新加坡股票研报 | 凯德商用中国信托(CapitaLand Retail China Trust)

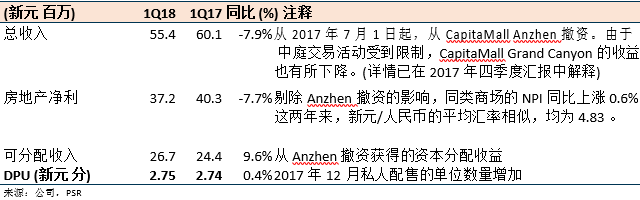

NPI 和DPU 在我们的预期范围内。

零售销售改善,同比增长2.1% ,而2017财年的增长为0.8%。

从 CapitaMall Anzhen 的撤资中收益,获得300万新元的资本分配,以增加可分配收入。

018年没有再融资需求。

升级至增持评级,根据股利贴现模型-衍生目标价不变,仍为新元1.66

积极方面

从CapitaMall Anzhen 撤资中收益,获得300万新元的资本分配,以增加可分配收入。这符合我们对管理层的期望,以弥补撤资所带来的收入损失。从Anzhen撤资(2017年7月) 获得的净收益为3200万新元。我们估计,从Anzhen撤资所带来的净利润损失每季度将达到340万新元左右,并预计管理层将继续利用撤资收益来弥补收入的损失。

2018年没有再融资需求。将于2019年到期的4亿新元贷款 (占总贷款额的40%) 的早期再融资正在进行中。以固定利率进行对冲的债务,占总债务的80%。这将减轻未来两年从利率波动中所带来的影响。

消极方面

苦苦经营的商场仍没有任何改善的迹象。整体投资组合的入住率略降至94.9%。虽然较大型的购物商场保持稳定,但处于稳定状态的商场经营仍是步履维艰。尽管如此,这些商场仅占投资组合商场估值的5%。

前景

DPU 前景稳定。从Wangjing AEI 和Rock Square 获得正租金回归,将继续支持盈利。今年没有到期的债务,将减轻利率波动的影响。

投资活动

升级至增持评级,目标价不变,仍为新元1.66 。

我们的预测和目标价保持不变。升级是在近期的利率担忧,导致价格疲软之后进行的。我们的预测假定,同比的新元/人民币汇率是持平的。管理层通过Wangjing AEI 表现出主动积极的商场管理 (投资回报率超过30%) 以及成功提高Xinnan 成本收益,从收购时的5.4%,提升至目前估计的6.3%,这是最初的目标。

关键字:新加坡股票研报,新加坡股,新加坡研报,新加坡账户,交易新加坡股票,新加坡股票开户,免费开户,在线开设新加坡股票开户,新加坡证券,新加坡券商,投资组合,新加坡证券交易所(SGX),CapitaLand Mall Trust, 凯德商务产业信托(CapitaLand Commercial Trust)