新加坡股研报 | 星展集团控股有限公司(DBS)

2018年一季度的税后净利符合预期 (剔除了8600万新元的处置收益)

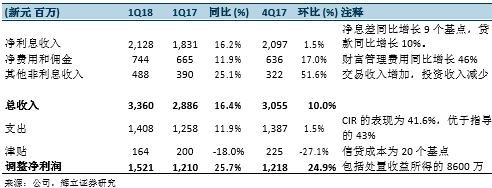

表现突出的是集团的净息差收入,财富管理和香港业务。

净利息收入的增长势头为盈利提供了可持续性和可见性。剔除处置收益后,净资产收益率为12.5%。

我们上调目标价至新元32.70 (先前目标价为新元29.30)。由于股价的表现,我们已将评级下调至增持级别。

积极方面

资产质量良好。2018年一季度新形成的不良资产为1.95亿新元。这是四年来的最低位。对于新的不良资产来说,没有任何有意义的具体规定。本季度的信贷成本为20个基点,而不是如指导的25-30个基点。

消极方面

只有投资收入没有达标。投资证券的收入往往每季度会产生1亿新元的收益。在2018年一季度,这收入降至2200万新元。部分原因是由于只对债务证券进行了重新分类。我们认为另一个原因是,债券市场整体表现疲弱。在另一个其他非利息收入类别的疲软中上升,净交易收入反弹至3.68亿新元 (2017年一季度为:2.7亿新元)。

在更高的利率下,可能出现的情况。目前还不是一个令人担忧的问题,但利率上升会给借款人带来压力。中小企业和消费者贷款将是最脆弱的,这取决于利率上升的速度。星展银行确实强调了,抵押贷款人是以3.5%的利率假设进行评估的。此外,从历史上看,住宅贷款的资产质量在利率上升时,受到的影响是有限的。住宅贷款资产质量更显著的驱动因素是就业。

新加坡的拨备仍然很棘手。虽然集团的拨备低于我们的预测,但新加坡要求的拨备为1.25亿新元,略低于2017年一季度拨备的1.4亿新元。我们假设星展银行在新的SFRS (I) 9 法则下,采取了更为激进的第二阶段的准备金拨备。第二阶段要求对贷款剩余期限的信用损失进行确认。

前景

2018年的增长有多种驱动因素。首先,由于SIBOR,SOR 和HIBOR的上升而导致利润率的扩张。其次,随着整体经济的改善,交易量增长。香港贷款的增长一直很好,同时新加坡住宅贷款将受到交易量激增的支撑。第三,资产质量良好,我们预计大约有10亿新元的拨备出现逆转。第四,随着星展银行建立更强大的特许经营权和平台,财富管理业务正在享受结构性的增长。

投资活动

我们上调目标价至新元32.70 (先前目标价为新元29.30)。

由于股价的表现,我们已将评级下调至增持级别。我们的目标是在较高的永久增长率以及对净资产收益率适度上调的基础上提出的。

关键字:新加坡股票研报,新加坡股,新加坡研报,新加坡账户,交易新加坡股票,新加坡股票开户,免费开户,在线开设新加坡股票开户,新加坡证券,新加坡券商,投资组合,新加坡证券交易所(SGX),DBS, 星展集团控股有限公司