度达到6.2%。