新加坡股研报 | 昇菘集团启动扩张模式,50之前不止步

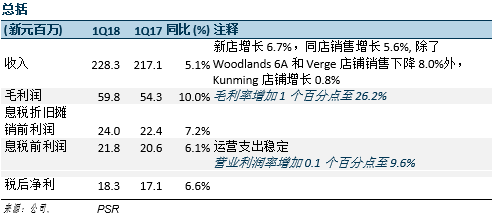

2018年一季度的收入/税后净利达到了我们全年估值的26.6%/25.3%

新店贡献带动盈利增长,在有利的宏观背景下产生顺差和提高毛利率。

从目前48家门店起计,到2018上半年实现开业50家门店的目标

;将继续拓展其销售网络,以抢占市场份额。

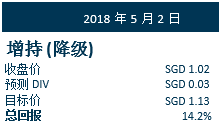

基于近期股价上涨,下调至增持评级;目标价不变,仍为新元1.13

积极方面

由新店贡献和市场情绪上涨,带动了一系列强劲的业绩。尽管第一季度因关闭Verge 和 Woodlands Block 6A 店铺,而受到全面的影响,新加坡业务的销售额同比增长4.3%。我们预计,2018年一季度将出现平缓的单位数低增长。尽管有来自7家新店带动销售增长 (4家于2018年一季度开业,3家于2017下半年开业),, 但出乎预料的是,与之相比,同店销售(SSSG)同比增长5.6%。管理层把同店销售增长的5.6%归因于销量的提高,Tampines Blk 506 的店面扩张以及客户的忠诚度。客户从关闭的Verge 和Woodlands Blk 6A 店铺转移到邻近的Jalan Berseh 和WL301 店铺购物,也对同店销售增长作出了贡献。

毛利率尚未稳定,继续争取增长至约26%。得益于有利的投入价格和新鲜产品渗透率的提高,2018年一季度的毛利率为26.2%,创下上市以来,一季度最高的毛利率。回想一下,由于该行业倾向于在春节期间推动销量,一季度的利润会因季节性因素回落。2018年一季度的销售组合也与在春节期间购买更多的食品杂货的标准形成鲜明对比。这可能导致2018财年末的毛利率高于预期。我们预测2018财年末的毛利率为26.2% 。

消极方面

2017年一季度没有新店开业,人力成本增加。新加坡运营部门的管理费用上涨至其收入的16.7%,而去年同期为15.8%。2017下半年和2018年一季度,新增7家店铺,同时员工总数增加。2017年一季度没有新店开张。然而,集团在成本管理方面有着良好的记录。我们认为,管理费用可控制在收入的17%以下。

中国昆明店铺的首季营收为175万新元,但亏损10万新元。集团在中国的第一家旗舰店仅开业5个月,就看到这座城市的增长潜力,并打算再新增1-2家店铺。

前景

前景保持乐观。得益于有利的宏观背景和来自9家新门店的贡献 (见图1) 应可减轻已关闭的两家大型店铺的收入损失,并为2018财年末的增长提供支撑。另外,我们相信在未来几个季度,潜在的新店将带来更多的收入增长。据HDB HBiz网站的数据显示,到2018年,将有9家新增超市待完工。然而,管理层也对这些地点与现有门店的邻近性表示担忧,其中包括昇菘品牌下的店铺。

投资活动

下调至增持评级,目标价不变,仍为新元1.13。我们的目标价是基于2018财年末的每股盈利预估为4.92 分以及23倍的市盈率提出的。截至2018年一季度,集团的财务状况良好,零负债和持有现金头寸7860万新元。我们认为,集团的自由现金流应从2019财年起,得到进一步的改善,因计划中没有大规模的资本支出。不断增长的自由现金流可能是未来更高派息的前奏。

关键字:新加坡股票研报,新加坡股,新加坡研报,新加坡账户,交易新加坡股票,新加坡股票开户,免费开户,在线开设新加坡股票开户,新加坡证券,新加坡券商,投资组合,新加坡证券交易所(SGX),昇菘集团,Sheng Siong