新加坡研报 | 新加坡房地产信托基金 (REITs)

2018年首次加息以及对新加坡地产信托基金(REITs)的影响

正如市场普遍预期的那样,美联储上周将利率提升了25个基点,至1.75%,同时维持对2018年加息三次的预测。 尽管美联储上调了对经济的展望,但预计2018年的短期通胀仍将保持温和,核心通胀和整体通胀预期均为1.9%。

这一消息在很大程度上摆脱了其对房地产信托基金的影响,富时新加坡房产指数在加息后的第二天下跌了0.2%。尽管如此,自今年年初以来,新加坡房产信托基金行业似乎正在从宏观方面考虑一些不利因素,其中FTSREI由年初至今下跌了5.4%,而STI’s 上升了0.1%。面对即将到来的加息中,我们强调投资者在这个关键时候可能会遇到一些问题。

美联储在2018年刚实行的首次加息,并预期在2018年将有额外两次加息。这对新加坡房产行业会有什么影响呢?

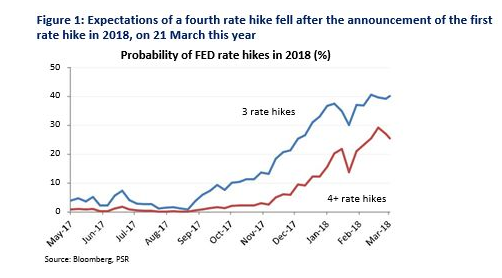

根据美联储早期的指引,加息是市场普遍预期的。事实上,在加息之后,市场对今年将有四次加息或更多加息的预期实际上是有所下降。这可能是由于美联储主席鲍威尔的言论再次肯定了加息是渐进式的,而当前特朗普政府的贸易政策可能会让企业感到担忧。

值得注意的是,尽管将经济增长预测从2.5%提高至2.7%,并降低了失业率的预测,但2018年和2019年的整体通胀预期仍分别维持在1.9%和2%不变。

根据美联储最新的评估,如果这一评估得以奏效,加强经济增长和温和的通胀,它将继续为新加坡房产提供宽松的环境,这将使美联储能够保持渐进的加息步伐。

从这些加息中对新加坡房产的每单位信托支付的红利(DPU)有什么影响?

云计算对于众多科技公司是一个巨大的福音。预计2018 年全球公共云服务行业收入将从2017 年的2,602 亿美元增至

3,058 亿美元。

平均而言,我们注意到,由于预期利息成本上升,在各行各业中,80%的新加坡房产信托基金,至少有70%的债务以固定利率进行套期保值。这有助于减轻利率上升对2018年末DPU的影响。

对于 我们覆盖的房产信托基金的范围来看,我们预计在当前利率对冲的情况下,目前的融资成本将增加100个基点,DPU将受到1-3%的负面影响。

假设为零对冲的情况下,DPU可能受到8-12% 的负面影响。

新加坡房产信托基金行业的前景

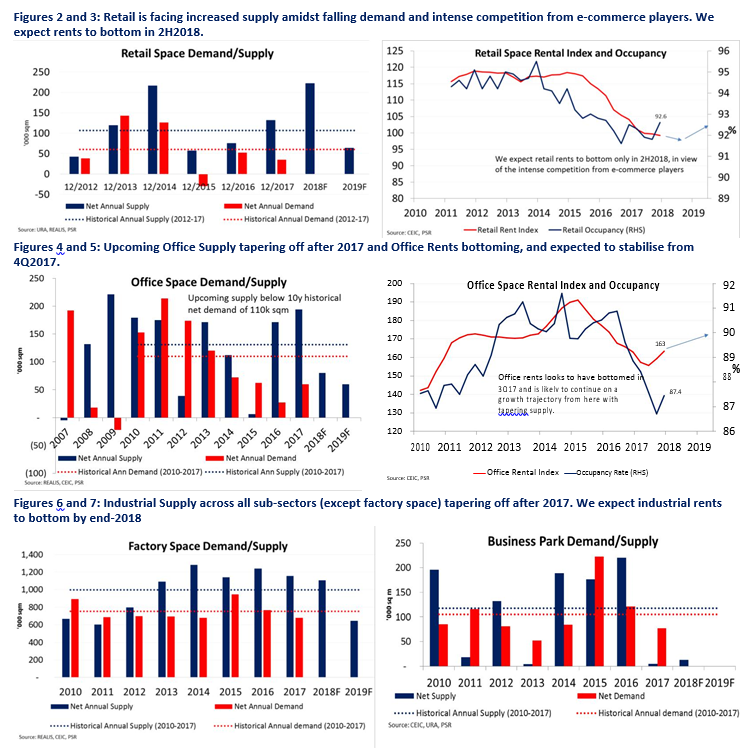

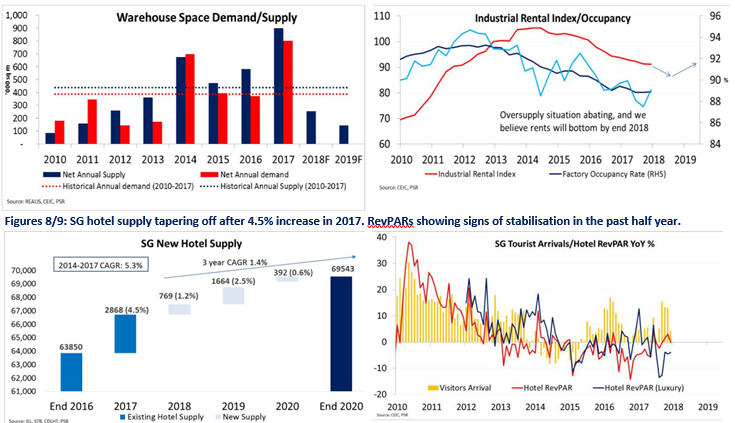

除零售业外,所有的其他行业 – 写字楼,工业和酒店业 – 在经历了2017年的供应高峰后,总体上都面临着供应减少的积极局面。

2018年供应的缓和应为租金开始攀升奠定了基础。这应该会减轻我们对零售,工业和写字楼等行业租金负回报的影响。

其他一管变化将如何影响新加坡房信托基金

在新加坡上市的REIT交易所交易基金 (简称ETFs) 将不再受限于就特定收入分配给单位持有者征收17%的公司税。

预计将于2018年7月1日或之前颁布,这一变化甚至将使个别的新加坡房产基金和新加坡房产交易所交易基金之间的税收待遇趋向平等。

需求将不可避免地流向在新加坡上市的三家新加坡上市交易所买卖基金,以及相应的,也流入整个新加坡上市房产信托交易所买卖基金的房产基金部分。目前,这三家房产信托交易所买卖基金的总市值为2.6471亿新元,而整个新加坡房产信托基金市场的市值为809亿新元。

新加坡房产信托基金目前的状况

三家新加坡上市交易所交易基金是:

1. Lion-Phillip S-REIT ETF

2. Nikko AM Asia Ex Japan REIT ETF

3. Phillip SGX APAC Dividend Leaders REIT ETF

目前进入新加坡房产信托基金的主要风险

宏观经济因素 – 尤其是美国加息 – 仍然是未来关注新加坡房产信托基金的首要风险。美联储资产负债表的缩减可能会给收益率带来上行压力。

尽管预计2018年将有三次加息,但在2018年3月21日鲍威尔首次在公开市场委员会的发言中,措辞微妙的暗示了第四次加息的可能性。

然而,如果加息是为了应对经济状况的改善,这并不一定意味着厄运和悲观。加息是负面影响,但并不一定意味着价格会下降。

关键字:新加坡股票研报,研报,REITs,房地产信托基金,EFT,新加坡股票开户,免费开户,在线开设新加坡股票开户,新加坡证券,新加坡券商,新加坡上市交易所交易基金