新加坡股研报 | 吉宝数据中心(Keppel DC REIT)

投资概要

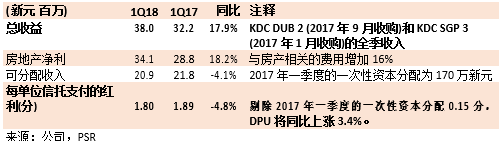

由于净税和调整,总收入比我们预期的高出4.8%,DPU比我们预期的下降10.4%。

与2018财年的预测一致,总收入和DPU分别达到25%和23%。

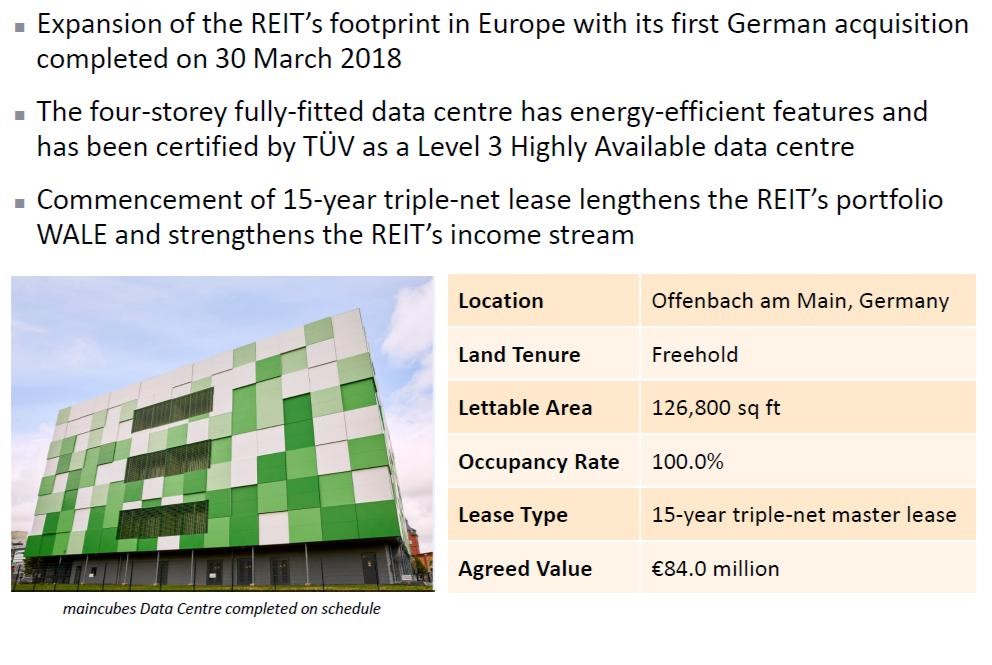

3月30日,德国maincubes 数据中心的收购已完成,将投资组合的环比由15.1亿新元增长至16.6亿新元。

维持中性评级;目标价不变,仍为1.47新元。

积极方面

投资组合WALE 仍然长达9.6年。由于受到3月30日收购maincubes数据中心的影响,投资组合加权平均租赁期(WALE) 环比从原来的9.1年有所增长。Maincubes 数据中心是一个为期15年的三重净租赁。

投资组合的占比由92.6%稍微提高至93.7%,主要原因是纳入了maincubes数据中心。在吉宝数据中心Dublin 1 (KDC DUB 1) 和Dublin 2 (KDC DUB 2) 的入住率也略高一些。KDC DUB 2 目前的入住率为90.7%,经理人报告说,其中一个租户已承诺会把剩下的空间也承租下来。相关的承租事宜正在洽谈中,而KDC DUB 2 应可在2018年下半年全部租出去。

实际上,没有更多的债务在2018年到期。截至2018年一季度的短期贷款9310万新元实质上已再融资至2023年,并在2018年二季度期间,尚有少量余额需要偿还。

消极方面

Basis Bay 数据中心 (63.1%) 和KDC DUB 1 (57.2%)的入住率仍然是一个拖累。经理人反馈,Basis Bay 的困难在于找到想要租赁这个空间的合适租户。经理人更看好KDC DUB 1。在KDC DUB 1的AEI为提高供电效率的工程才刚刚开始,这将花费18个月的时间,耗资2000万新元才能完成。

当AEI的工程即将完成的时候,经理人预期看到空间将被承租。就上下文而言,Basis Bay 数据中心和KDC DUB 1 分别占投资组合NLA的4.6%和6.5%。

杠杆率环比从32.1% 提高至37.4%。这是由于为支付maincubes数据中心90%的余额而提供的贷款。

前景

前景稳定。长达9.6年的WALE提供了收入的可见性,而续约风险是可控的,在2018年和2019年需要续约的租赁区域分别仅有1.8%和1.9%。最近在德国收购的maincubes 数据中心将从4月1日起,将带来积极的作用。目前的资产管理规模为16.6亿新元,基金经理重申今年的目标是将其规模增至20亿新元。长期目标杠杆率为30%的策略维持不变。

维持中性评级;目标价不变,仍为1.47新元。

我们喜欢股票的增长故事,但认为该估值似乎很丰厚,其隐含的2018财年末的市净率为1.44倍。

在2018年3月30日完成了对maincubes 数据中心的收购。

2015年支付了10%的定金

该房产以8400万欧元(约为1.3亿新元)收购。2015年支付了10%的定金,余下90%的余额将在收购完成时支付。

收购完成的时间比预期要早

我们此前曾假定收购将于2018年第二季度末完成,取而代之的是,该收购已于2018年一季度末完成,并且将从2018年二季度开始贡献全季的收入。我们已相应地调整了收入的假设。

收购完成后,剩余的90%全部用债务支付,而不是债务-股权组合。

该房产剩余的90%余额是通过债务获得的,从而使收购收益增加。此前,我们曾假设了一个股权融资(EFR) 与余额支付相结合的组合。我们在这次收购中假设了30-70 的债务股权资本结构。30% 是经理反复强调的长期杠杆的目标。

我们的目标价大致保持不变,尽管目前没有稀释EFR

目前的杠杆率为37.4%,股权融资是不可避免的,因为该策略是到2018年底,将资产管理规模增长至20亿新元。今年年底,我们将考虑实现9100万新元的股权融资(占1.3亿新元收购价的70%),以实现30%的长期杠杆率目标。

前景。

与澳洲证券交易所(ASX)-上市同业的亚太数据中心相比,KDCREIT 尾随市净率的估值过高。KDCREIT 交易的收益率也有所收窄。

关键字:新加坡股票研报,新加坡股,新加坡研报,吉宝数据中心(Keppel DC REIT),新加坡账户,交易新加坡股票,新加坡股票开户,免费开户,在线开设新加坡股票开户,新加坡证券,新加坡券商,投资组合,Basis Bay 数据中心,maincubes 数据中心,澳洲证券交易所(ASX)