新加坡股票研报 | 莱佛士医疗集团有限公司

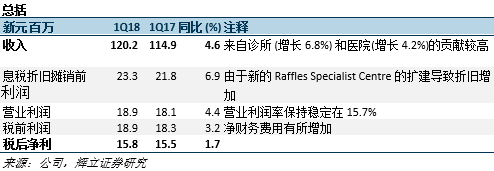

2018年一季度的收入/税后净利达到23.5%/23.1% ,符合我们全年的预期。

2018年一季度,私人医疗保健服务的需求上涨,表现强劲。

新加坡和中国方面的新产能,在满足日益增长的地区医疗服务方面的需求。

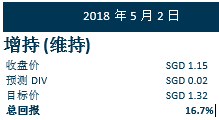

维持增持评级,目标价不变,仍为新元1.32

积极方面

受到本地患者负荷增加的驱动,医疗保健服务恢复。2018年一季度,医疗保健服务(诊所)扭亏为盈,同比强劲增长6.8%,此前2017年一季度和2017财年增长分别收缩至 -2.0% 和 -1.6%。公私合作伙伴关系,即PCN计划(初级保健网络) 和与MOH (卫生部) 签订的航空边界筛选合同,为这一提升提供了支持。

随着RafflesSpecialistCentre 的产能扩张,医院服务的发展势头增强。新成立的RafflesSpecialistCentre 从2018年1月22日开始运营。该部门同比增长4.2%,而2017年一季度的增长为 -1.9%。值得称赞的是,管理层表示,尽管医疗旅游持续受阻,特别是新元的走势强劲,但2018年一季度外国患者的负荷同比增长了2%。

随着15个专科中心搬迁和扩张至新的RafflesSpecialistCentre,莱佛士医院目前正在进行整修。到2018年三季度,集团将扩张床位和门诊部初级护理中心的容量,以满足不断增长的本地和外国患者需求。

消极方面

营业利润率可能仍将面临压力。为莱佛士医院重庆地区的医务人员和管理人员的招聘活动已经展开。随着莱佛士医院重庆和上海地区计划分别于2018年四季度和2019年四季度开业,2018年三季度和2019年三季度可能将出现更大的利润挤压。

当RafflesSpecialistCentre,MCH (MC Holdings)和在中国的两家新医院的患者数量增加时,我们预计在未来几年,员工成本将维持占集团收入的50%以上。

前景

尽管来自两家新的中国医院产生的人力成本和启动成本增加,带来中期利润压力,但集团的前景仍然乐观。

2018财年末,公共服务外包可为医疗保健服务再增加5%。这些举措可以扩大潜在患者群体,并提高现有设施的利用率 (即提高生产率和效率)。

为长期利益忍受短期的阵痛。管理层预计,每家新医院将在三年后公布营业利润,在2018财年至2021财年期间,预计运营启动的损失分别为250万新元,1125万新元,1250万新元和375万新元。集团每年产生的息税折旧摊销前利润为1亿新元。

剩余的资本支出为2.8亿新元,将在18-19财年分摊。我们预计,集团将以人民币计价的债务,为这两家中国医院提供部分资金。 管理层指导将资本负债率控制在50%,这意味着贷款还有很大的上升空间,因为截至2018年一季度末的负债比率为9.5%。

投资活动

维持增持评级,目标价不变,仍为新元1.32

我们对这些新医院将为集团带来的潜在增长保持乐观:(i) 多元化,海外业务做出更大的贡献;以及 (ii) 利用中国的增长。

潜在的重新评级催化剂:(i) 来自卫生部合作的强劲需求;以及 (ii) 中国医院的表现优于预期。

关键字:新加坡股票研报,新加坡股,新加坡研报,新加坡账户,交易新加坡股票,新加坡股票开户,免费开户,在线开设新加坡股票开户,新加坡证券,新加坡券商,投资组合,新加坡证券交易所(SGX),莱佛士医疗,Raffles Medical Group