研报 | 新加坡 | 电信| 2020年四季度汇报

-

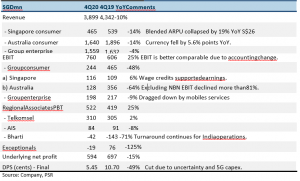

- 2020年四季度收益和盈利低于预期。澳洲是拖累收益的最大因素。Optus的收益同比下降了83%。新加坡移动受到漫游收入疲软的影响,但工资抵免额提高了利润率。

- 印度的联营公司利润扭亏为盈,收益近9800万新元,为一大亮点。

- 2020财年的末期股息削减49%,至5.45分。没有为2021财年提供收益指引。

- 维持中性评级,并下调目标价至2.44新元 (先前目标价为3.18新元)。我们将2021财年的税后净利削减了16%。Singtel的前景疲软。国际旅游的减少,将是导致高利润的漫游收入降低。疲软的经济背景将通过减少预付费用的使用和充值来损害可自由支配的支出,对联营公司产生负面影响。澳洲正面临着固定宽带业务后付NBN减少的额外挑战。

业绩一揽表

积极方面

+新加坡的ICT收入增长了7%。NCS收入增长,这是因为数据中心的合同和维护项目均有所增加。2020年3月,NCS的订单量同比增长约7%,达到32亿新元 (2019年3月为30亿新元)。

消极方面

– NBN为Optus带来痛苦。Optus净利润同比暴跌83%,至3900万澳元。息税前利润从16%大幅降至5%。从其内部固定宽带网络切换到批发NBN网络,对消费者和企业接入业务的利润率均造成了严重的影响。仍有额外的135,000名Optus 客户需要迁移到NBN网络。

前景

- 疫情大流行将给Singtel运营的所有部门带来压力:

新加坡:由于国际旅游受限,漫游流量大幅下降。疫情带来的另一个影响是客户的收款速度放缓。工资抵免额将对收入提供一些支撑。 - 澳洲:预计Optus将进一步走弱,因为目前的固网宽带正在向NBN过渡,由此带来的成本负担将由Optus来承担。疫情的爆发,使可疑债务增加,设备销售减少,和漫游收入下降,更进一步加剧了经济的低迷。

- 企业:ICT业务实现温和增长,这通过NCS的订单量增加反映出来。然而,由于流量的减少,部分业务的接入将受到影响。

- 联营公司:Bharti的盈利预计将持续下去。在经历一场残酷的价格战之后,市场正在复苏。印尼和泰国正面临更激烈的竞争。此外,封锁和疲软的经济背景将导致占主导地位的移动预付部分的使用和充值均有所减少

维持中性评级,并下调目标价至2.44新元 (先前目标价为3.18新元)。

我们将2021财年的收益削减了16%。我们的估值模型包含了联营公司市场估值的20%的折让。