A股节后补跌,北上资金录大幅单日流出:杠反向产品以及大市表现更新

中国市场近期要点

富时罗素宣佈计画把A股纳入其关键指数,初始阶段预计有100亿美元流入A股,MSCI宣佈计画扩大A股纳入比重和范围。

美国宣佈自9月24日起对2000亿美元中国输美产品加征10%的关税,进而还要採取其他关税升级措施。中国商务部回应称“不得不同步进行反制”。

美国副总统彭斯发表演说,指中国政府干预美国中期选举。

中国央行于国庆日假期最后一日宣佈降准1%,释放7500亿元增量资金,属今年第4次降准。

大市表現更新:证券

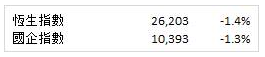

港股 :A股市场重启后补跌,港股续跌,博彩股受创。

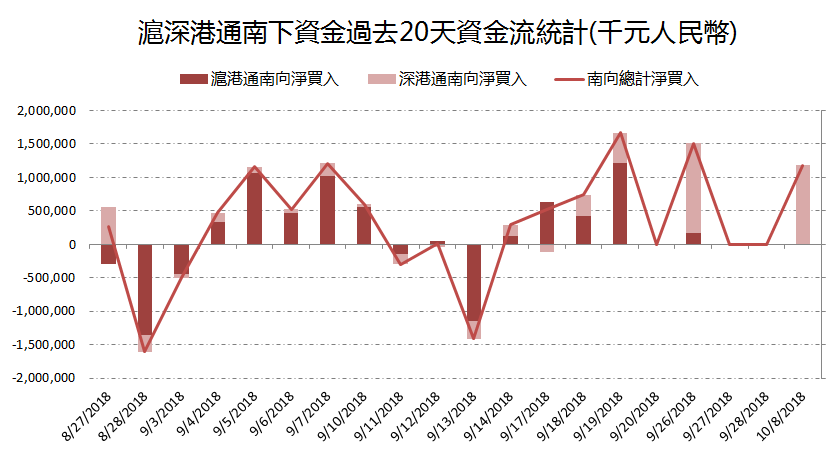

港币兑美元汇率再度飙升至本月最强位置,逼近7.83关卡。主板成交965.8亿港币,南下资金有净流入。

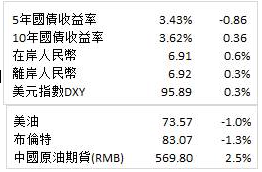

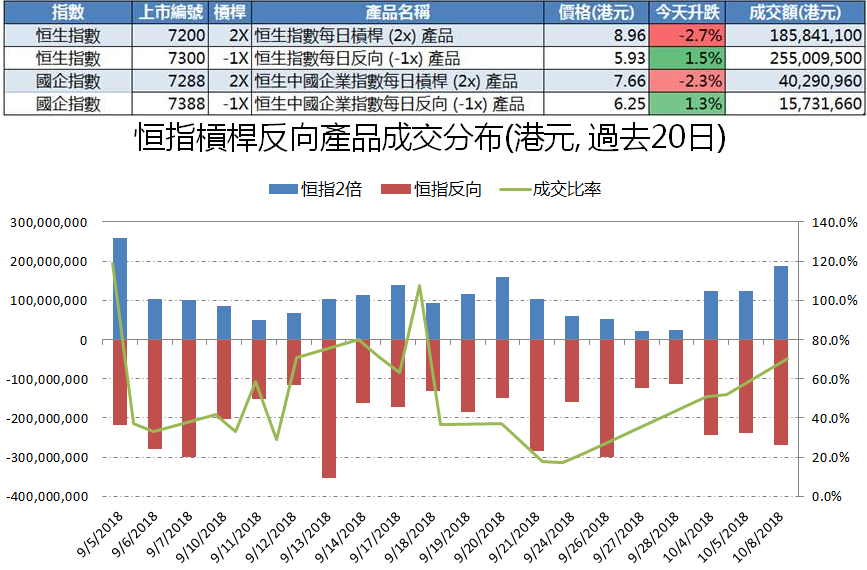

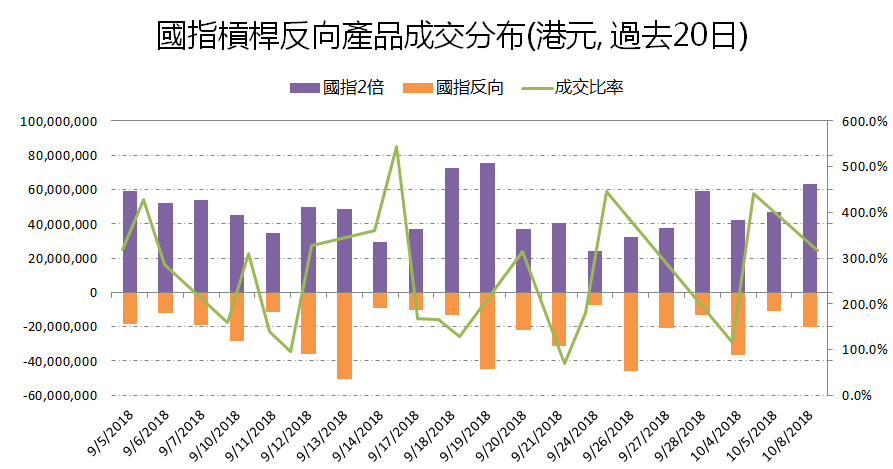

杠杆反向:港股在10月1-8日期间下跌超过5%,南方东英恆指一倍反向产品(7300.HK)出现获利回吐的的赎回迹象,同时,恆指两倍槓杆产品(7200)则录得净流入。

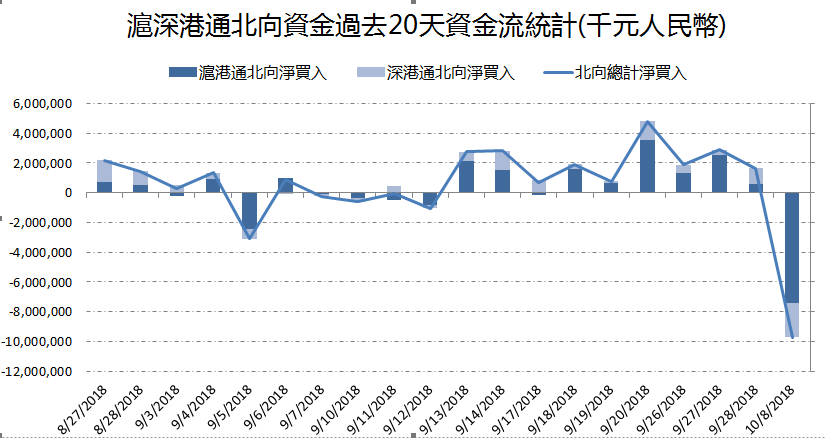

A股:国庆日休市一周后重启交易第一日,儘管有央行降准利好,仍出现补跌行情,北上资金淨流出达97亿人民币,创深股通开通以来第二高。所有板块一致下跌,餐饮旅游,食品饮料,电子元器件和房地产板块领跌。

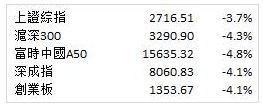

大市表現更新:货币/ 商品/固收

中美货币政策明显反向,随着央行降准消息公佈,在岸人民币收创3月10日来新低,官方收盘价报6.9135,离岸人民币一度跌破6.93关口;5年期及10年期国债期货齐跌。

大市表現更新:宏观

9月财新中国服务业PMI升至53.1 创三个月新高,低于历史均值及年初值,服务业新订单小幅增长,为四个月以来最高。

国家税务总局通知明确,从2018年10月10日起,各地税务机关通知本地区影视製作公司、经纪公司、演艺公司、明星工作室等影视行业企业和高收入影视从业人员,根据税收征管法及其实施细则相关规定,对2016年以来的申报纳税情况进行自查自纠。对在2018年12月底前认真自查自纠、主动补缴税款的,免予行政处罚,不予罚款。

杠杆反向产品表现

沪深港通资金流表现

关键字:新加坡股票研报,新加坡股,新加坡研报,新加坡账户,交易新加坡股票,新加坡股票开户,免费开户,在线开设新加坡股票开户,新加坡证券,新加坡券商,投资组合