新加坡股票 – 新加坡证券交易所(SGX)

投资概要

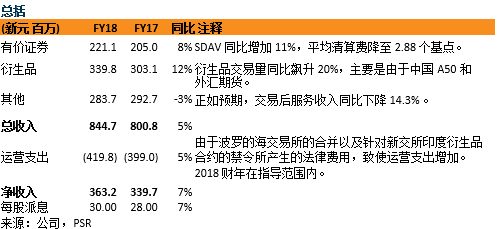

2018财年的营收符合预期,而税后净利则比预期低了3.7%,原因是新交所-印度衍生品禁令和波罗的海交易所合并所产生的法律费用令运营支出增加。2018财年的营收为8.45亿新元,达到了上市以来的最高水平。

2018财年衍生品业务继续推动收入增长;交易量同比飙升20%。外汇期货创下1430万份合约的新高,几乎是2017财年的两倍。

末期股息拟为每股15分 (2017年四季度:普通息为5分,特别息为8分)。

股息政策从净利润的百分比变为基于绝对金额的百分比。每季度派息7.5分/股,将从2019年一季度开始支付。

维持买入评级。我们的目标价下调至8.93新元 (之前是9.20新元),因为我们把2019财年末的盈利预测减少3%。

积极方面

衍生品业务继续保持其增长的轨迹。衍生品收入同比增长12%,这是由于交易量激增20%,达到了创纪录的1.98亿份合约。然而,由于产品组合转向为低收益产品,每份合约的平均费用同比下降10%至1.06新元。交易量的增长主要来自中国A50,日经225和外汇期货产品。

从波动中获益的有价证券。SDAV 实现了5年的高点,达到12.6亿新元,同比增长了12%。SDAV 增长是受到新的DLCs 和促进零售市场参与的增长所推动的。对美国联邦基金利率的加息以及贸易战冲突的预期,可能会推动投资者投资组合中更多的投资控股重新配置;这可能会导致未来几个季度的交易量增加。

支持增长的新股息政策。旧股息政策的派息比率至少为净利润的80%。过去3年的平均派息率为87%。展望未来,新股息政策提供灵活性,可以平衡季度股息支付的7.5分/股,这将使新交所能够保留收益以支持增长。根据我们的估计,假设新交所的年度股息为30分,与2018财年持平,那么2019和2020财年的派息率将分别降至84%和83%。

股东现在可以提前获得股息,股息的潜在增长依赖于未来的表现。

市场数据和连接收入同比增长5% 至9830万新元,占总收入的12%。增长的原因是申请系统使用和新交所托管服务业务的数据许可证的持续增长。

由于新发行的债券数量增加,上市公司的收入同比增长5%至5160万新元。2018财年,有1,154 只债券上市融资达到4819亿新元,与2017财年相比,则有819只债券上市,融资3847亿新元。在2018财年,22家新上市公司的融资额为62亿新元,相比2017财年,只有22家公司上市,融资额仅为13亿新元。

消极方面

与IISL 的仲裁悬而未决。GIFT City的跨境贸易链接合作似乎又回到了谈判桌上;因此,仲裁程序被推迟,但新交所就其Nifty 合约许可的延长至2018年8月之后的做法仍然有效。自2018年2月以来,印度衍生品的发展带来的不确定性,反映在2018财年四季度的衍生品日均成交量的疲软上,并且在仲裁得出结论之前仍然不确定。在2018年四季度,DDAV 环比下降了10.9%,但同比增加了13.6% 。然而,继续发放许可和推迟仲裁应能在短期内为印度衍生品提供一定的稳定性。Nifty 50 指数期货占2018财年衍生品交易总量的11%。

平均证券清算费用一直在下降。由于市场参与者和流量提供商 (MMLP) 的交易量增加,使2018财年的平均清算费用2.88个基点,较2017财年的2.94个基点要低,因为这些市场参与者通常支付较低的清算费用。

交易后服务同比下降14.2% 至9930万新元,占总收入的12%。由于经纪商在2018年2月把业务迁移到自己的后台系统,不再需要新交所的合约处理服务,合约处理收入在2017财年下降了71%,从1160万新元降至340万新元。在交易后服务的另一部分,由于后续结算指令的组合发生变化,使证券结算收入下降了8%。然而,我们认为,这一部分的业务似乎停滞不前,不会对新交所在2019财年的增长做出有意义的贡献。

前景

良好的盈利增长受到波动性,运营杠杆和稳健的资产负债表的支持。我们已将2019财年末的SDAV 估值增加至13.2亿新元 (先前是12亿新元),这是因为在美中贸易冲突和加息的推动下,股市的持续波动可能会在短期内有利于交易量的增加,因为市场在双向震荡中。新交所的无债务资产负债表和垄断地位应能促进无机盈利的增长。

投资行动

我们维持买入建议。鉴于38%的净资产收益率,4%的股息收益率和盈利的增长势头,我们认为估值是有吸引力的。

关键字:新加坡股票研报,新加坡股,新加坡研报,嘉德置地商业信托 ,新加坡账户,交易新加坡股票,新加坡股票开户,免费开户,在线开设新加坡股票开户,新加坡证券,新加坡券商,投资组合,新能源汽车,补贴新政