新加坡证券交易所 | 火力全开

- 新交所在持续的业务增长势头下,2020年四季度的收益比我们的预期超出了11.9%。

2020年四季度延续了三季度的出色表现,由于市场交易活跃度上升,现金股同比增长11%,而自2020年三季度收购了Scientific Beta以来,对收益做出了贡献,DCI同比增长39.5%。 - 随着收购BidFX进入外汇OTC市场,以及与FTSE(富时指数)合作,取代即将到期的MSCI Index Futures(摩根士丹利资本国际指数期货)合约,预计业务将出现扩张拟议末期股息从2020年四季度的每股7.5分增加到8.0分,折合年增长率为7%。展望未来,预计新交所将为持续的收益增长,支付32分的股息。

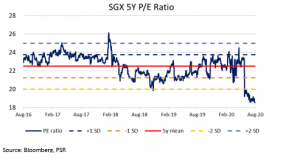

- 我们升级至买入建议,并上调目标价至45新元 (先前目标价为9.28新元)。我们将目标价与5年平均市盈率21.4倍的-1 SD(标准差)挂钩。目前的交易价格处于具有吸引力的水平(市盈率18.5倍),比5年平均市盈率低了超过2 SD。

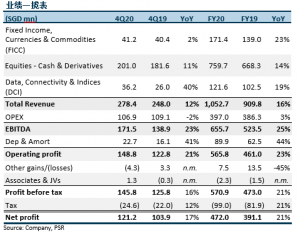

图1:2020年四季度与2020财年与去年同期的业绩对比

+ 2020年四季度,现金股业务将看到散户投资者的持续参与。据观察所有部门客户的交易活动均有所增加,本季度该部门的交易和清算收入同比增长了48.3%,收入从4440万新元增加至6580万新元。低迷的市况提供了有利的投资机会,因为散户投资者的兴趣呈现持续升温的势头。新交所观察到,今年新增了64,000个零售CDP账户,而去年只有45,000个 (同比增长40%)。

+ 通过收购Scientific Beta,2020年四季度的DCI收益同比增长了39.5%。2020下半年,合并了Scientific Beta的收益,使该部门在2020财年的收入增加了1440万新元。除了有机增长外,来自Scientific Beta的全年收入贡献将为该部门在2021财年的收入增长提供支撑。

+ 由于收益的持续增长,拟议末期股息为每股8.0分 (2020年三季度的每股派息为7.0分)。展望未来,新交所预计每年将派发32分股息,同比增长7%。这符合新交所的政策,即根据公司的长期增长前景,支付可持续和不断增长的股息。

消极方面

– 由于市场环境较差,融资活动仍然低迷。2020年四季度,由于新冠疫情爆发,各公司推迟了IPO,致使上市收入和企业活动收入同比分别下降了5.2%和27.5%。尽管如此,随着经济开始复苏,融资活动有望回归。

前景

战略性收购为未来的增长奠定了基础。继2020年三季度收购指数公司Scientific Beta后,新交所还在6月底全面收购了外汇交易平台BidFX,将其足迹扩展至外汇OTC市场。这两宗收购都将通过扩大新交所的产品系列,对公司当前的业务构成补充,并为公司提供了交叉销售机会。

Scientific Beta在2020财年,为新交所的DCI业务的半年收入(1440万新元)提供了有意义的贡献。它将赋予新交所推出新产品的能力,从smart beta投资到ESG投资,以迎合市场参与者的需求。

BidFX为新交所提供了进入外汇OTC市场的渠道,这将补充其现有的外汇期货产品。截至2020年6月,在6.6万亿美元的行业规模中,BidFX录得的日均交易量(ADV)为310亿美元,自2017年以来,该公司已实现的CAGR(复合年增长率)为57%。该平台为包括银行,对冲基金和资产管理公司在内的,全球100多家机构客户,提供了充足的有机增长空间。

对成套产品的积极管理,保证了业务长存。随着5月宣布于2021年2月终止非新加坡MSCI指数期货产品,新交所已与FTSE合作推出FTSE台湾指数期货,以取代即将到期的最大合约(即MSCI台湾指数期货)。该新产品还获得了美国商品期货交易委员会的批准,可以在美国市场销售和分销,而此前新交所的MSCI产品却无法获得这一批准。已与FTSE制定了计划,在MSCI于2021年2月到期之前,将推出一系列扩展产品。

投资行动

在2020年四季度的持续盈利下,我们升级至买入建议,并上调目标价至9.45新元 (先前目标价为9.28新元)。我们的目标价与21.4倍的市盈率挂钩,比新交所的5年平均值低1 SD(标准差)。当前的交易价格估值颇具吸引力(18.5倍市盈率),并将季度股息上调至每股8.0分,提供了3.9%的适度收益率。

图2:将我们的估值与新交所5年市盈率的-1SD作为基准

如果有想了解更多全球股市资讯,请关注微信公众号 “辉立资本新加坡” (SGPSPL)。同时提供在线免费开设股票账户,一个账户轻松交易全球股票和ETF

美股,港股,新加坡股,中国A股,越南股票,韩国股票,德国股票,马来西亚股票,泰国股票,印尼股票,菲律宾股票,日本股票,澳大利亚股票,台湾股票,加拿大股票,英国股票,法国股票,荷兰股票,葡萄牙股票,比利时股票,土耳其股票

如果本文是英文翻译版本,一切请以英文为准