新加坡股票研报 | 新加坡胜科工业集团

2018年一季度的收入符合我们的预期,而净利润却大幅下滑,主要原因是来自海事业务的业绩不佳。

新加坡公用事业的运营持平,正面临着利润的压缩。

印度公用事业的业绩受到SGPL和SGIL的负面影响,因为在2018年一季度,在SGPL和SGIL中,大多数或是短期的能源采购协议都是在低关税下以及低风期下签订的。

海事业务继续削弱集团的盈利能力。

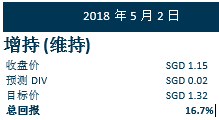

由于SMM长期以来的盈利能力较弱,我们将2018财年末的每股盈利从之前的新元19.8分下调至新元18.9分。在将SMM的综合目标价下调至新元1.85后,基于以各部门汇总的方法计算,我们升级建议至买入评级,下调目标价至新元3.83 (先前目标价为新元3.86) ,这是因为最后收盘价的预期回报率较高所致。

积极方面

新加坡公用事业的运营持平。2018年一季度,新加坡的净利润达到新元3520万 (同比增长 3% )。由于高硫燃料油(HSFO)的价格上涨和竞争环境,新加坡业务继续面临利润率的压缩。目前,零售利润率高于批发利润率,管理层预计,在可预见的未来,两者间的差距将会缩小。

中国的公用事业业务受益于季节性因素。2018年一季度,中国的净利润同比大幅增长48%至新元3270万,这是由于位于中国重庆的Anwen电厂,坑口的燃煤电厂延长了服务时间。这是由于冬季异常寒冷的天气造成的。

消极方面

印度公用事业的业绩受到SGPL和SGIL的负面影响。2018年一季度,印度的净亏损同比适度下降了6%至新元1560万。 SGPL 和SGIL 公布的亏损分别为2450万新元和650万新元,这主要是由于SGPL项下的工厂临时关闭两周,以及SGIL正处于低风期。根据短期能源采购协议 (PPA) ,60%的产能将于5月和6月到期,其余的合约持续至2018年9月到期。目前还没有签订中期和长期的协议。因此,那些将被削减的合约预计将以短期PPA来签订。然而,当前的即期和短期的关税大幅提高;在2018年4月,每月的平均价格为4.15卢布/千瓦时 (同比上涨53%)。普遍的短期PPAs (6个月) 的报价范围从4卢布/千瓦时到7卢布/千瓦时。

海事业务继续削弱集团的盈利能力。在2018年1月,SMM 采用了新加坡财务报告准则 (国际) 15 (SFRS 15)。剔除采用SFRS 15的影响,营收同比仅增长了15%,而公布的净亏损为3300万新元。净订单量继续下滑 (2018年一季度为:77亿新元,对比2017财年 (重新计算后):84亿新元)。

前景

对于公用事业部门来说,管理层预计印度的整体运营以年度为基础将实现盈利,其中超过70%的产能是在更高价值的PPA下签订的,管理层旨在确保包括短期和中期的合约。此外,对于中国和印度在季节性因素上的积极和消极方面的影响,预计将以一整年为基础得到缓和。另一方面,尽管原油价格持续上涨,而上游勘探和生产方面的资本支出也在逐步改善,但由于供应过剩,市场将需要再多几个季度才能复苏。因此,集团在未来几个季度,将继续受到SMM业务的拖累。

投资活动

由于SMM长期以来的盈利能力较弱,我们将2018财年末的每股盈利从之前的新元19.8分下调至新元18.9分。在将SMM的综合目标价下调至新元1.85后,基于以各部门汇总的方法计算,我们升级建议至买入评级,下调目标价至新元3.83 (先前目标价为新元3.86) ,这是因为最后收盘价的预期回报率较高所致。

关键字:新加坡股票研报,新加坡股,新加坡研报,新加坡账户,交易新加坡股票,新加坡股票开户,免费开户,在线开设新加坡股票开户,新加坡证券,新加坡券商,投资组合,新加坡证券交易所(SGX),Sembcorp Industries,新加坡胜科工业集团