新加坡股票研报 | 腾飞房产投资信托(Ascendas REIT)

总收入和DPU与我们的预测相符

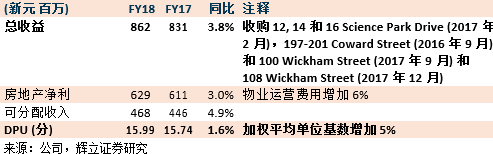

2017/18财年下半年的DPU为7.880分,相比2016/17财年下半年的DPU则为 7.845 分/17 (同比增长0.45% )

投资组合在估值,入住率和总杠杆率方面保持稳定

维持增持评级;上调目标价至新元2.91 (先前是新元2.89)

积极方面

投资组合价值保持稳定,资本化率略有收紧。同店126套物业的估值稳定在98.4亿新元,而一年前为97.5亿新元。(总资产额达103.5亿新元。) 投资组合资本化率从6.29% 小幅压缩至6.24%。这是由于新加坡投资组合的加权平均资本化率收窄5个基点,以及澳洲投资组合收紧10个基点所致。

入住率保持稳定,净租金正面回暖。总投资组合占比环比从91.1%上升至91.5%。新加坡和澳洲投资组合的占比均表现出同样的稳定性。总投资组合在2017/18财年实现增长0.7% 的租金回归,但是在2017/18财年四季度的租金回归为-6.8%。

健康的资产负债表总杠杆率为34.4%。总杠杆率从35.2%起略低于环比。充足的债务上限约为10亿新元(杠杆率为40%),有可能使资产规模增长约10%。平均债务期限从2.8年提高到3.2年。债务到期情况是交错的,在任何一年中,债务到期总额不得超过20%。

前景

前景稳定。投资组合足够多样化,可以缓冲任何短期的局部影响。今年,基金经理指导一个疲软的租赁市场,但从Business Park 和Hi-Specs properties 中可能获得正面的租金回归。供应过剩将继续给物流资产带来压力。

基金经理还分享了它的收购/增长策略。新加坡仍将是该投资组合的主要市场,海外资产占比为30%-40%。除了在澳洲现有的海外市场(特别是东部沿海地区)寻找机会外,基金经理还在积极地寻找其他的新市场。经理青睐欧洲和美国,因为他们的风险状况与REIT已经涉足的风险类似。进入新市场将以平台为基础,其关键标准是可扩展性和能使REIT从长期中获益。

投资活动

维持增持评级;上调目标价至新元2.91 (先前是新元2.89)

我们的预测基本上没有变化。我们预计收益率将稳定在6%左右,我们的目标价隐含着2018/19财年末的远期多重资产净值为1.37倍。

关键字:新加坡股票研报,新加坡股,新加坡研报,新加坡账户,交易新加坡股票,新加坡股票开户,免费开户,在线开设新加坡股票开户,新加坡证券,新加坡券商,投资组合,新加坡证券交易所(SGX),腾飞房产投资信托(Ascendas REIT)