新加坡研报股票 | 中国尚舜化工控股有限公司

中国尚舜化工控股有限公司

2018年一季度的收入与预期相符,同时净利润超过14.2%。GPM比预期的要高。

高平均售价和销量延续至2018年一季度。GPM和NPM达到了历史最高水平。

新产能的试运行预计将在2018年二季度获得批准。

随着我们提高对利润的假设,我们将2018财年末的每股盈利上调45%至新元23.3分,以及将2019财年末的每股盈利上调26%至新元22.4分。我们维持买入评级的建议,上调目标价至新元1.97 (先前的目标价是新元1.60)。

积极方面

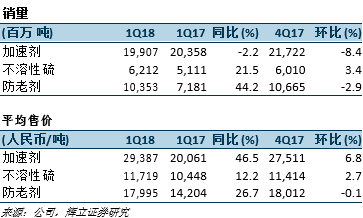

GPM 和NPM 在2018一季度达到历史高位:在2018年一季度,公布的GPM 和NPM 分别为34.9% 和17.4% (2017年一季度为:24.4% 和10%,2017年四季度为:33.3% 和15.1%)。利润率的显著提高是由于平均售价的增长以及税率的降低。根据图1所示的苯胺价格指数,2018年一季度的价格水平同比上升了26%。同时,该集团被授予“高新技术企业” 地位,致使税率降低 (总体税率从25%降至15%的优惠税率)。

消极方面

试运行状态:等待批准:试运行预计新增10千吨的TBBS加速剂的产能和不溶性硫工厂将于2018年二季度通过审批。每次试运行可能持续1到3个月。乐观地说,两家工厂可能将于2018年四季度开始全面投入运营。预计新产能将于2019财年获得全年的贡献

前景

环境保护政策和法规的执行将进一步加强。因此,我们预计在大型企业新增产能进入市场之前,会有更多的橡胶化工厂面临倒闭。其结果是,供应短缺将持续至2018财年,并将使尚舜受益。

投资活动

维持买入评级,上调目标价至新元1.97

随着利润的增长,我们修订上调2018财年末的每股盈利至新元23.3分 (先前是新元16 分) 和上调2019财年末的每股盈利至新元22.4 分 (先前是新元17.7 分)。我们维持买入评级建议,并上调目标价至新元1.97 (先前目标价为新元1.60)。

关键字:新加坡股票研报,新加坡股,新加坡研报,新加坡账户,交易新加坡股票,新加坡股票开户,免费开户,在线开设新加坡股票开户,新加坡证券,新加坡券商,投资组合,新加坡证券交易所(SGX),CapitaLand Mall Trust, 凯德商务产业信托(CapitaLand Commercial Trust)