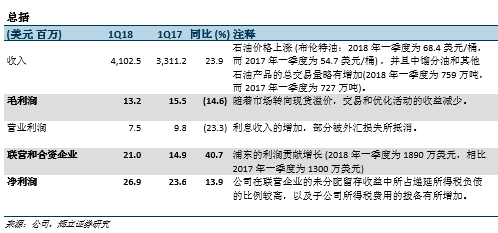

新加坡股票研报 | 中国航油 (新加坡)

由于联营企业的利润增长高于预期,2018年一季度的净利润超出我们预期的11.8%。

贸易量处于健康水平,并且联营企业的利润创新高。

现货溢价持续,压缩了贸易利润。

CAO 采用了SFRS (I) 9会计准则,报告预计信贷损失和变化。2018年一季度,公司对应收账款的减值拨备达到157万美元。

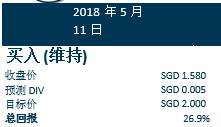

在采用了SFRS (I) 9 会计准则的影响后,我们适度调整了2018财年末的每股盈利至10.9 美分 (先前为11.0 美分) 。基于平均远期12个月的市盈率为13.3倍,我们维持买入评级的建议,2018财年的目标价不变,仍为新元2.00 。

积极方面

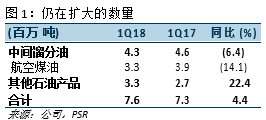

贸易规模持续改善:CAO 正在建立贸易规模以实现更低的盈亏平衡点。2018年一季度,其他石油产品的贸易量主要来自原油方面。(见图1所示)。

联营企业带来了惊人的增长:由于加油量,外汇收益和投资收益的增加,浦东的利润达到1890万美元 (同比增长46%)。在此期间,加油量同比增长了6.8%至110万吨,以及人民币兑美元升值了8%。OKYC 的业绩也有所改善,一季度利润达到140万美元,同比增长了6.9%。CNAF HKR 继续将净亏损缩减至17万美元,这是自2014年收购以来的最低水平。

消极方面

由于受到现货溢价持续的影响,贸易利润收窄:虽然贸易总量有所增加,但2018年一季度的毛利润率同比下降了14.6%。随着石油价格转向现货溢价,CAO放慢了贸易业务的扩张速度,并在更有利可图的订单中变得更加精挑细选。

前景

石油价格正处于上升的轨道,而现货溢价可能会持续一个或者两个季度。因此,贸易活动的增长预计将放缓。同时,短期内,贸易利润率将继续面临压力。尽管如此,我们对CAO的前景仍然乐观,这是由于联营企业尤其是浦东的利润将在今年持续高速增长,主要是受益于第五条跑道的运营将带来更多的航空交通量所致。

投资活动

维持买入评级,目标价不变,仍为新元2.00

由于受到采用了SFRS (I) 9 会计准则所带来的影响,我们对2018财年末的每股盈利适度的调整至10.9美分 (先前是11.0 美分)。基于平均远期12个月的市盈率为13.3倍,我们维持买入评级的建议,2018财年的目标价保持不变,仍为新元2.00 。

关键字:新加坡股票研报,新加坡股,新加坡研报,新加坡账户,交易新加坡股票,新加坡股票开户,免费开户,在线开设新加坡股票开户,新加坡证券,新加坡券商,投资组合,新加坡证券交易所(SGX),中国航油 (新加坡)